Introduction

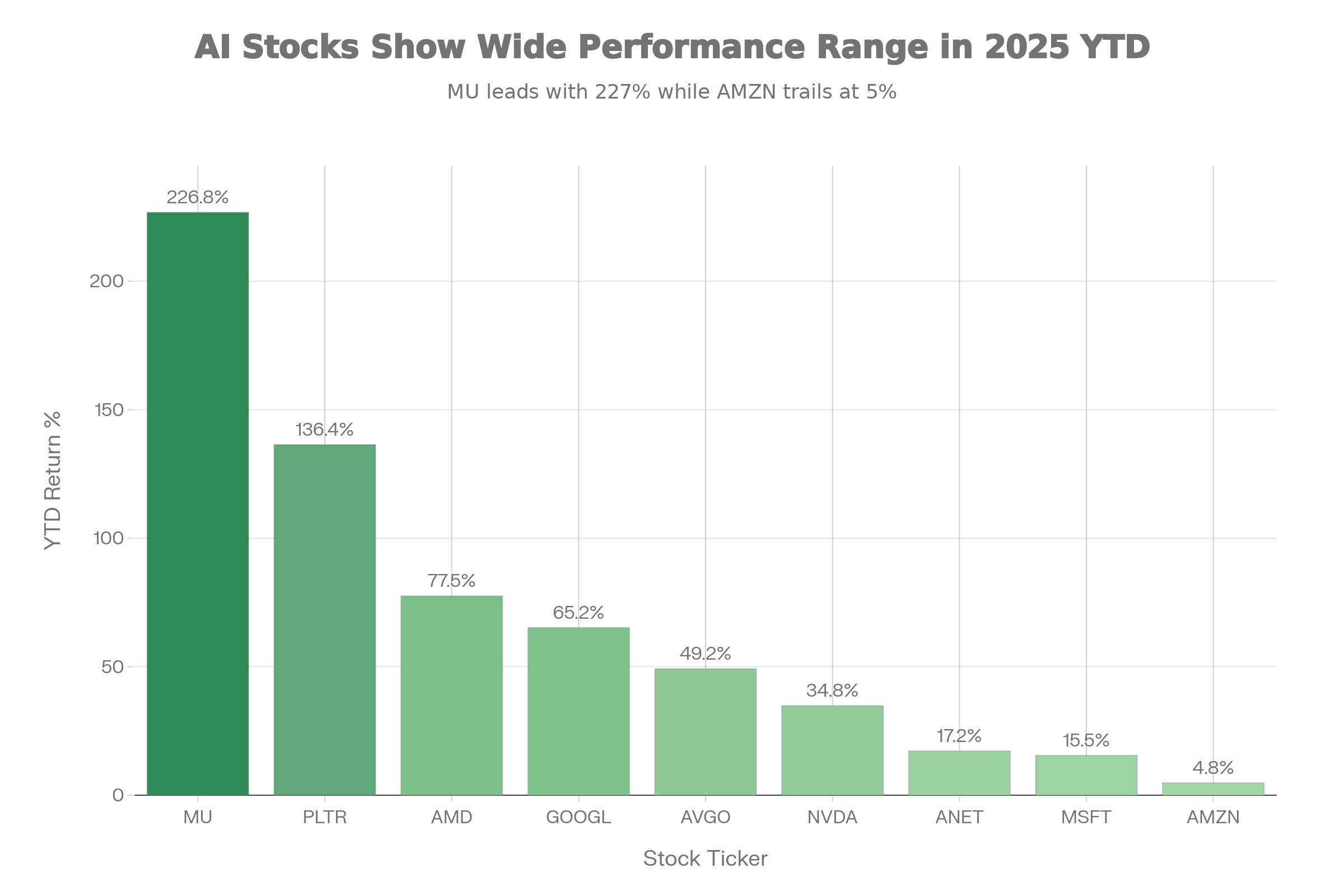

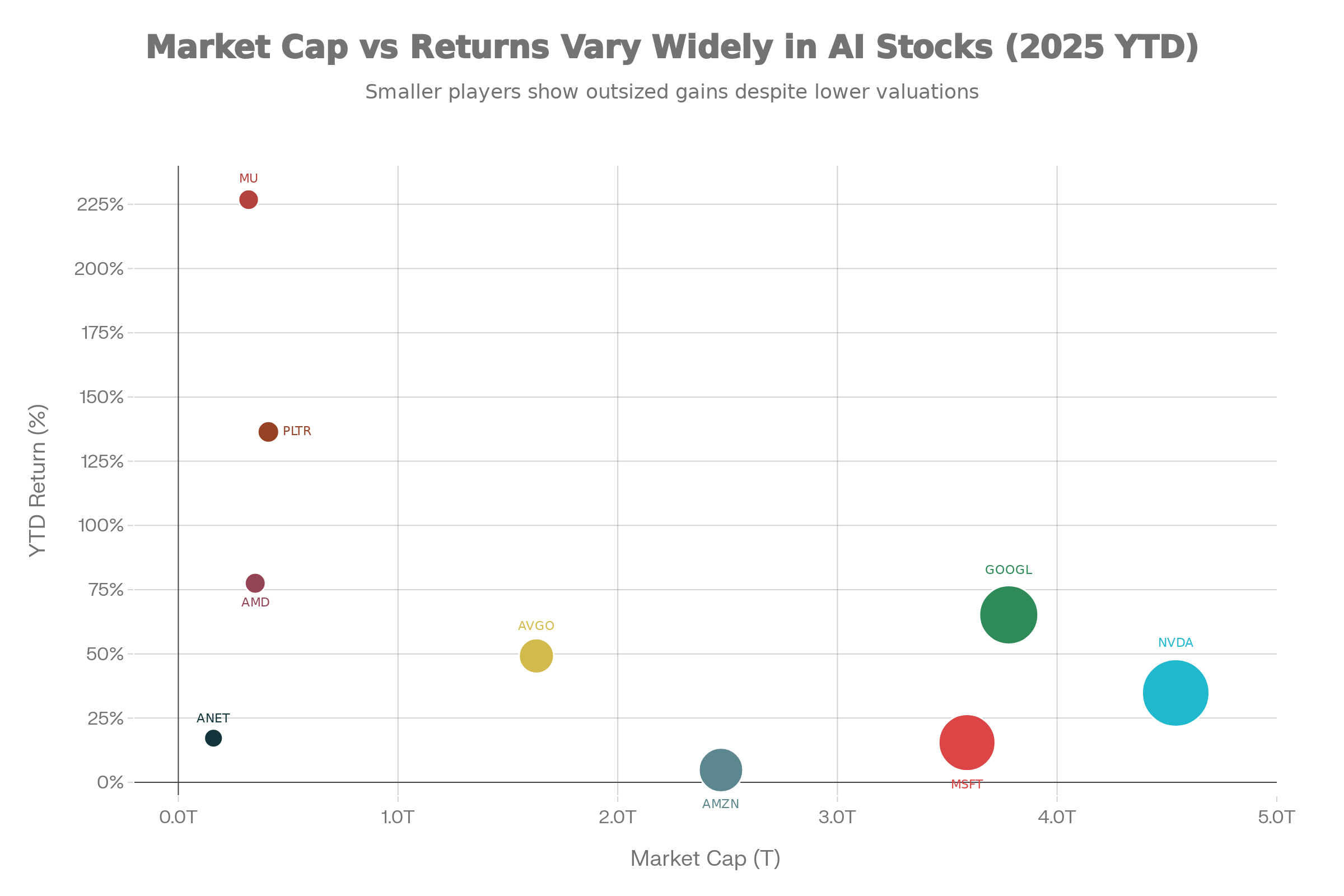

The AI revolution isn’t slowing down—it’s turning into the backbone of the global economy. While Nvidia dominated headlines in 2025, the biggest money was actually made elsewhere. Micron jumped 230%, Palantir surged 140%, and AMD delivered 80% returns. As we move into 2026, investors looking for clear US trading and investment advice need to understand one key shift: the next phase of AI gains won’t come from a single stock, but from an entire ecosystem working together.

The opportunities now stretch across memory makers, cloud platforms, enterprise software, and custom chip designers. This guide breaks down where capital is actually flowing—and how investors can position themselves wisely in US markets.

The Big Shift That Changed the Game

Something important changed in 2025. AI stopped being an “experiment” and became essential infrastructure for businesses. Companies are no longer testing AI—they are depending on it to run operations, cut costs, and make decisions. This shift rewards companies that fix real problems, not just those selling popular chips.

Nvidia still leads with nearly 90% share in data center GPUs and a powerful software ecosystem (CUDA). But the AI industry has grown up quickly. Memory shortages became a serious issue. Custom-built chips became cheaper and more efficient for big players. Software that turns AI data into real business decisions became extremely valuable. Because of this, the biggest winners are no longer the obvious ones.

The AI revolution isn’t slowing down—it’s turning into the backbone of the global economy. While Nvidia dominated headlines in 2025, the biggest money was actually made elsewhere. Micron jumped 230%, Palantir surged 140%, and AMD delivered 80% returns. As we move into 2026, one thing is clear: the next big AI opportunities are no longer limited to just Nvidia. They are spread across memory makers, cloud platforms, software companies, and custom chip designers. This is where smart capital should be deployed in the AI era.

Core Holdings: Nvidia, Microsoft, Alphabet, Amazon

Think of these companies as the strong foundation of your portfolio. They may not deliver explosive short-term returns, but they are reliable and hard to replace.

Nvidia ($NVDA)

Nvidia remains the backbone of AI computing. It controls around 90% of the data center GPU market. Its CUDA software makes it extremely difficult for competitors to catch up, because developers have spent years optimizing their work for Nvidia’s platform. Earnings are expected to grow around 48% per year through 2028. The stock isn’t cheap, but its dominance and pricing power justify it. Analysts still see about 31% upside.

Microsoft ($MSFT)

Microsoft is quietly leading one of the biggest AI rollouts ever. Copilot is being built directly into Office, Windows, and GitHub. About 90% of Fortune 500 companies are already using Microsoft 365 Copilot. Its commercial backlog grew 22% quarter-over-quarter, mainly due to AI cloud demand. Compared to Nvidia, the valuation is lower, making it a safer, steady-growth option.

Alphabet ($GOOGL)

Google’s Gemini AI powers smarter search and now has over 650 million users as a standalone assistant. Google Cloud is becoming a serious AI development platform and has been recognized by Gartner as one of the best for AI work. Among large tech companies, Alphabet looks undervalued relative to its growth and fundamentals. It’s still not fully appreciated by the market.

Amazon ($AMZN)

Amazon Web Services runs a huge share of AI workloads globally. The company spent heavily on infrastructure, and that investment is now setting up future revenue growth. Amazon’s diversified business also helps limit downside risk. It may not be exciting, but it’s critical to the AI ecosystem.

The High-Growth Layer: Memory, Chips, and Infrastructure

This is where most of the biggest gains in 2025 came from. These companies solve very specific problems that AI cannot function without.

Micron ($MU)

Micron was the clear winner. AI systems need massive amounts of memory, especially DRAM and high-bandwidth memory. There are no real substitutes. Micron controls a tight supply market, which allows it to charge higher prices. The nearly 227% return wasn’t luck—it came from real supply-demand imbalance. Even after the rally, the valuation remains reasonable for a company controlling such a critical bottleneck.

Broadcom ($AVGO)

Big tech players like OpenAI, Meta, and Amazon are increasingly using custom AI chips designed by Broadcom instead of relying only on Nvidia GPUs. These custom chips are cheaper and more efficient for specific tasks. As AI workloads scale, custom silicon often makes more financial sense for large cloud providers.

AMD ($AMD)

AMD’s EPYC processors are gaining real traction in data centers as customers look for alternatives to Nvidia. The strong return shows investors believe AMD can keep taking market share. However, the high valuation means growth must continue. This is best treated as a supporting position, not a replacement for Nvidia.

Arista Networks ($ANET)

AI data centers require extremely fast networking to connect large GPU clusters. Arista provides high-speed Ethernet switches that handle this massive data flow. It’s not a flashy stock, but AI cannot scale without strong networking infrastructure.

The Software Layer: Where Profits Grow Fastest

Palantir ($PLTR)

Palantir’s AI platform helps companies turn complex data into clear decisions. Its U.S. commercial business is growing at triple-digit rates quarter after quarter. Businesses are willing to pay high prices for software that directly improves efficiency and outcomes. The strong stock performance reflects this value.

However, the valuation is extremely high. With a P/E above 400, the stock assumes near-perfect execution. Any slowdown could hurt returns, so position size should be managed carefully.

CoreWeave ($CRW)

CoreWeave is a pure-play AI infrastructure company. It has signed massive long-term contracts with OpenAI ($22.4B), Meta ($14.2B), and Microsoft. These aren’t speculative deals—they are firm commitments for AI computing capacity from the biggest players in the world.

Build Your AI Portfolio Like a Business

A strong business has multiple departments working together. Your AI investment portfolio should follow the same idea, with each stock playing a clear role.

Foundation Layer (60% of AI allocation):

$NVDA, $MSFT, $GOOG, $AMZN

These stocks form the stable base. Nvidia provides computing power. Microsoft delivers software used by hundreds of millions daily. Google owns search and powerful cloud tools. Amazon supplies infrastructure. You’re not expecting these stocks to multiply quickly—you’re expecting them to stay strong and stable while others drive growth.

Growth Engine (30% of AI allocation):

$MU, $PLTR, $AVGO, $AMD

These companies drive higher returns. Micron controls memory supply. Palantir dominates enterprise AI software. Broadcom enables custom chips. AMD competes in high-performance computing. Each solves a problem that companies must solve to use AI at scale.

Specialized Support (10% of AI allocation):

$ANET, $CRWV

These firms handle critical support roles—networking and AI infrastructure. They may not grab headlines, but AI systems cannot function without them. They add diversification and strengthen the overall portfolio.

The Simple Test That Finds Real Winners

Instead of chasing hype, ask one question:

Would this company still be profitable if AI excitement faded tomorrow?

Micron passes easily. Memory is always needed. AI just increased demand.

Palantir passes as well. Companies already spent heavily on data tools before AI—Palantir simply makes those investments more effective.

Broadcom passes. Custom chips are needed to lower AI costs and improve efficiency.

Now think about Nvidia. It would still exist without AI—gaming, data centers, and autonomous systems would keep it alive—but it would be smaller. Nvidia is a strong business boosted by AI, not a one-trick bet.

Many AI stocks fail this test. They rely on hype rather than solving real problems. That’s why some stocks rise 200%, while others eventually fall 50%.

Conclusion: Where the Real AI Opportunity Lies

The question is no longer whether to invest in AI—it’s how to do it wisely. Nvidia remains important, but the biggest gains in 2026 are likely to come from companies solving the practical challenges of scaling AI: memory shortages, custom chip efficiency, fast networking, and enterprise-grade software.

Core holdings provide stability. Growth stocks capture outsized returns. Specialized players strengthen the system. This balanced approach reflects how experienced investors and professional trading advisory services for US stocks are positioning portfolios for the next phase of AI growth.

AI stocks are not all the same. They form an interconnected system of suppliers, builders, and enablers. Understand that structure, invest accordingly, and 2026 could become a standout year for your portfolio.