Introduction

Imagine you bought $1,000 worth of silver on January 1, 2025. By December 26, that same silver would be worth $2,750. That's almost triple your money in one year. No stocks. No tech companies. Just a simple metal that suddenly became extremely valuable.

This isn't fantasy. This actually happened in 2025. Silver went from $29 per ounce in January to nearly $80 per ounce by December—a jump of 175%. Most people missed it completely. Wall Street was talking about tech stocks and AI. Meanwhile, silver was quietly creating wealth for anyone paying attention.

Here's what makes this story interesting: this wasn't luck or speculation. There are real reasons why silver's price exploded. Understanding these reasons helps you see whether this trend will continue into 2026—and why silver has become increasingly relevant in broader US trading and investment advice discussions around commodities and real assets.

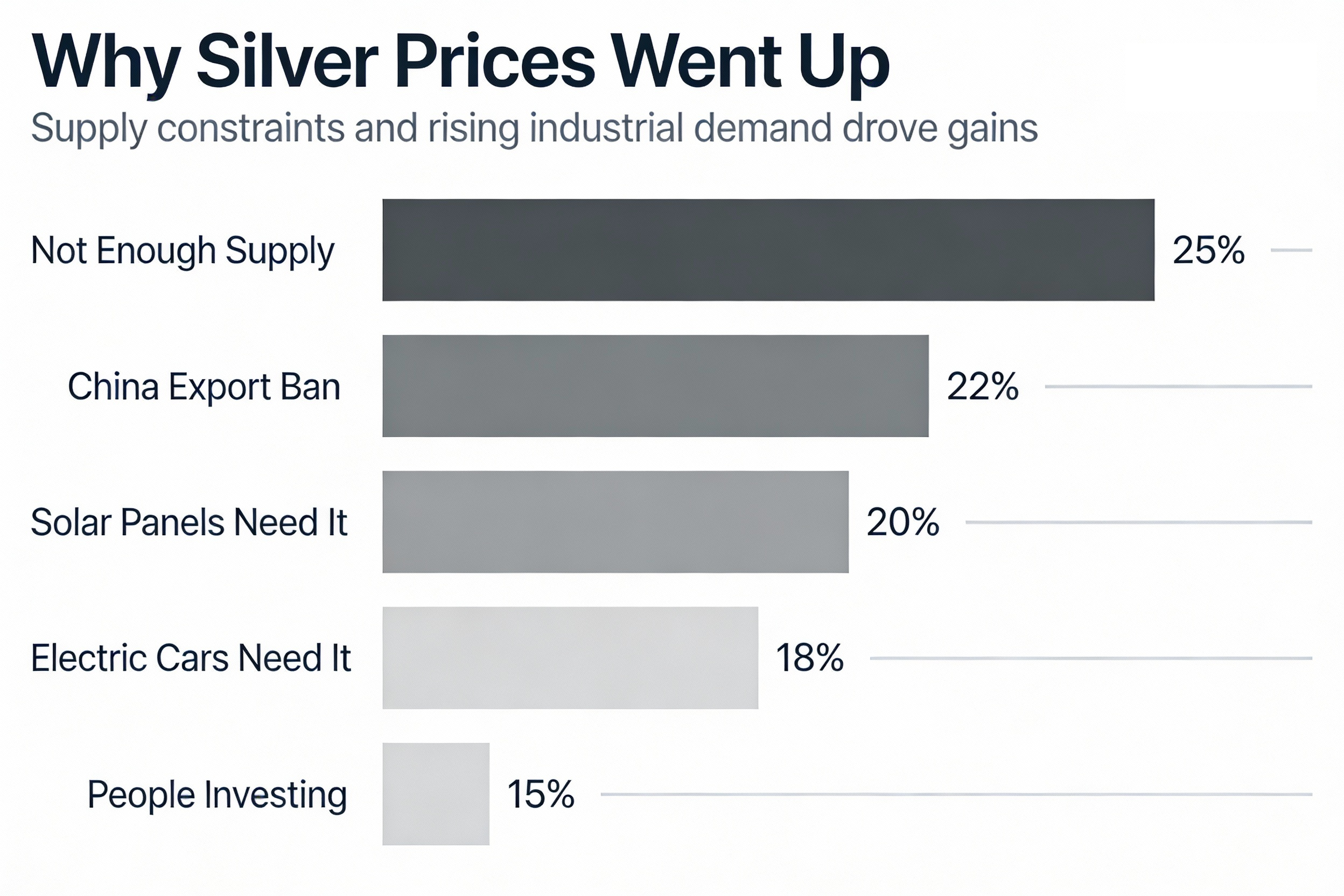

Why Did Silver Get So Expensive? Five Simple Reasons

Reason #1: We're Not Making Enough Silver (The Supply Problem)

Here's something most people don't know: we don't have enough silver. Every year, the world needs more silver than miners produce. This has been happening for eight years straight.

Think of it like a bucket with a hole in it. Every year, the bucket gets smaller because we're using more silver than we're making. Eventually, the bucket runs empty.

Why can't miners just make more silver? Because 70 out of every 100 ounces of silver comes from mining other metals like copper and gold. It's like when you dig for gold and accidentally find silver—you can't just decide to find more silver instead. Miners mine for copper, and silver comes along for the ride.

If copper prices drop, mines close down—even if silver prices are super high. Mines can't flip a switch and just make more silver. Opening a new mine takes 10-15 years and costs billions of dollars. That's why supply stays flat even when prices triple.

Result: We're running out of stored-up silver. This pushes prices higher.

Reason #2: Solar Panels Are Eating Silver (Green Energy Demand)

Every solar panel needs silver inside it. It's not optional—it's how solar panels work. Silver is the best material for conducting electricity in these panels, and nothing else works as well.

Here's the big picture: the world is building solar panels faster than ever before. Countries around the globe are switching to clean energy. Governments offer tax breaks and subsidies to encourage more solar installations.

In 2024, solar panels used up 15% of all silver made globally. That number is growing by 20% every year. With more and more countries committing to clean energy, this demand isn't stopping—it's accelerating.

This demand is locked in. Governments made promises to build renewable energy. Companies already committed to solar projects. This silver will be bought no matter what.

Reason #3: Electric Cars Need Silver Too (EV Boom)

Every Tesla, every Chevy EV, every electric car being made contains silver. It's used in the battery, in the wiring, in the sensors—basically everywhere electricity flows through the car.

One electric car needs about 1 ounce of silver. Now imagine: the world is making more electric cars every year. In 2024, about 14 million EVs were sold. By 2030, that could jump to 50 million EVs per year.

That's 50 million ounces of additional silver needed—just for electric cars. And that's on top of solar panels, smartphones, medical devices, and everything else.

This is not going away. Governments have rules requiring car companies to make electric vehicles. Companies have already invested billions in EV factories. They can't just stop. So silver demand from EVs will only grow.

Reason #4: China Just Locked Down Silver Exports (The Geopolitical Shock)

Here's the plot twist nobody expected: China announced in late 2025 that starting January 1, 2026, companies need government permission to ship silver out of China.

Why does this matter? Because China refines about 60-70% of the world's silver. Imagine if one country controlled 70% of the world's electricity, water, or food. That's the power China has over silver.

Now China is saying: "Before you sell silver abroad, you need permission from our government." This is the same strategy China used with rare earth metals—and it worked. Prices skyrocketed when China tightened controls.

What this means: Global companies can't easily get silver anymore. They have to ask China for permission. China will probably keep more silver for its own factories (making solar panels, EVs, and electronics). Less silver for the rest of the world = higher prices.

Even Elon Musk, the founder of Tesla, said this is a problem. If you can't get silver, you can't make EV batteries. Simple as that.

Reason #5: Regular People Started Buying Silver (Investment Demand)

When prices rise, people notice. Some smart investors realized: "Hey, silver is becoming rare and it's needed for stuff we'll definitely buy in the future like solar panels and electric cars. Maybe I should own some silver."

In 2025, people bought billions of dollars worth of silver through silver ETFs (exchange-traded funds)—basically mutual funds that hold physical silver. These are like buying a piece of silver without having to store it yourself.

Between January and December 2025, people added roughly 130 million ounces of silver to ETFs. That's like taking 130 million ounces out of circulation and locking it away for investment. When less silver is available for purchase, prices go up.

The Supply Vs. Demand Problem: Why Prices Keep Rising

Let's make this super simple. Imagine a restaurant with only 10 pizzas available each day but 100 people want to buy pizza. What happens? Prices go up because there's not enough pizza.

That's exactly what's happening with silver.

The Demand Side (People Who Want Silver):

- Solar panel makers need more and more silver

- EV makers need more and more silver

- Electronics makers need more and more silver

- Investment buyers want to buy silver

- Jewelry makers still need silver

All of these people want more silver every year. This demand is locked in—they can't just stop needing it.

The Supply Side (Silver Being Made):

- Miners make about the same amount of silver as always

- Mining can't speed up (it takes 10-15 years to open a new mine)

- 70% comes from other mining operations (miners can't just make more silver alone)

- Stored-up silver is being used up

Result: Demand is growing fast. Supply is stuck. Prices go up.

What Does This Mean for You?

Here's the honest truth: We're in a new situation with silver. It's not just a precious metal anymore (like jewellery). It's now a critical industrial material—like copper or oil.

This changes everything because:

- Silver demand won't disappear. Solar panels will keep being made. Electric cars will keep being made. This isn't temporary. This is permanent change.

- Supply is stuck. We can't just make more silver quickly. It takes years. Miners can't respond fast enough to demand.

- China controls the flow. With export restrictions, Western companies can't easily get silver. This gives China huge power.

- Prices will stay high. When demand is locked in and supply is limited, prices don't crash back down. They stay elevated.

For market participants following Trading Advice for USA, silver is increasingly viewed not just as a hedge, but as a structurally important asset tied to energy, technology, and geopolitics.

Will Silver Keep Going Up? Here's the Realistic View

Will silver hit $100 per ounce? Maybe. Probably not immediately, but eventually if these trends continue.

Can silver crash down to $30? Very unlikely in the next few years because the demand drivers (solar, EVs, electronics) are here to stay.

What could stop this? A really bad recession that crushes demand. Or if someone suddenly discovered huge new silver deposits. Or if China releases more silver to the market. These things are possible but not probable right now.

The most likely scenario: Silver stays in the $70-$90 range through 2026, with the possibility of going higher if China keeps restricting exports or if industrial demand accelerates.

The Simple Takeaway

2025 was the year silver woke up. It wasn't a bubble or hype. It was the market recognizing that:

- The world needs more silver than ever (solar, EVs, electronics)

- We can't make enough silver fast enough

- China is controlling the supply

- This isn't going away

If you missed the 175% gain in 2025, the good news is: the fundamental reasons for higher silver prices are still here in 2026. The bad news is: the quick explosive gains might be harder to find going forward.

For investors, silver presents an interesting opportunity: a real asset that's actually needed and increasingly scarce. That's rare.

The age of cheap, abundant silver is over. What comes next is a new reality where silver's scarcity actually matters—and prices reflect that scarcity.

That's the story of 2025. And it's probably just the beginning.