Introduction

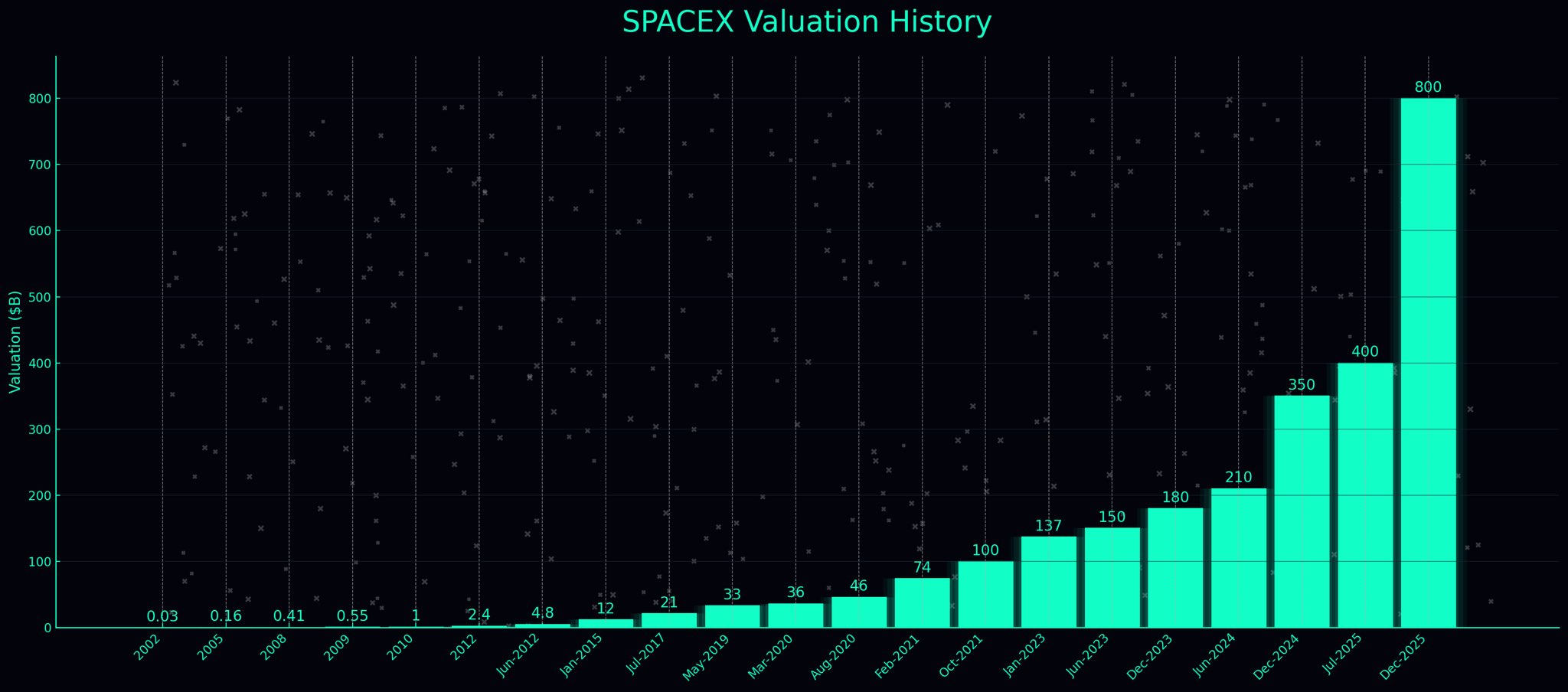

If you look at SpaceX’s valuation chart from 2002 to the projected IPO in 2026, one thing instantly stands out:

This isn’t a normal growth story. It’s a revolution unfolding in slow motion—and then suddenly all at once.

SpaceX starts as a struggling startup burning cash and ends up as a company that could launch the largest IPO ever witnessed, surpassing even Saudi Aramco.

This is the story of how it happened.

Phase 1: The Struggle Years (2002–2010)

Eight Years. Four Rocket Failures. One Lifeline.

When SpaceX began in 2002, its valuation was just $27 million—barely visible on the chart.

For the next eight years, it crawled to $1 billion.

Behind that flat line lies pure survival mode:

- Between 2006 and 2008, SpaceX suffered three consecutive Falcon 1 failures.

- They were weeks away from shutting down when Falcon 1 finally reached orbit on its fourth attempt.

- That single success helped secure the $1.6 billion NASA contract in 2008, which saved the company from collapse.

The early chart doesn’t show drama.

But the reality? SpaceX was born in fire.

Phase 2: The Reusability Breakthrough (2010–2015)

The Moment Space Became Affordable

From 2010 to 2015, SpaceX grew from $1 billion to $12 billion.

The growth felt steady—but something extraordinary was happening behind the scenes.

On December 21, 2015, SpaceX did the impossible:

It landed a Falcon 9 booster back on Earth, upright.

Months later, they re-launched the same booster.

This transformed the economics of space forever.

- Launch cost per kg dropped from $65,000 → $2,500

- SpaceX grabbed over 50% of global commercial launches

- Rivals like ULA, Roscosmos, and Arianespace were effectively cornered

The valuation slope on the chart begins to rise—not explosively, but persistently.

This was the foundation of everything that came next.

Phase 3: The Starlink Awakening (2015–2021)

From Rocket Company to Telecom Giant

Between 2015 and 2021, SpaceX grew from $12B → $100B.

This is where the curve starts bending upward.

Why?

Because SpaceX quietly launched its second empire: Starlink.

- Thousands of satellites.

- Millions of customers.

- Instant global coverage.

Suddenly SpaceX wasn’t selling rockets—it was selling internet, with recurring revenue and massive margins.

By 2021, SpaceX became one of the world’s highest-valued private companies.

The chart now officially enters “exponential” mode.

Phase 4: Hypergrowth (2021–2024)

When a Growth Curve Becomes Vertical

This is the jaw-dropping part of the chart.

In just three years, SpaceX’s valuation rocketed from:

- $100B (2021)

- $137B (Jan 2023)

- $150B (Jun 2023)

- $180B (Dec 2023)

- $210B (Jun 2024)

- $350B (Dec 2024)

That final jump—$210B → $350B in six months—isn’t normal.

It signals one thing:

Starlink hit escape velocity.

By the end of 2024:

- Over 5 million subscribers

- $8.2B in annual Starlink revenue

- 63% of total SpaceX revenue

- Proven military importance in Ukraine

- Positive unit economics

- Ready for an IPO

This is the moment SpaceX turns from a powerful company into a dominant force across two industries.

Phase 5: The IPO Countdown (2024–2025)

The Moon Shot That Could Double Its Valuation

Projections now show:

- Dec 2024: $350B

- Jul 2025: $400B

- Dec 2025: $800B

SpaceX has reportedly informed investors that it is preparing for an IPO in the second half of 2026, with an expected valuation of around $1.5 trillion.

That would instantly make it:

- The largest IPO in history

- The most valuable aerospace company ever

- The foundational stock of the space economy

This IPO could create as much shareholder value in 12 months as SpaceX created in the previous two decades.

Will the IPO Make Elon Musk the First Trillionaire?

Short answer: Very likely.

Here’s the math:

- Musk owns 42% of SpaceX

- At a $1.5 trillion IPO, that stake = $630B

- Add his Tesla stake (~$140B)

- Add his xAI stake (~$85B)

- Add other assets

Total: ~$950B

If SpaceX trades up post-IPO → $1T net worth becomes inevitable.

And if SpaceX reaches Aramco-like territory ($1.8 trillion)?

Musk crosses $1 trillion even before Starlink is spun out.

Some analysts also believe Starlink alone could eventually be worth $500B–$1T if it reaches 50 million subscribers.

The Largest IPOs in History—And Where SpaceX Stands

| Company | IPO Year | Amount Raised | Valuation | Context |

|---|---|---|---|---|

| Saudi Aramco | 2019 | $25.6B | $1.7T | World's largest oil producer, 1.5% stake listed |

| AgBank China | 2010 | $22.1B | $150B | China's agricultural bank, served 320 million customers |

| Alibaba | 2014 | $21.8B | $168B | E-commerce giant, largest IPO on US exchanges at the time |

| SoftBank Corp | 2018 | $21.3B | N/A | Japanese telecom, still one of largest IPOs ever |

| Visa | 2008 | $17.9B | $37B | Payment network, beat-down valuations at IPO |

| SpaceX (Projected) | 2026 | $25B+ | $1.0-1.5T | Space economy pioneer, youngest on this list |

Even before its debut, SpaceX is already positioned to beat:

- Saudi Aramco ($29.4B)

- Alibaba ($25B)

- Agricultural Bank of China ($22.1B)

SpaceX’s IPO could raise $25B–$30B while listing at a valuation 3–5× larger than Aramco’s.

Why?

Because unlike legacy industries, the space economy is just beginning.

For deeper IPO strategy breakdowns, always rely on a professional USA stock advisory.

The Space Economy's Explosive Growth: Why SpaceX's Valuation Matters

The global space economy is expected to reach $1 trillion by 2030.

SpaceX dominates nearly every growth segment:

- Defense & Security: $73 billion (54% of government space spending in 2024)

- Satellite Manufacturing: Expected to grow at 16% annually to reach $57 billion by 2030

- Launch Services Market: Projected to reach $32 billion by 2030 (from ~$12B in 2025)

- Satellite Services: Expected to exceed $300 billion by 2030

Starlink has become essential infrastructure.

Falcon 9 has become the gold standard.

And Starship could unlock the multi-planet economy.

Few companies in history have ever controlled such a large share of a future trillion-dollar market.

The Risks That Could Slow Down the IPO

Even though SpaceX looks unstoppable, a few real challenges could delay the IPO:

Rocket Failures

- Falcon 9 is extremely reliable, but one major accident could scare investors and push the IPO timeline back.

Complex Global Regulations

- Starlink needs approval from dozens of countries to operate.

- Direct-to-phone satellite service makes this even tougher because it requires extra spectrum permissions.

Rising Global Competition

- China is building its own satellite network.

- Arianespace is coming back.

- Blue Origin’s New Glenn is finally launching.

- More competition means more pressure.

Starship Delays

- Starship is the key to SpaceX’s future plans—but it’s not fully commercial yet.

- Any major delay would affect long-term revenue expectations and valuation.

Economic Slowdown

- If the global economy weakens, big IPOs become harder to pull off.

- SpaceX might simply wait for better market conditions.

The Bottom Line: Why This Matters to You

Whether you're an investor, space enthusiast, or simply curious about the future, SpaceX's IPO will be historic. The company is on track to become the largest IPO by valuation in modern history—potentially surpassing Saudi Aramco while operating in a sector that's just beginning to scale.

The era of private space is ending. The era of publicly traded space companies is about to begin. And Elon Musk's path to becoming the world's first trillionaire is clearer than ever before.

If you want to capitalize on movements around the SpaceX IPO, getting reliable short term stock trading advice in USA can help you position your portfolio before volatility begins.

Join our community of traders and investors: