- Naranj Research Desk

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

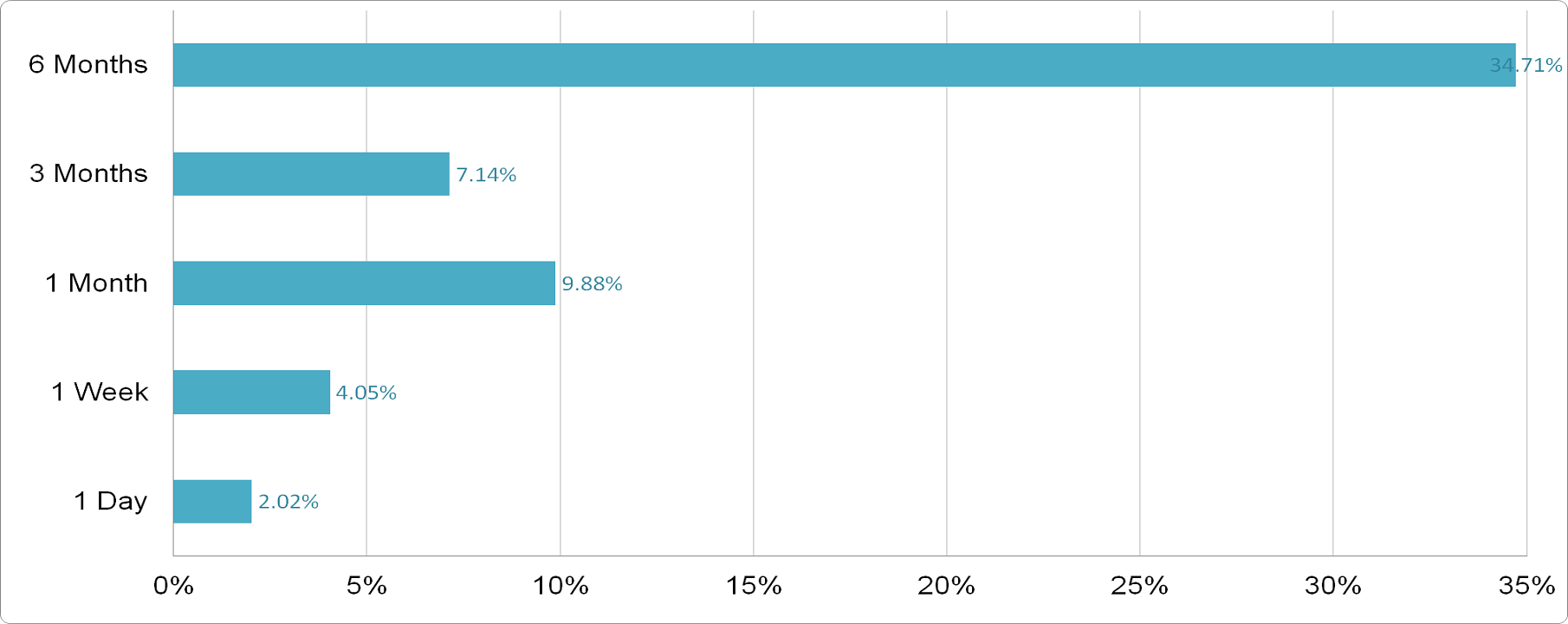

5% – 7%

12 - 14 Days

5% – 7%

12 - 14 Days

| Metric | Q3 2025 | Q2 2025 | QoQ Change | Q3 2024 | YoY Change |

|---|---|---|---|---|---|

| Net Sales | $3,591M | $3,638M | -$47M | $3,449M | +$142M |

| Gross Profit | $664M | $640M | +$24M | $636M | +$28M |

| Gross Margin | 18.50% | 17.60% | +90 bps | 18.40% | +10 bps |

| Adjusted Operating Income | $385M | $373M | +$12M | $350M | +$35M |

| Adjusted Diluted EPS | $1.24 | $1.21 | +$0.03 | $1.09 | +$0.15 |

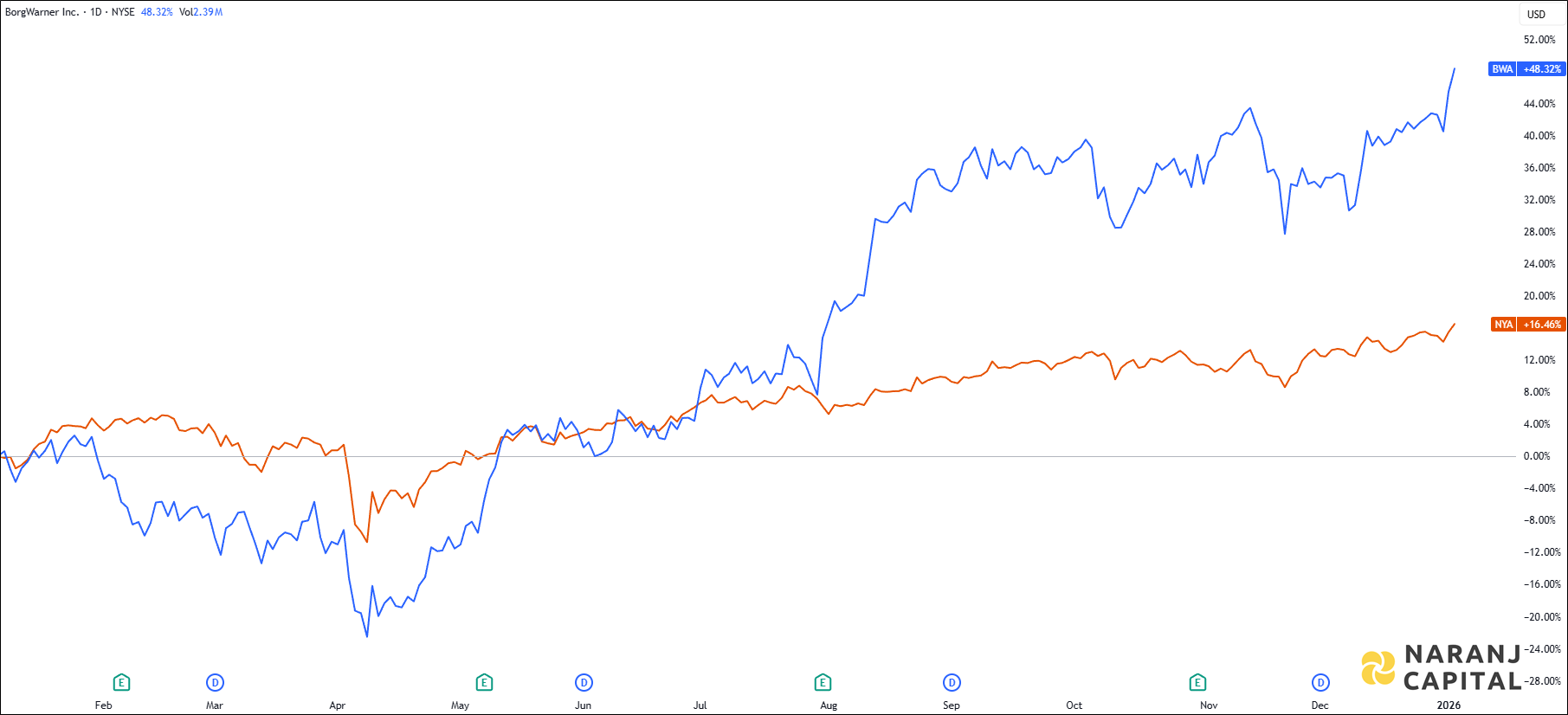

BWA — NYSE —

| Indicator | Value | Zone |

|---|---|---|

| RSI-14 | 68.61 | Neutral |

| CCI-14 | 310.01 | Overbought |

| ROC | 6.97 | Positive |

| Stochastic RSI | 100.00 | Overbought |

| William %R | -2.60 | Overbought |

| EMA | Value | Stock Position |

|---|---|---|

| 5 EMA | 46.40 | Above |

| 10 EMA | 45.80 | Above |

| 20 EMA | 45.23 | Above |

| 50 EMA | 44.39 | Above |

| 100 EMA | 42.44 | Above |

| 200 EMA | 39.87 | Above |

Based on our swing trading strategies for USA stocks, BorgWarner stock price target will be USD 50 - USD 51 in the next 12-14 trading sessions.

5% – 7%

12 - 14 Days

5% – 7%

12 - 14 Days

BorgWarner Inc. is a global auto-technology company that makes parts for combustion, hybrid, and electric vehicles. It supplies products like turbochargers, electric drive systems, power electronics, batteries, and transmission components. The company sells mainly to vehicle manufacturers across passenger, commercial, and off-highway vehicles. Founded in 1928, BorgWarner is headquartered in Auburn Hills, Michigan.

| Metric | Q3 2025 | Q2 2025 | QoQ Change | Q3 2024 | YoY Change |

|---|---|---|---|---|---|

| Net Sales | $3,591M | $3,638M | -$47M | $3,449M | +$142M |

| Gross Profit | $664M | $640M | +$24M | $636M | +$28M |

| Gross Margin | 18.50% | 17.60% | +90 bps | 18.40% | +10 bps |

| Adjusted Operating Income | $385M | $373M | +$12M | $350M | +$35M |

| Adjusted Diluted EPS | $1.24 | $1.21 | +$0.03 | $1.09 | +$0.15 |

BWA — NYSE —

| Indicator | Value | Zone |

|---|---|---|

| RSI-14 | 68.61 | Neutral |

| CCI-14 | 310.01 | Overbought |

| ROC | 6.97 | Positive |

| Stochastic RSI | 100.00 | Overbought |

| William %R | -2.60 | Overbought |

| EMA | Value | Stock Position |

|---|---|---|

| 5 EMA | 46.40 | Above |

| 10 EMA | 45.80 | Above |

| 20 EMA | 45.23 | Above |

| 50 EMA | 44.39 | Above |

| 100 EMA | 42.44 | Above |

| 200 EMA | 39.87 | Above |

Based on our swing trading strategies for USA stocks, BorgWarner stock price target will be USD 50 - USD 51 in the next 12-14 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website