- Naranj Research Desk

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

12% - 16%

15 - 16 Days

12% - 16%

15 - 16 Days

Arab Sea Information Systems Company is a Saudi-based IT and software company founded in 1980 and headquartered in Riyadh. It develops business software solutions such as accounting systems, ERP, POS, warehouse management, and e-government platforms for small to large organizations. The company also provides IT consulting, system installation, training, cybersecurity services, network management, and sells computer hardware and accessories, serving both private businesses and government institutions across Saudi Arabia.

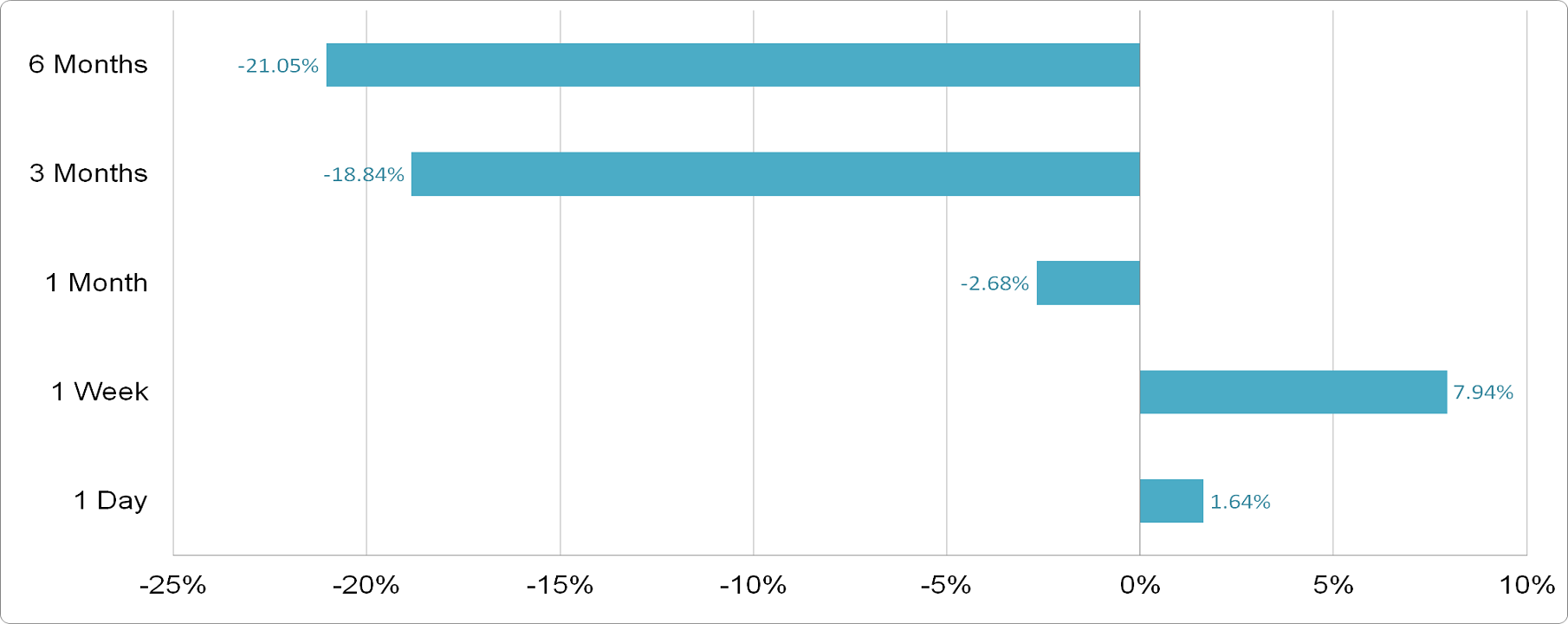

ARAB SEA — TASI —

| Indicator | Value | Zone |

|---|---|---|

| RSI-14 | 54.39 | Neutral |

| CCI-14 | 199.54 | Overbought |

| ROC | 4.854 | Positive |

| Stochastic RSI | 100.00 | Overbought |

| William %R | -23.21 | Neutral |

| EMA | Value | Stock Position |

|---|---|---|

| 5 EMA | 4.22 | Above |

| 10 EMA | 4.17 | Above |

| 20 EMA | 4.19 | Above |

| 50 EMA | 4.42 | Below |

| 100 EMA | 4.72 | Below |

| 200 EMA | 5.17 | Below |

Based on our Saudi stock market trading signals, Arab Sea Information Systems stock price target will be SAR 4.8 - SAR 5 in the next 15-16 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website