Introduction

Saudi Arabia's stock market, known as Tadawul (TASI), presents one of the most interesting puzzles in global investing. Companies listed on this exchange are posting strong earnings growth—banks are growing profits by 30-32%, petrochemicals are expanding rapidly, and the real estate sector is booming—yet the entire market trades at significantly lower prices compared to other countries. This is like buying a house that is well-maintained, in a good location, and appreciating in value, but at a price 20-30% cheaper than similar homes nearby. Investors searching for Saudi Tadawul stock trade advice are often surprised by this gap. So let's understand why it happens and what it means for long-term investors.

The Valuation Discount: A Fact Not Opinion

First, let's look at numbers. On December 1, 2025, Saudi Arabia's TASI index had a P/E ratio (Price-to-Earnings ratio) of 15.4x. This is a key measure that tells us how much investors are willing to pay for each unit of company earnings.

Compare this to other markets:

- India: 23.4x P/E ratio

- Japan: 21.8x P/E ratio

- South Korea: 18.1x P/E ratio

- China: 16.0x P/E ratio

What does this mean in simple terms? When you invest SAR 100 in Indian stocks, you're paying for SAR 4.27 of annual company profits. But when you invest SAR 100 in Saudi stocks, you're paying for only SAR 6.50 of annual profits. Saudi stocks are cheaper—but why?

The Paradox: Strong Fundamentals, Weak Prices

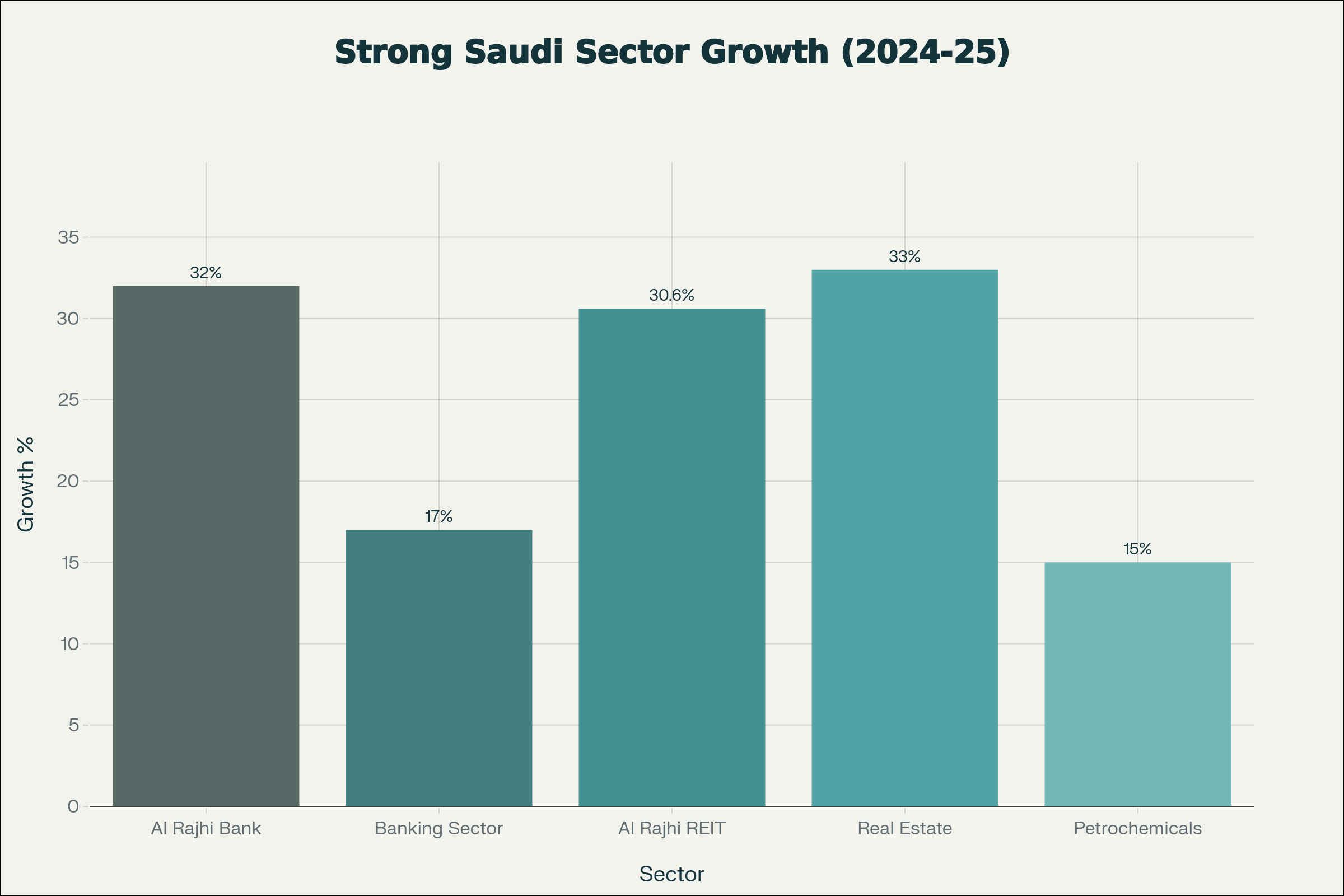

Here's what makes this truly puzzling: The fundamentals are strong. During the first nine months of 2025, Saudi banks alone earned SAR 68.87 billion in profits, a 17% increase year-on-year. Al Rajhi Bank, the country's largest Islamic bank, reported a 30% jump in profit in Q2 2025 alone, reaching SAR 6.15 billion. By the end of September 2025, Al Rajhi's nine-month profit jumped 30% to SAR 18.4 billion.

Outside banking, the story is equally strong. Real estate companies achieved 250% earnings growth in some cases, and real estate sector growth reached 33%. Al Rajhi REIT Fund saw earnings jump 30.6%, far outpacing the industry average decline of -36.7%. The petrochemical sector continues to expand with Vision 2030 projects driving new investments.

So we have a mystery: companies with strong profits, growing earnings, and solid dividends are trading cheaper than they should be. Why?

Reason 1: Limited Foreign Investment Capacity

One of the biggest reasons is foreign investor restrictions. Currently, foreign investors can own a maximum of 49% of any Saudi company. While this cap may sound high, it creates a real problem: it limits how much money can flow into Saudi stocks from global investors.

Think of it like a small door at a stadium. Even though 100,000 people want to come watch the game, only limited numbers can fit through because the door is small. The same happens with Saudi stocks.

However, there's good news coming. In late 2025, Saudi Arabia announced plans to gradually remove these foreign ownership restrictions. One proposal is to completely remove the QFI (Qualified Foreign Investor) regime and eventually lift the 49% cap on foreign ownership. When this happens, analysts estimate $10.5 billion in new foreign capital could flow into Saudi stocks from global index funds alone.

Reason 2: Low Liquidity and Free-Float Problems

Liquidity means how easily you can buy or sell a stock without affecting its price. Saudi stocks have liquidity challenges.

For example, Saudi Aramco—the world's largest oil company and most valuable Saudi company—had an average daily trading volume of only $51 million in 2022. Compare this to companies like Apple or Microsoft that trade billions of dollars daily. The issue is that the Saudi government directly or indirectly controls 98% of Aramco shares, leaving only 2% available for public trading.

The same problem affects many Saudi companies. The free-float (shares available for public trading) is often small because the government or founding families own large stakes. When free-float is low, foreign index funds can't invest as much as they want, because there simply aren't enough shares available to buy.

Reason 3: Geopolitical Risk and Regional Uncertainty

The Middle East is a sensitive region. When tensions rise—whether with Iran, regional conflicts, or global political changes—investors become cautious. In June 2025, when the US announced concerns about regional instability and nuclear tensions with Iran, TASI immediately fell 1.5%, driven by fear rather than bad company news.

Research shows that geopolitical risk has a real impact on Saudi stock performance. While Saudi Arabia's stock market shows resilience to geopolitical shocks compared to some other Middle Eastern markets, the mere perception of risk makes international investors uncomfortable. They prefer to invest in markets they see as "safer," even if those markets are more expensive.

This is similar to how a house might be wonderful but sells for less simply because it's located near a noisy highway. The fundamental quality of the house (good bones, good plumbing, good roof) doesn't change, but the price does because of location perception.

Reason 4: Small Market Size and Limited Diversity

The Saudi stock market is big by regional standards but tiny compared to global markets. The total market value of all Saudi stocks is approximately $2.3 trillion, which sounds large. However, this represents only 3.3% of the MSCI Emerging Markets Index—meaning it's less than 4% of the world's emerging market stocks.

For comparison, Chinese and Indian stock markets are several times larger, with hundreds more companies and sectors. When global investors allocate money across emerging markets, Saudi Arabia gets a small slice simply because the market is small. More stocks and sectors mean more opportunities and more money flowing in.

Reason 5: Sectoral Concentration

Over 80% of market value comes from a few giant companies—mainly Saudi Aramco and banks. This means there's limited diversity. Most smaller Saudi companies lack the liquidity and international recognition that would attract global investors.

When your market depends so heavily on oil prices (which affects Aramco and government spending) and interest rates (which affects banks), the market becomes predictable to some global investors who might avoid it in favor of more diversified markets.

The Vision 2030 Effect: Transformation Brings Opportunity

Here's the exciting part: Saudi Arabia is changing. Vision 2030 is systematically removing the barriers that have kept valuations low.

Non-oil sector growth is accelerating. The non-oil economy is projected to grow 4.4% in 2025, up from 3.5% in 2024. New sectors are emerging—technology, entertainment, tourism, renewable energy, and advanced manufacturing. These sectors offer growth stories that weren't available before.

Government spending remains robust. The 2025 budget projects SAR 1.285 trillion in spending against SAR 1.184 trillion in revenues, signaling continued investment in mega projects and Vision 2030 initiatives. This spending creates profits for listed companies.

Economic growth is strong. Saudi Arabia's overall GDP is forecast to grow 4-4.6% in 2026, driven by both oil and non-oil sectors. In regional context, this is solid performance.

What Does This Mean for Investors?

For investors looking at Saudi stocks, the discount presents both a warning and an opportunity:

The Warning: Low valuations sometimes reflect real risks—liquidity issues, geopolitical concerns, and market structure limitations are real problems that can't be ignored.

The Opportunity: When a company has strong fundamentals, growing profits, and sells at a discount, it may be undervalued. The reforms happening now—removing foreign investor restrictions, improving liquidity, diversifying the economy—could unlock significant value. This is exactly the kind of environment where long-term investment picks in Saudi Tadawul can outperform over the next 5–10 years.

Global investors who bought Saudi stocks early in Vision 2030 have benefited from both earnings growth and valuation expansion (the P/E ratio increasing from very low to current levels as reforms take effect).

The Bottom Line

Saudi stocks trade at discounts not because the companies are weak. Al Rajhi Bank is as profitable as any regional bank. Saudi petrochemicals are world-class. Real estate developers are building infrastructure for a modern nation. The discounts exist because of market structure issues—liquidity limits, foreign investor caps, and geopolitical perception—not because of weak business fundamentals.

The reforms underway are systematically addressing these structural issues. As foreign ownership restrictions ease, as liquidity improves, and as the economy diversifies further, the discount could narrow or disappear entirely. This is why sophisticated investors are paying close attention to the Saudi market in late 2025.

For the average investor, understanding this distinction is crucial: Don't confuse a cheap price with a cheap company. Sometimes low valuations reflect real problems. Sometimes they reflect temporary barriers that are being removed. In Saudi Arabia's case, it appears to be mostly the latter—making this one of the most interesting emerging markets to watch.

Join our community of traders and investors: