- Naranj Research Desk

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

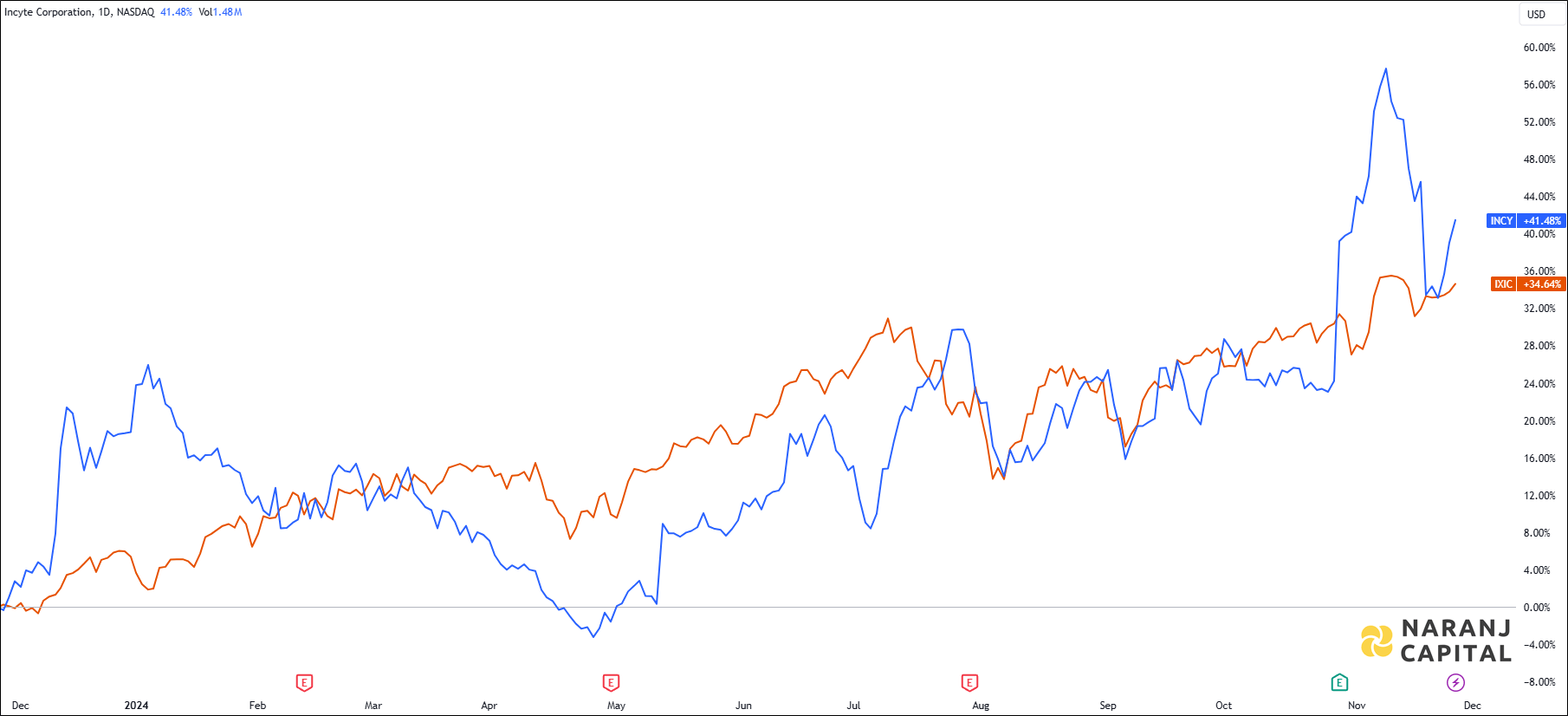

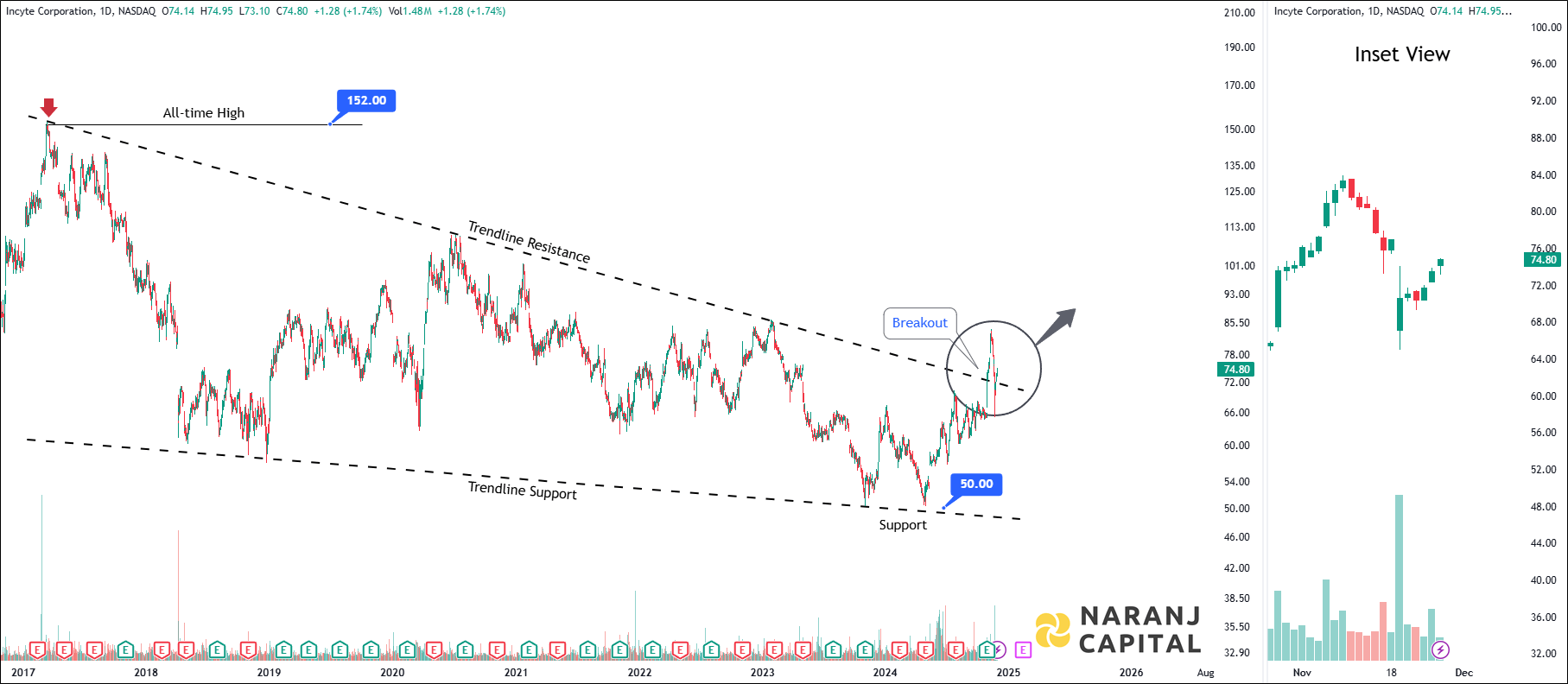

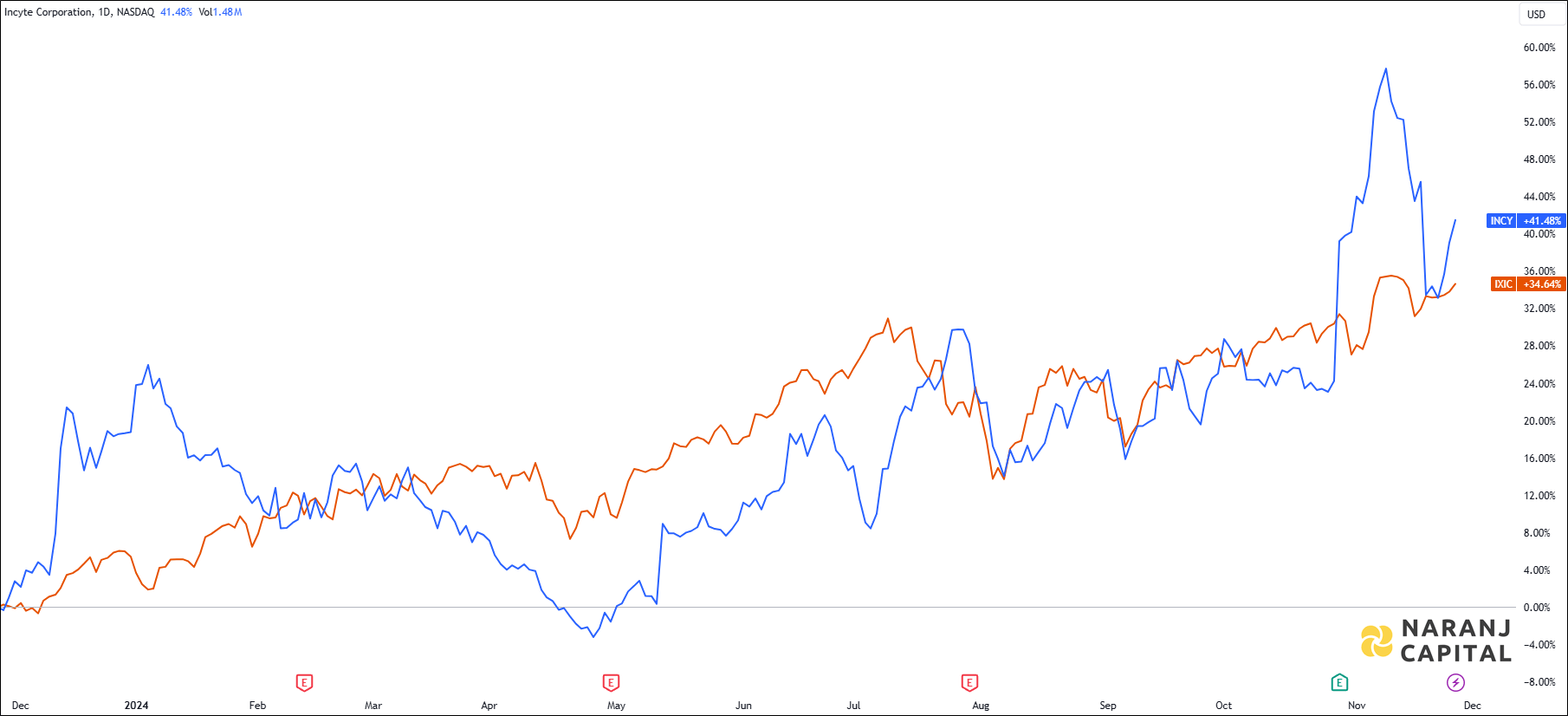

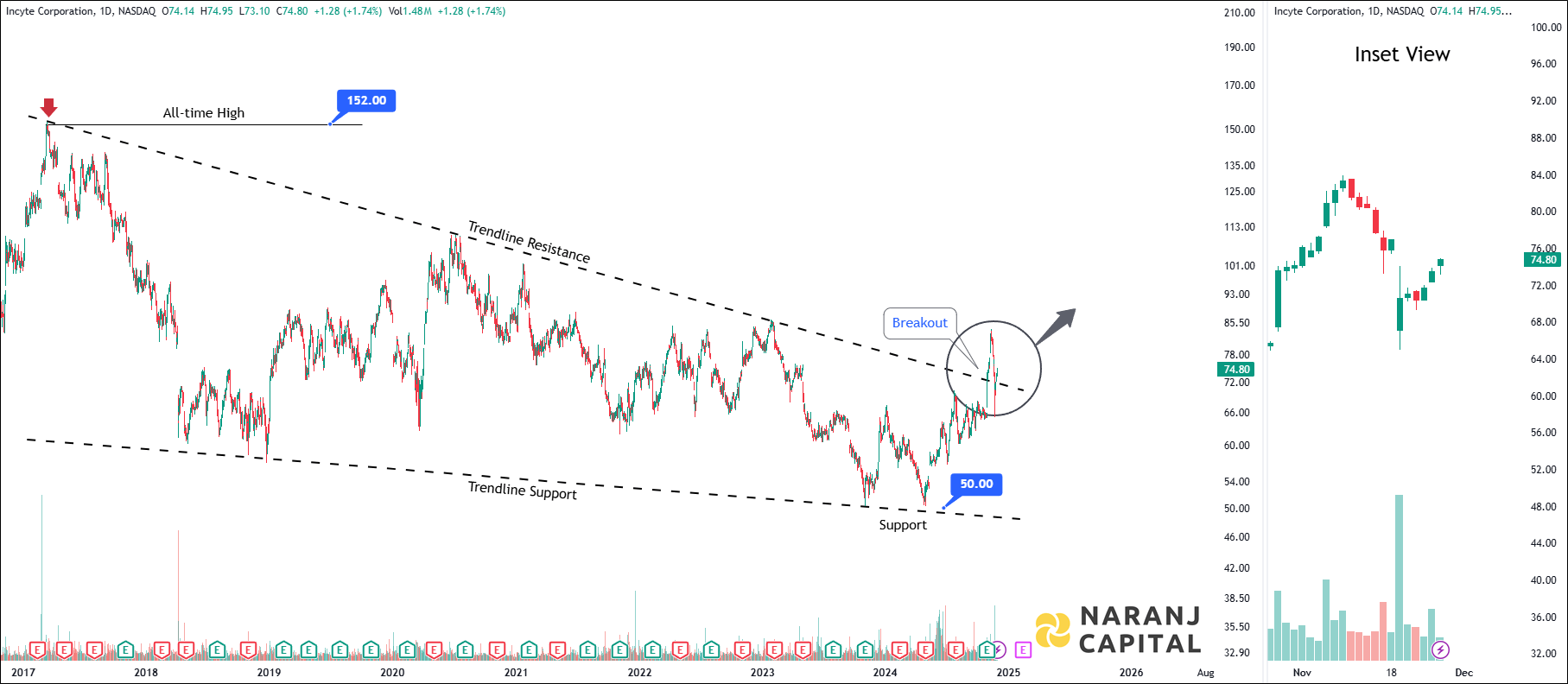

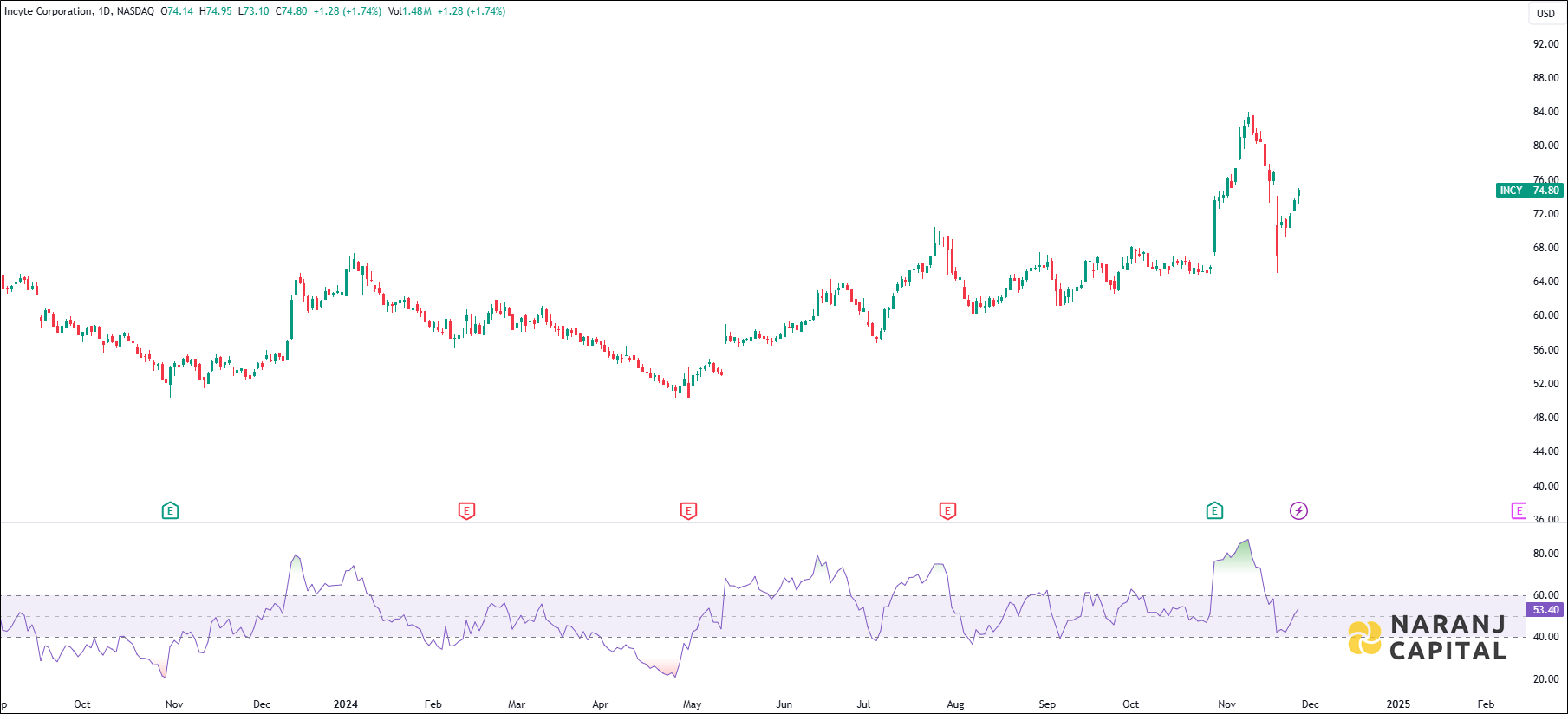

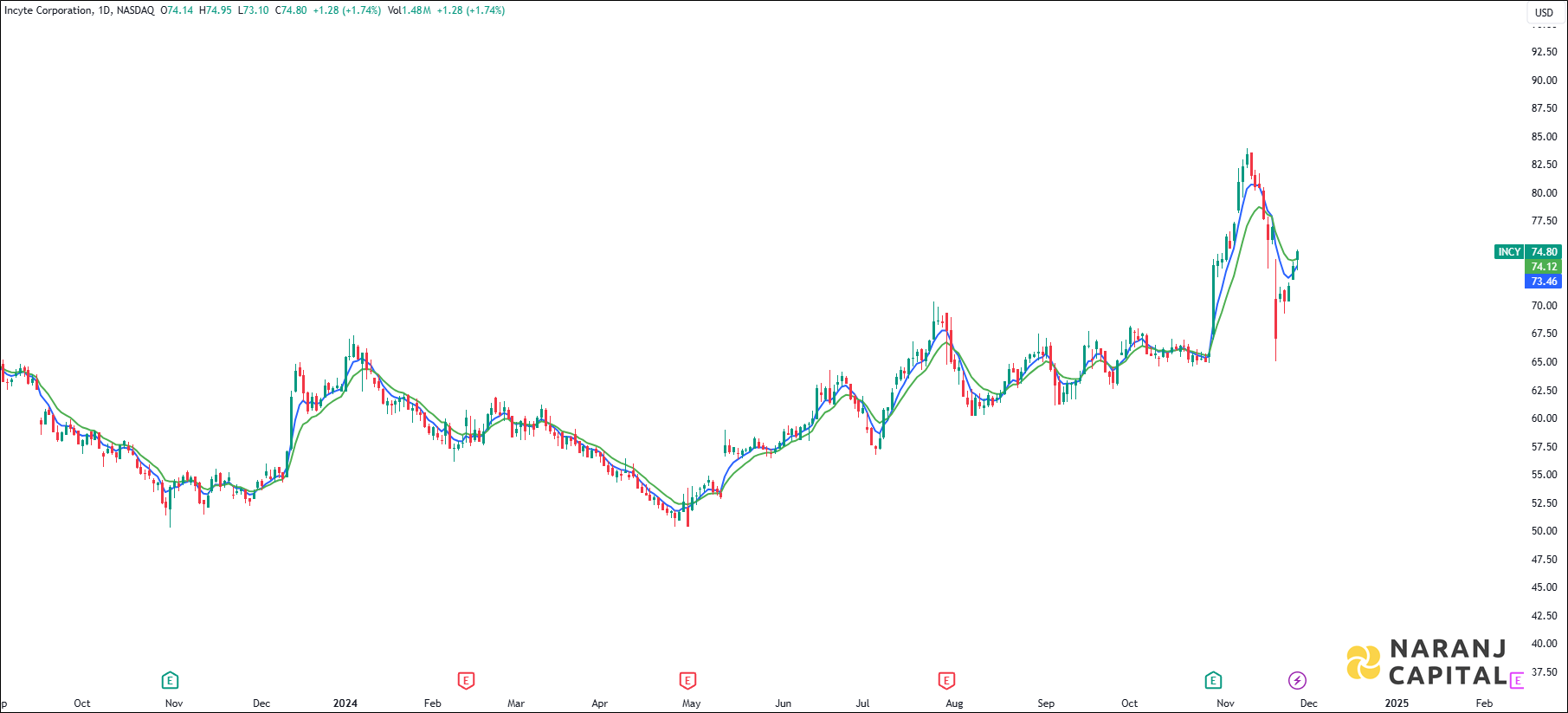

INCY — NASDAQ —

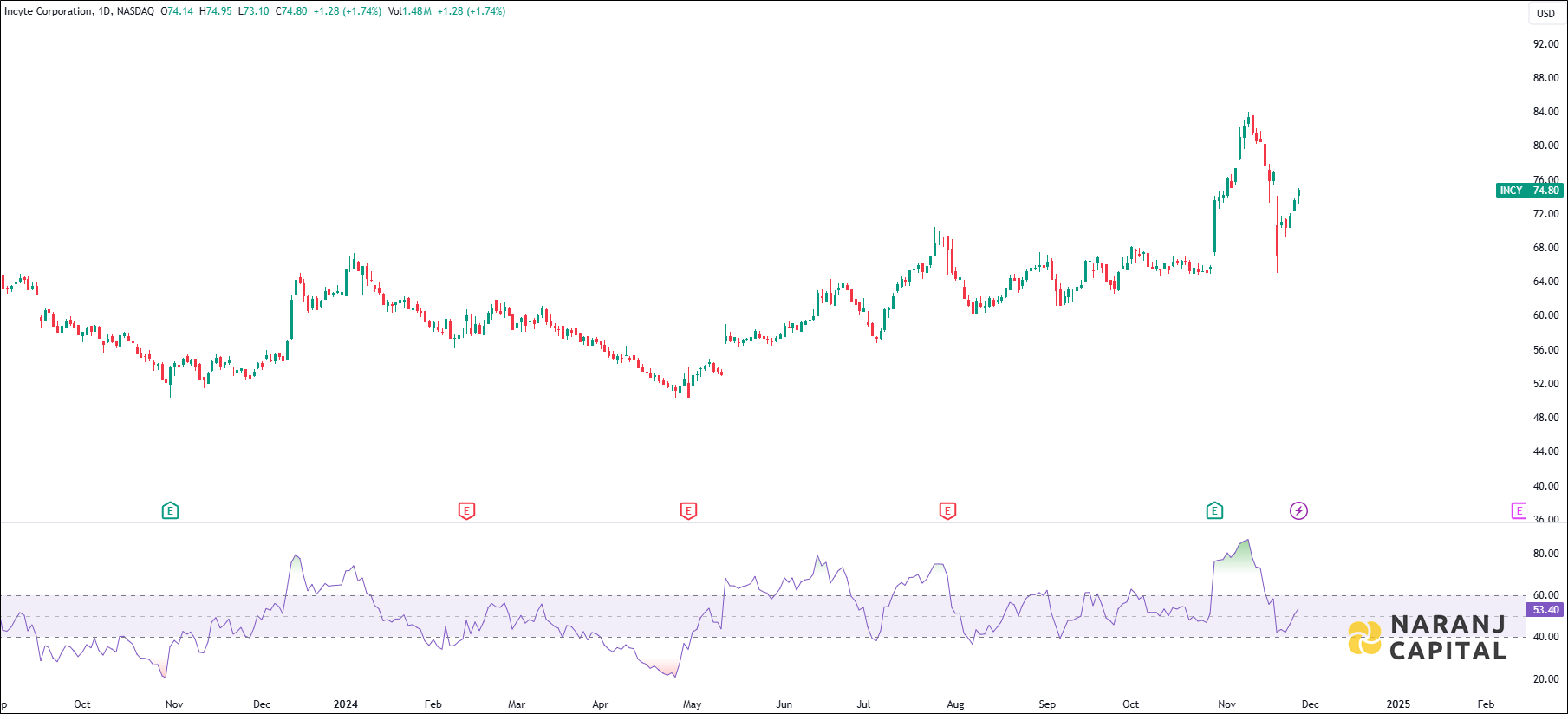

The stock's current RSI stands at 53.40, indicating a rebound from the 40 level, which reflects a favorable market sentiment.

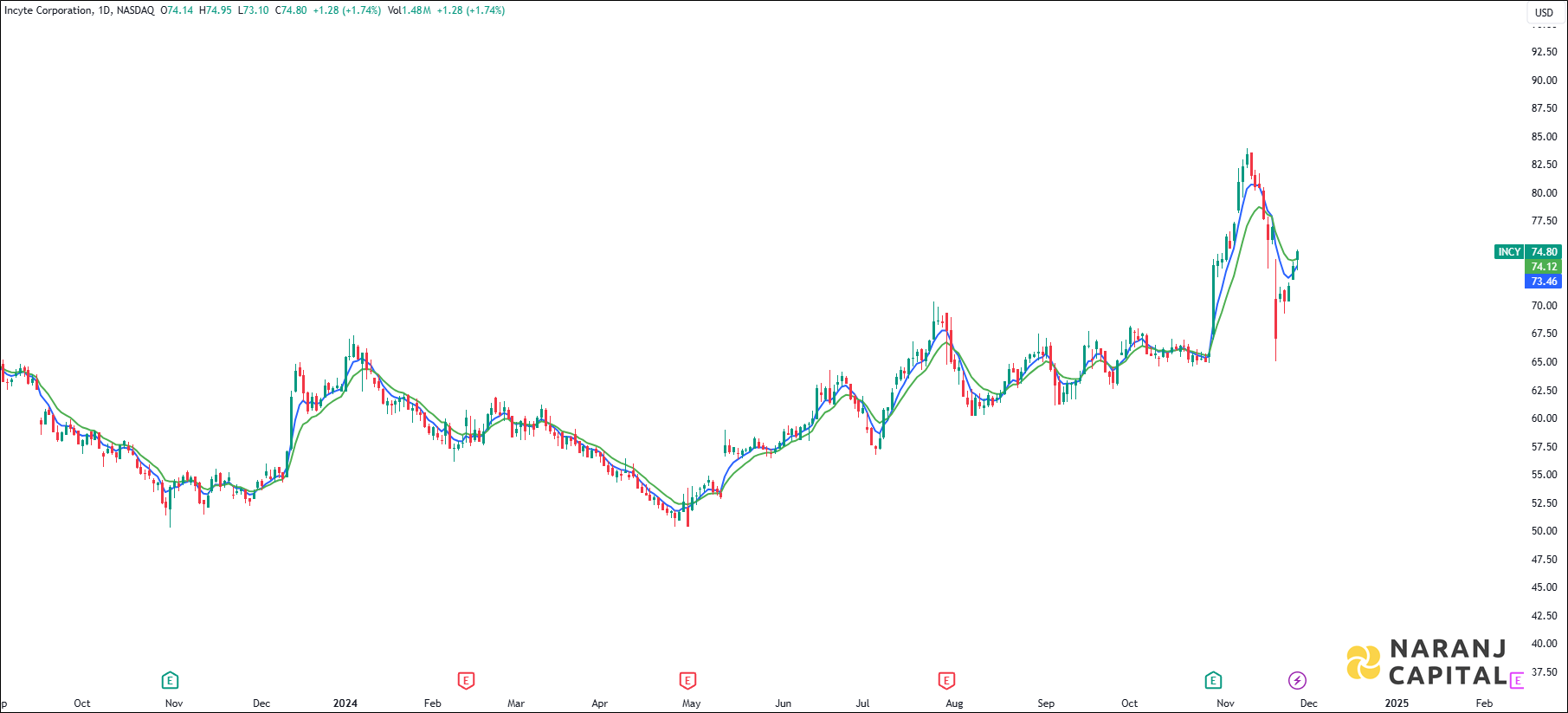

The short length exponential moving average (5 EMA) is about to cross the long length exponential moving average (10 EMA) from the below, generates bullish signal. Last day’s candle has closed above all these moving averages. This suggests buyers are taking interest in this stock.

Based on our US swing trading stocks, Incyte Corporation stock price target will be USD 78.5 - SAR 80 in the next 14-15 trading sessions.

Incyte Corporation is a biopharmaceutical firm focused on discovering, developing, and commercializing therapies for haematology/oncology, inflammation, and autoimmunity globally. It offers JAKAFI for myelofibrosis, polycythemia vera, and acute graft-versus-host disease; MONJUVI/MINJUVI for diffuse large B-cell lymphoma; PEMAZYRE for tumors; ICLUSIG for chronic myeloid leukemia; ZYNYZ for Merkel cell carcinoma; and OPZELURA for atopic dermatitis. Its clinical pipeline includes retifanlimab in Phase 3 trials for anal canal and lung cancers, axatilimab for chronic GVHD in Phase 2, and several other investigational products. The company has partnerships with Novartis, Lilly, and others for development and commercialization. Formerly Incyte Genomics Inc, it rebranded to Incyte Corporation in March 2003.

INCY — NASDAQ —

The stock's current RSI stands at 53.40, indicating a rebound from the 40 level, which reflects a favorable market sentiment.

The short length exponential moving average (5 EMA) is about to cross the long length exponential moving average (10 EMA) from the below, generates bullish signal. Last day’s candle has closed above all these moving averages. This suggests buyers are taking interest in this stock.

Based on our US swing trading stocks, Incyte Corporation stock price target will be USD 78.5 - SAR 80 in the next 14-15 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website