- Naranj Research Desk

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

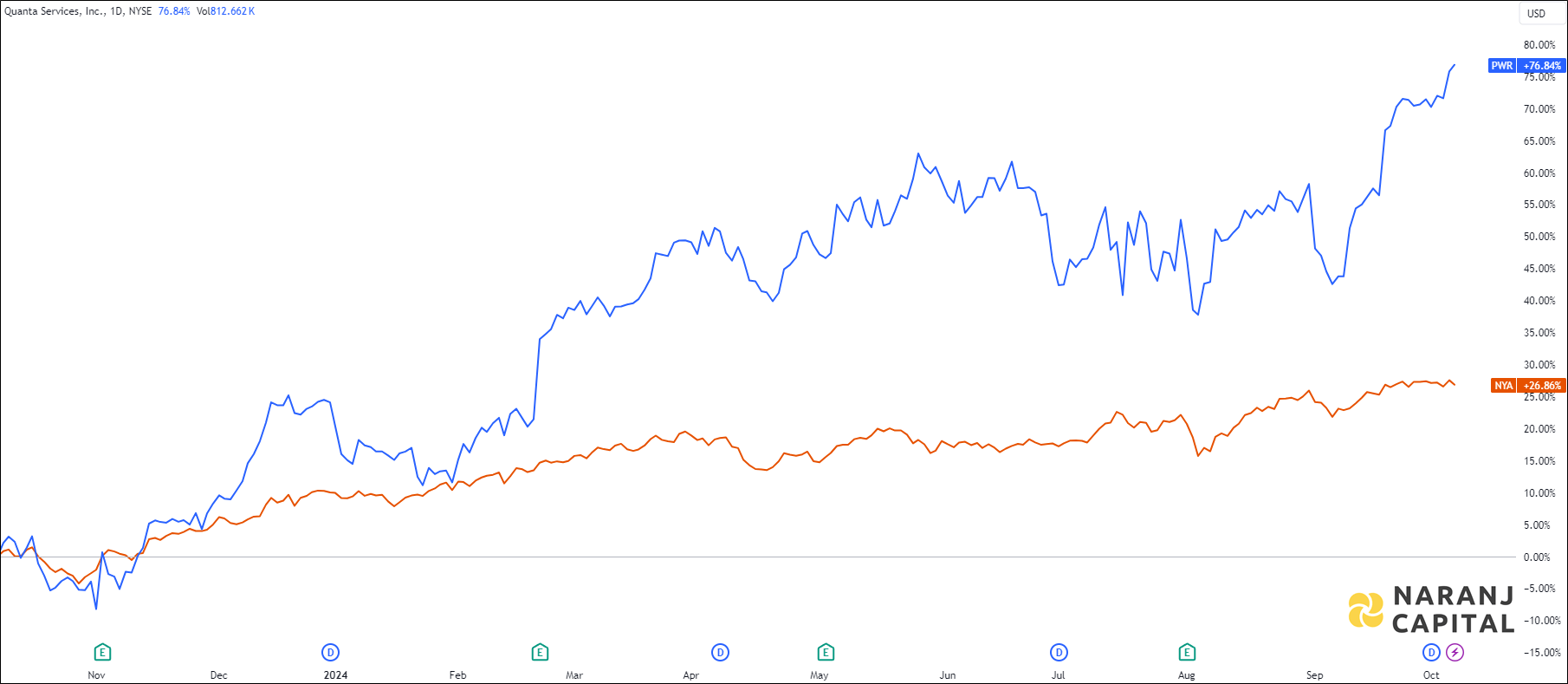

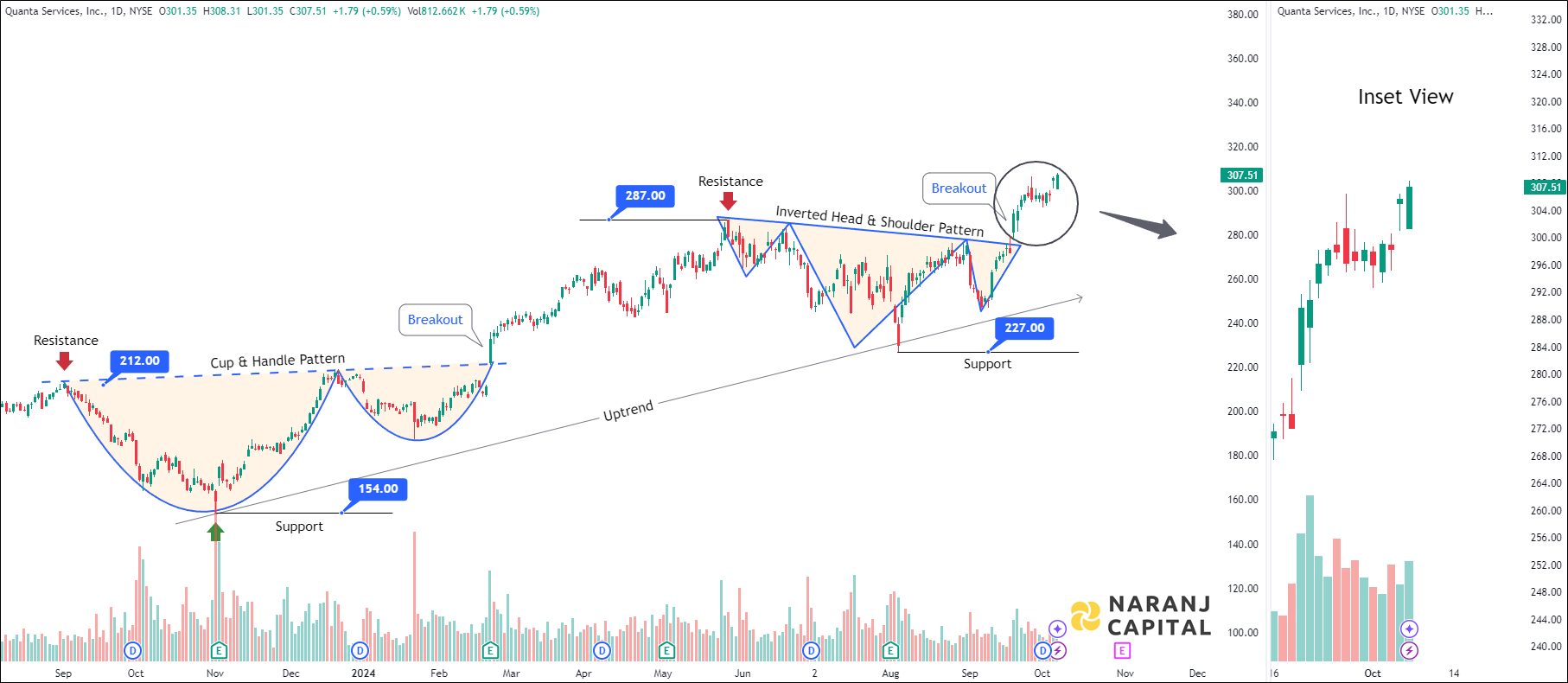

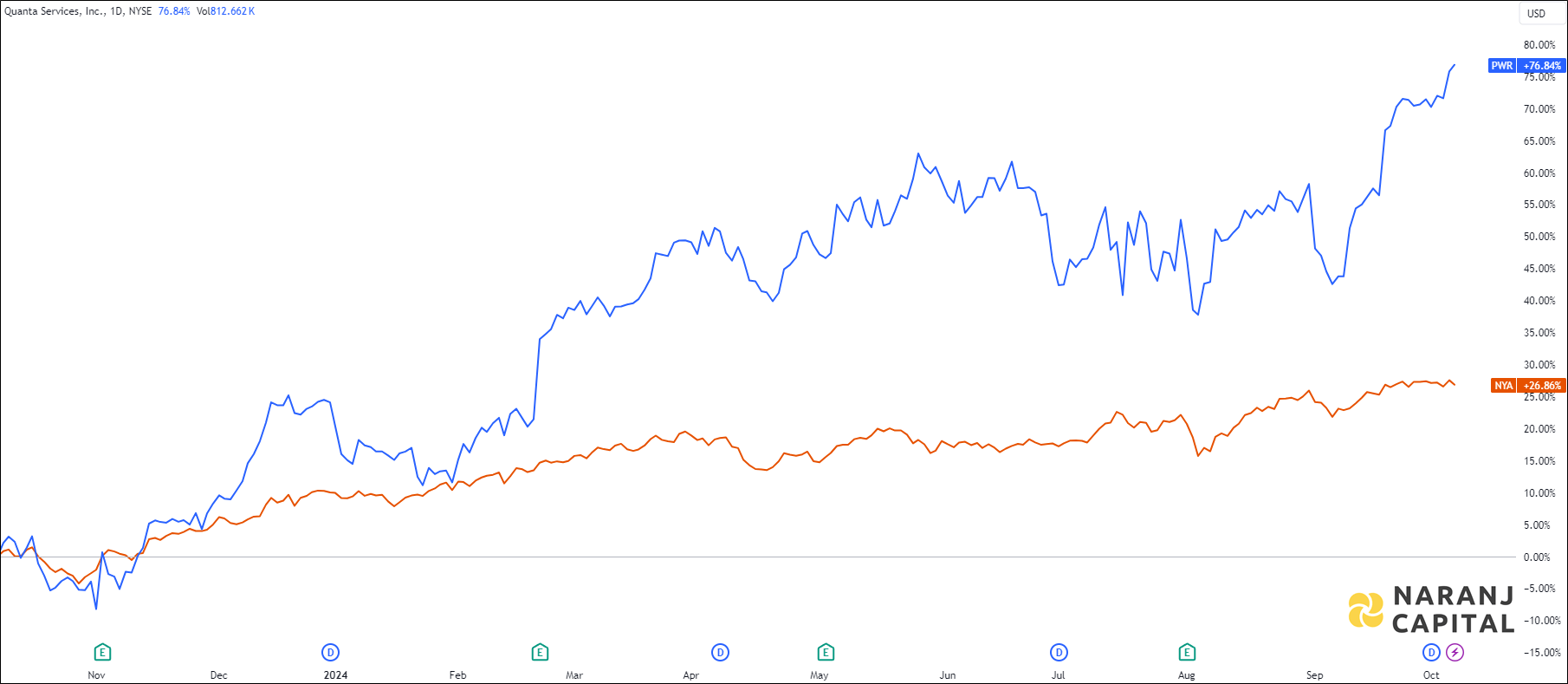

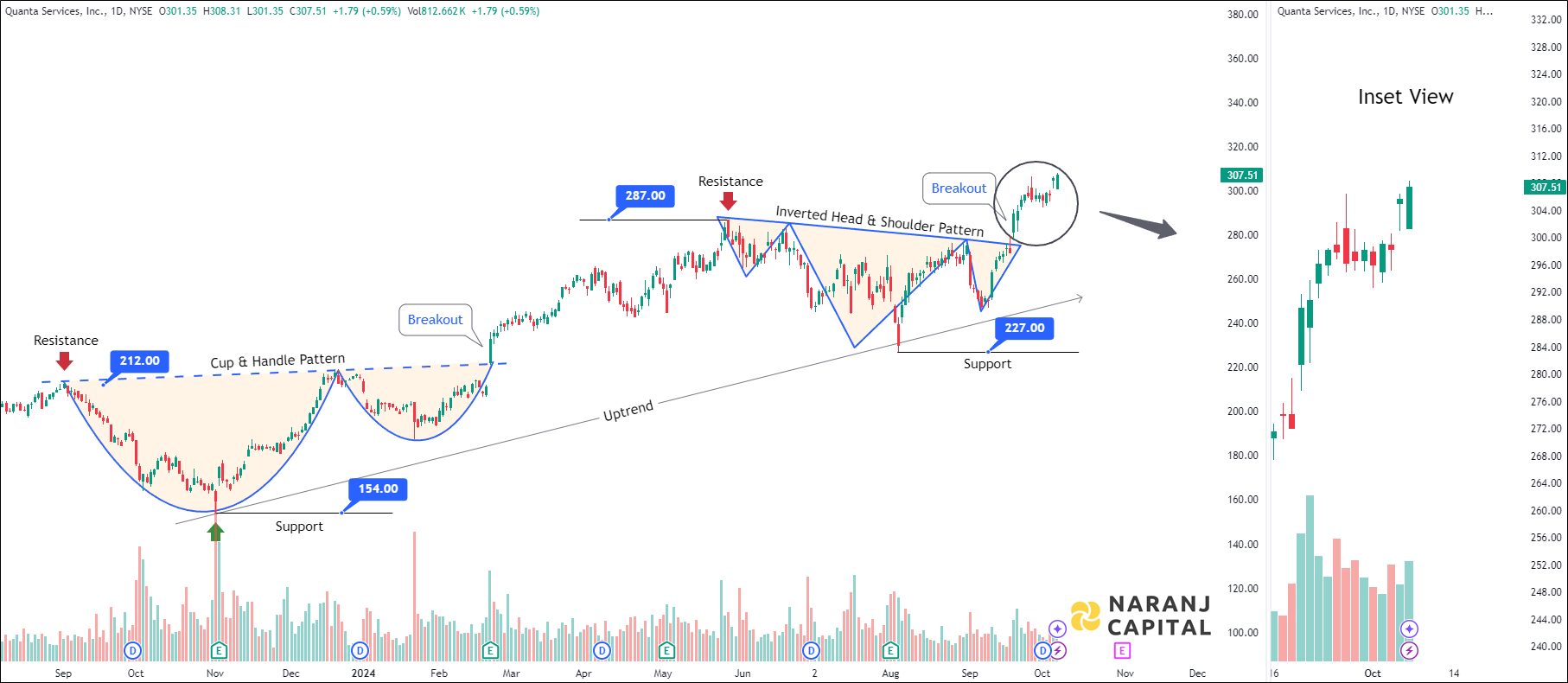

PWR — NYSE —

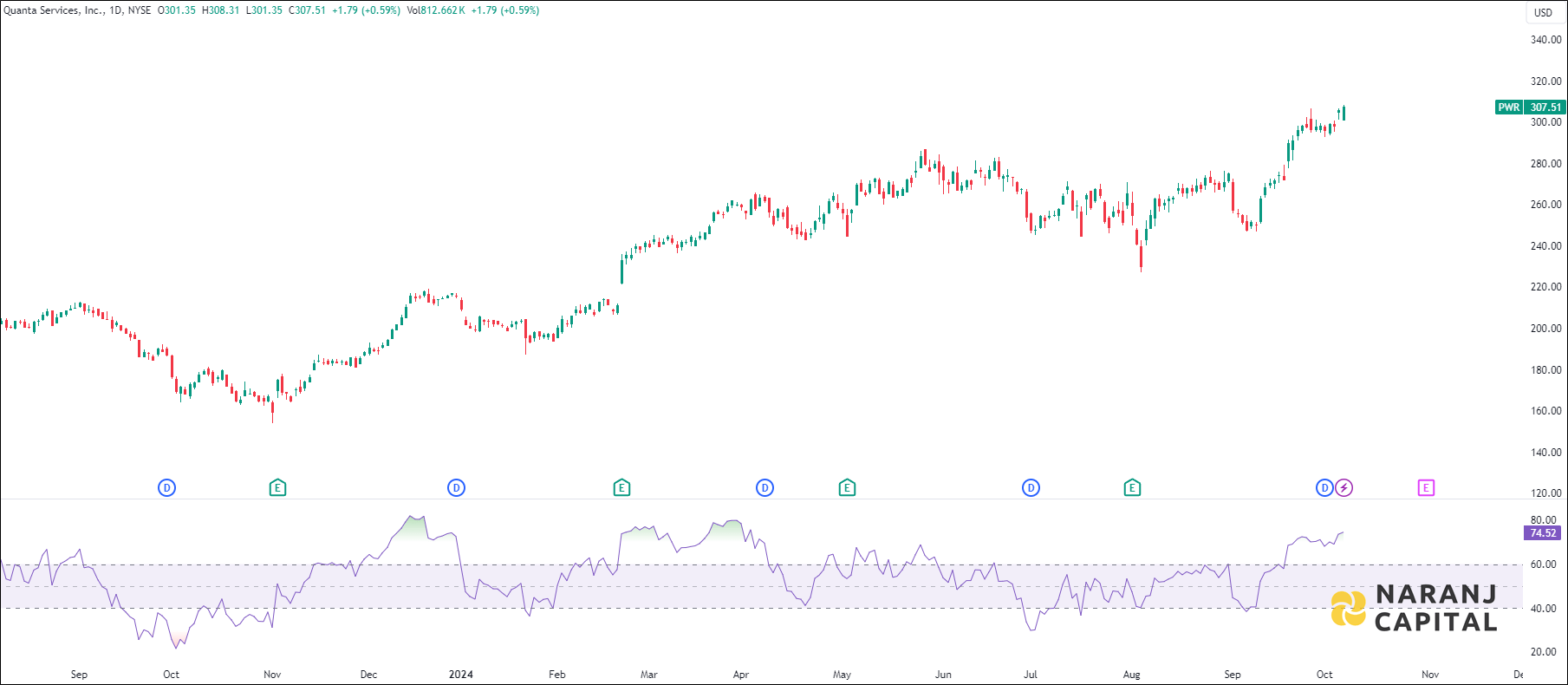

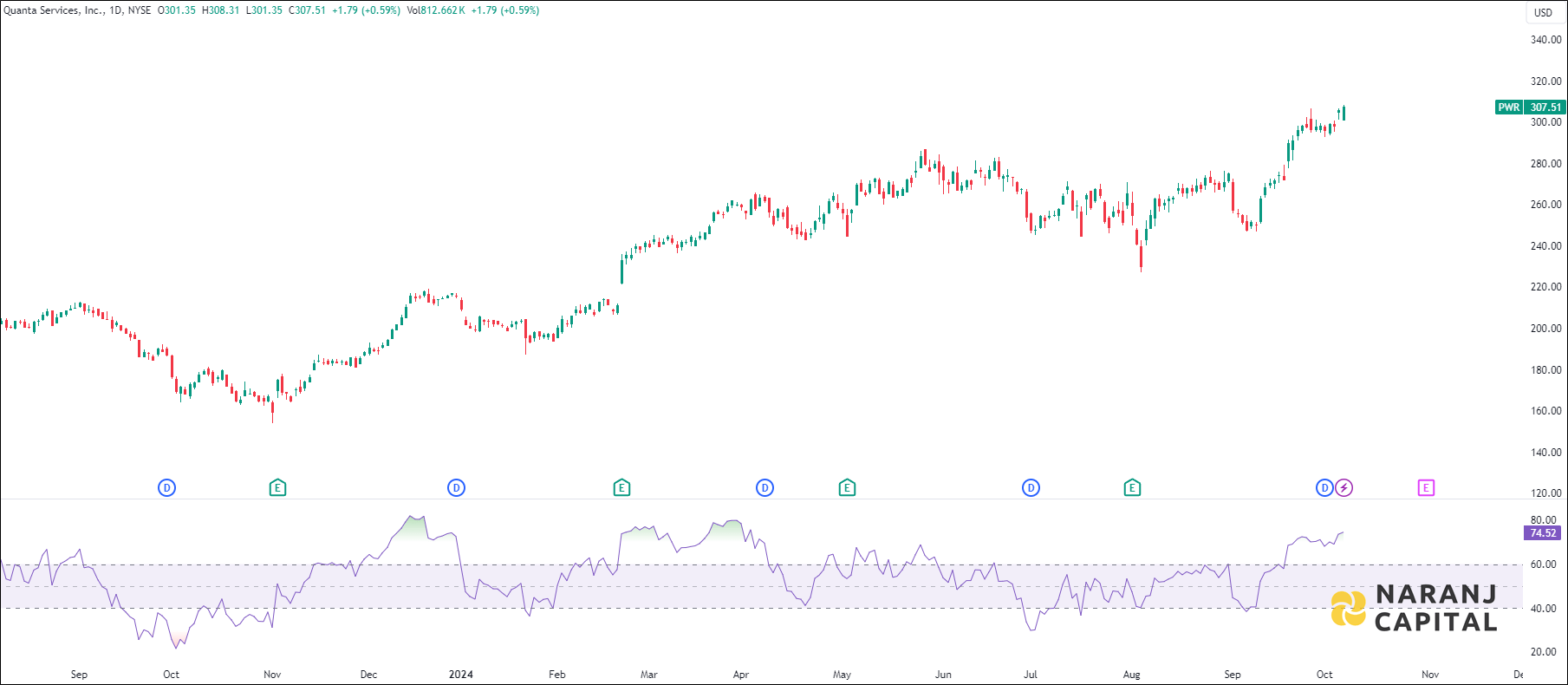

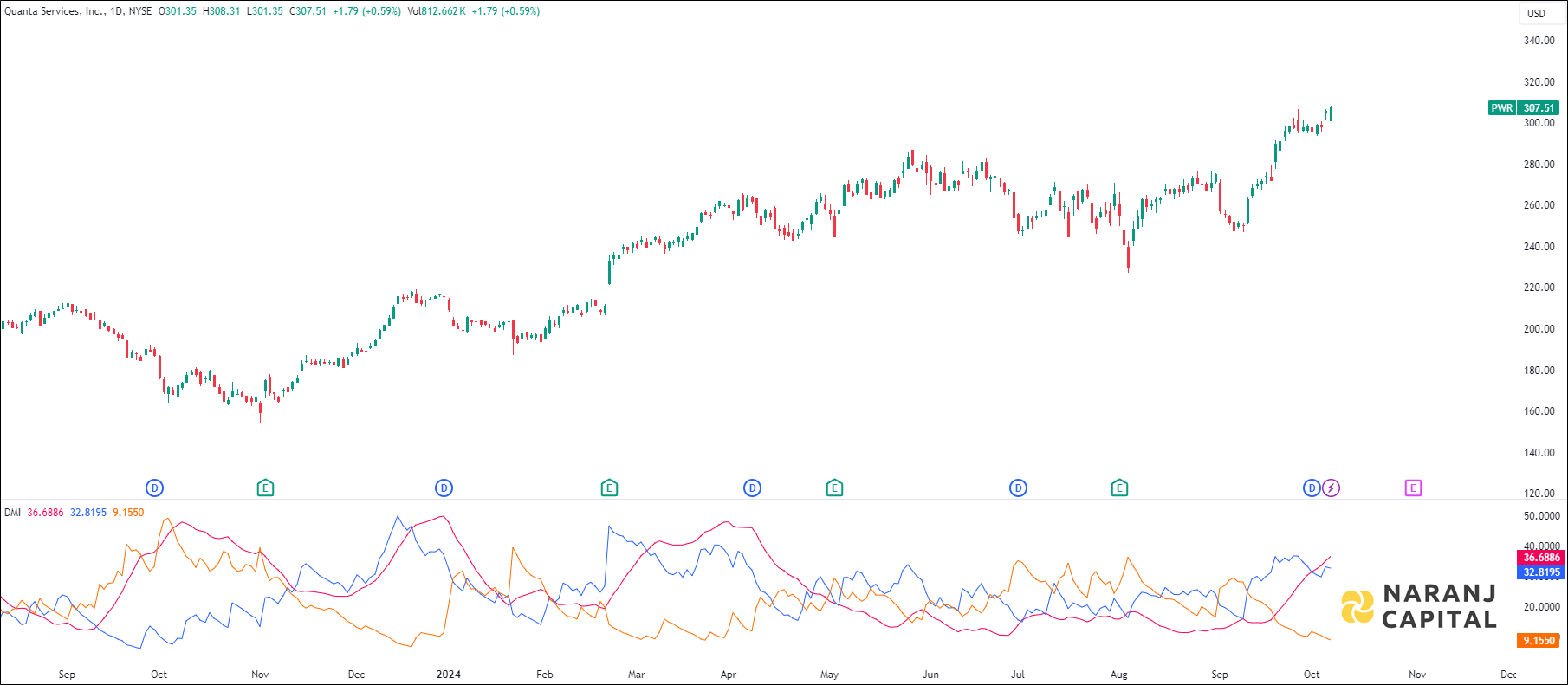

Current RSI of this stock is 74.52, which indicates the strength of buyers.

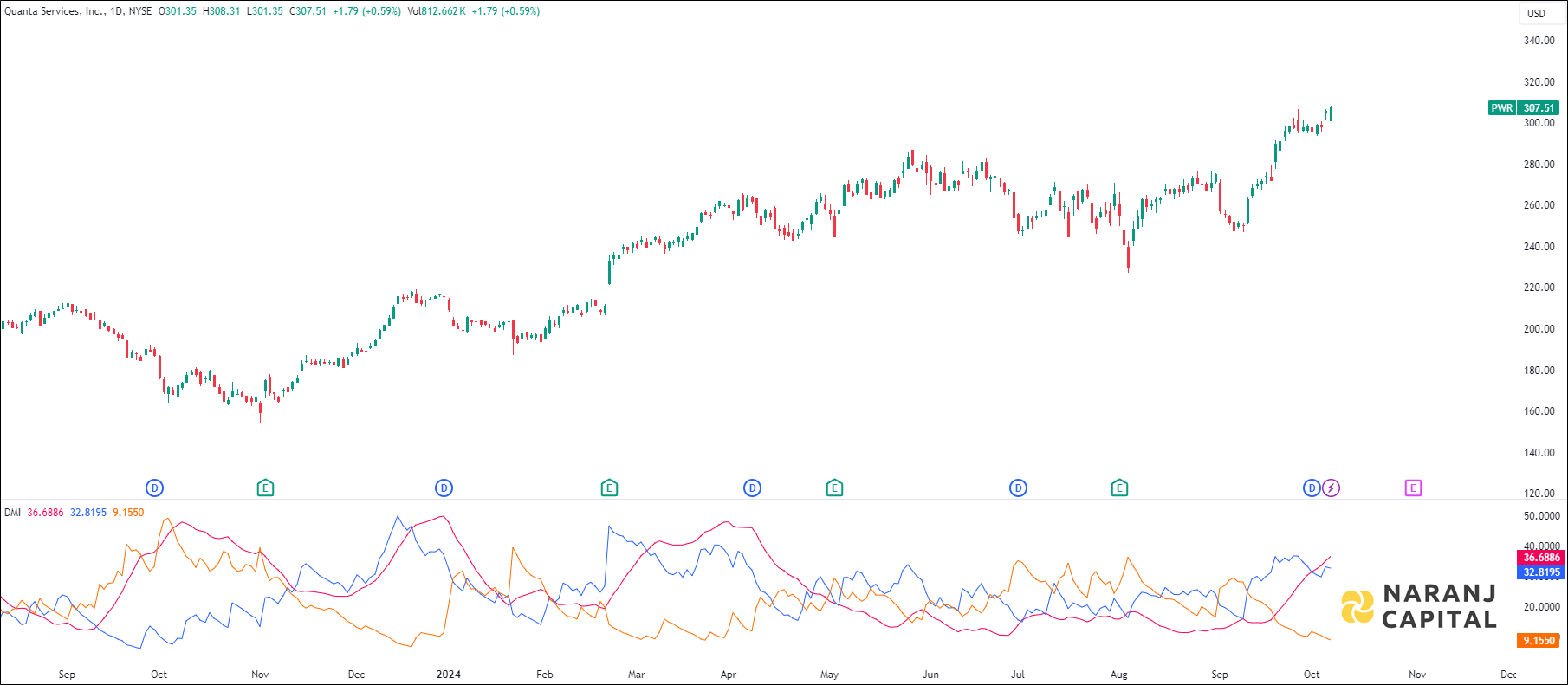

Increasing ADX value above 20, indicated the strength of the trend, thereby uptrending ADX confirms the bullish or bearish supportive decisions. Along with the rising ADX, and the +DI is above (or crossing) -DI, indicates the long trades should be favoured.

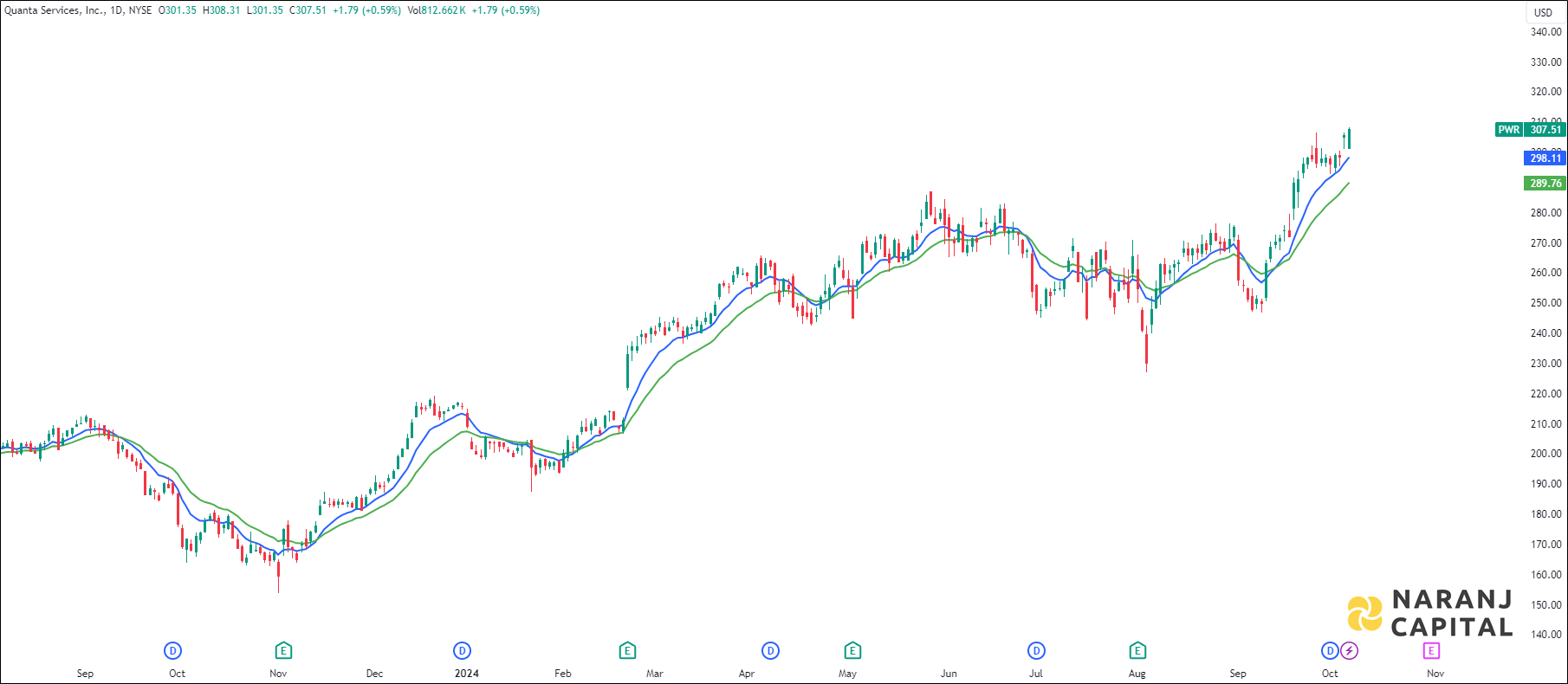

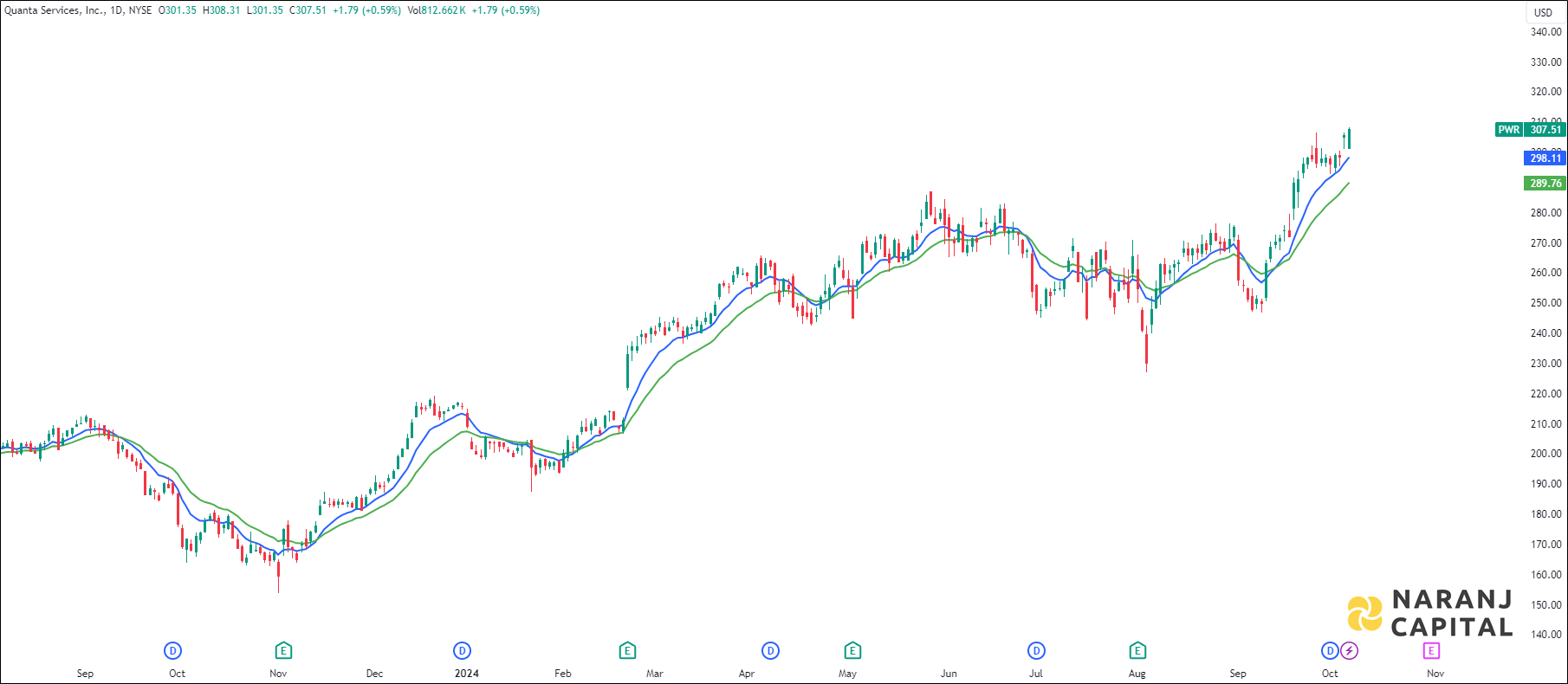

The short length exponential moving average (10 EMA) has crossed the long length exponential moving average (20 EMA) from the below, generates bullish signal. Last day’s candle has closed above all these moving averages. This suggests buyers are taking interest in this stock.

Based on our swing stock trading calls, Quanta Services stock price target will be USD 320 - USD 323 in the next 14-15 trading sessions.

Quanta Services, Inc. engages in the provision of comprehensive infrastructure solutions to the electric power, oil and gas, communication, pipeline, and energy industries. It operates through the following segments: Electric Power, Renewable Energy, and Underground and Infrastructure. The Electric Power segment provides services for the electric power and communications markets. The Renewable Energy segment is involved in providing infrastructure solutions to customers involved in the renewable energy industry. The Underground and Infrastructure segment offers infrastructure solutions to customers involved in the transportation, distribution, storage, development, and processing of natural gas, oil, and other products. The company was founded by Kevin D. Miller, Steven P. Colmar, William G. Parkhouse, and John R. Colson on August 19, 1997 and is headquartered in Houston, TX.

PWR — NYSE —

Current RSI of this stock is 74.52, which indicates the strength of buyers.

Increasing ADX value above 20, indicated the strength of the trend, thereby uptrending ADX confirms the bullish or bearish supportive decisions. Along with the rising ADX, and the +DI is above (or crossing) -DI, indicates the long trades should be favoured.

The short length exponential moving average (10 EMA) has crossed the long length exponential moving average (20 EMA) from the below, generates bullish signal. Last day’s candle has closed above all these moving averages. This suggests buyers are taking interest in this stock.

Based on our swing stock trading calls, Quanta Services stock price target will be USD 320 - USD 323 in the next 14-15 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website