- Naranj Research Desk

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

Abstract

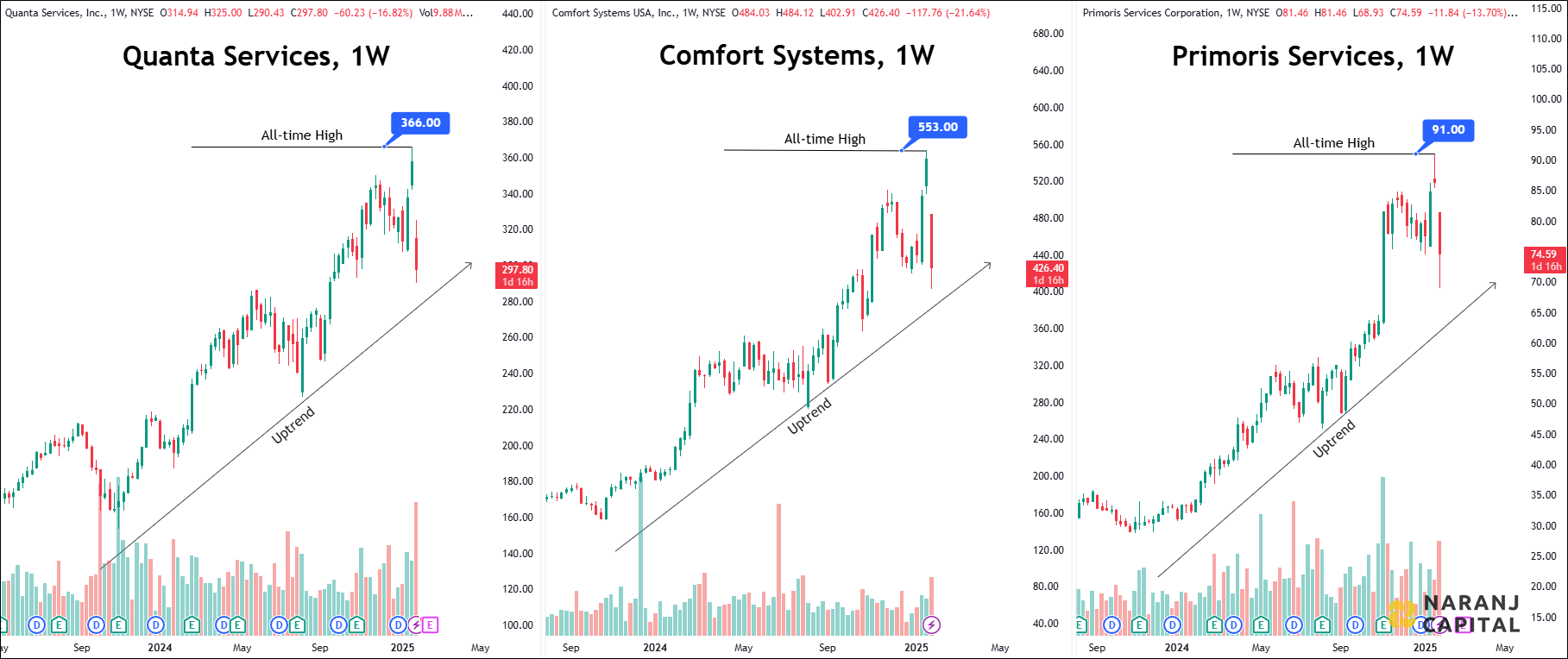

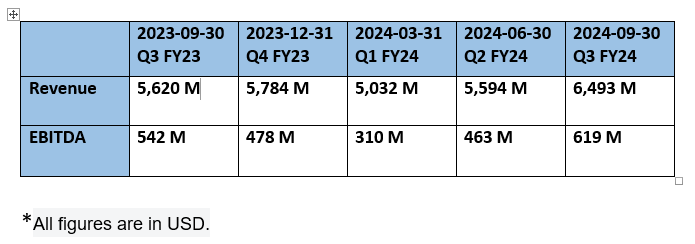

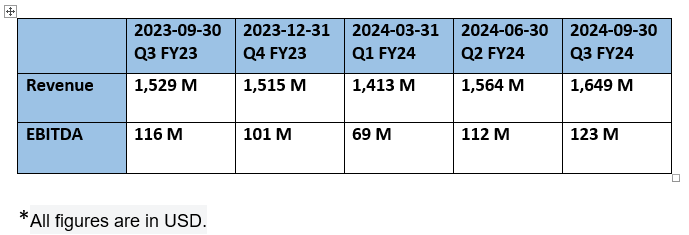

The U.S. construction and engineering sector is experiencing a significant boom, driven by infrastructure investments, rapid urbanization, and the rise of renewable energy projects. Leading companies such as Quanta Services (PWR), Comfort Systems USA (FIX), and Primoris Services Corporation (PRIM) are capitalizing on these trends, each demonstrating strong performance. Among them, PRIM stands out with exceptional financial health and attractive valuation metrics, positioning it as a compelling choice for investors. PWR and FIX are also performing well, benefiting from the sector's growth momentum.

With substantial government spending and ongoing urbanization fueling demand, the sector presents promising opportunities for long-term investors. However, thorough research, clear investment goals, and effective risk management remain crucial to navigating this dynamic landscape successfully.

The U.S. construction and engineering sector is a vital component of the nation's economy, driving infrastructure development, urbanization, and economic growth. It encompasses various activities, including residential, commercial, industrial, and infrastructure construction, as well as engineering services for design, planning, and project management. Recent trends shaping the sector include urbanization, sustainability, technological advancements, and government investments in infrastructure.

This report provides a comparative analysis of Quanta Services, Comfort Systems USA, and Primoris Services Corporation, examining their competitive dynamics in the U.S. construction and engineering sector.

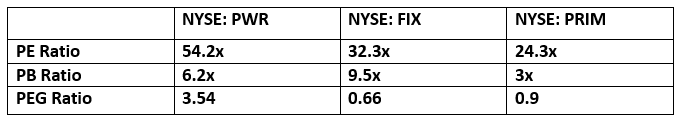

This ratio compares the company's stock price to its earnings per share.

These numbers indicate that PRIM is considerably undervalued when compared to its competitors.

2. P/B Ratio (Price-to-Book)

This ratio compares the company's stock price to its book value.

This ratio looks at the P/E ratio while also considering the company's expected earnings growth.

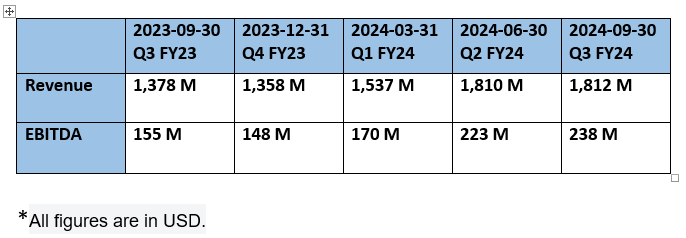

Analyzing the PEG ratios reveals that FIX is currently undervalued relative to its peers.

All three companies have reported significant improvements in operating cash flow for Q3 FY24:

The Debt-to-Equity ratio shows how much a company owes compared to what shareholders have invested.

Lower ratios (<1) are usually safer, while higher ratios (>2) mean more risk.

FIX boasts the lowest debt-to-equity ratio, indicating a stronger balance sheet and reduced reliance on debt financing compared to its peers.

After a comprehensive analysis of the major players in the U.S. Construction & Engineering sector, including an in-depth review of technical capabilities and financial performance, Primoris Services Corporation (PRIM) emerges as a standout candidate. The company’s robust financial health, supported by strong cash reserves, positions it well to navigate challenges such as debt concerns.

The sector as a whole is poised for significant growth, driven by massive government spending on infrastructure and the ongoing trend of rapid urbanization. For investors, this presents a compelling opportunity. However, it is essential to conduct thorough research, establish clear investment objectives, and maintain a long-term perspective to capitalize on this growth while effectively managing risks.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website