- Naranj Research Desk

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

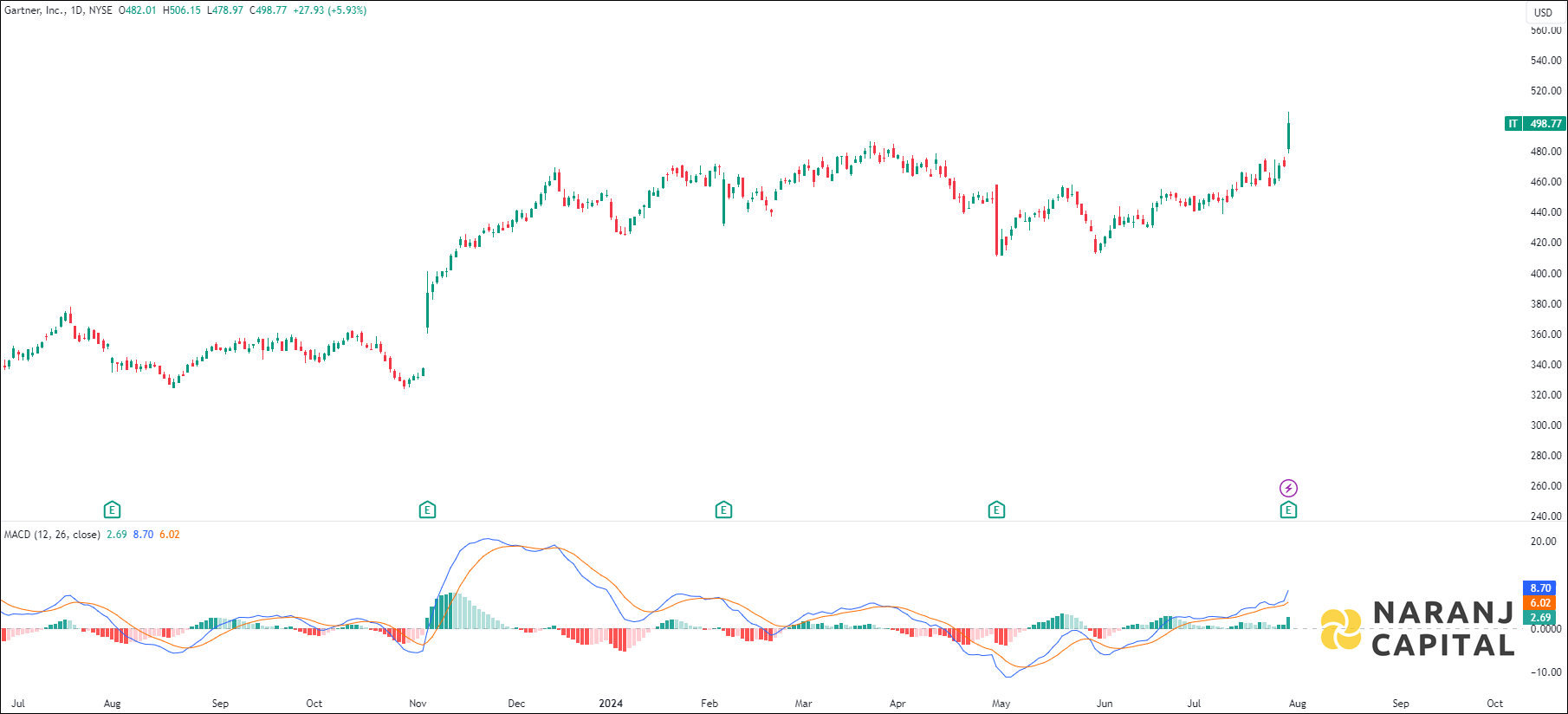

IT — NYSE —

Current RSI of this stock is 74.26, which indicates the strength of buyers.

MACD line has just crossed the signal line from the below, generates bullish signal.

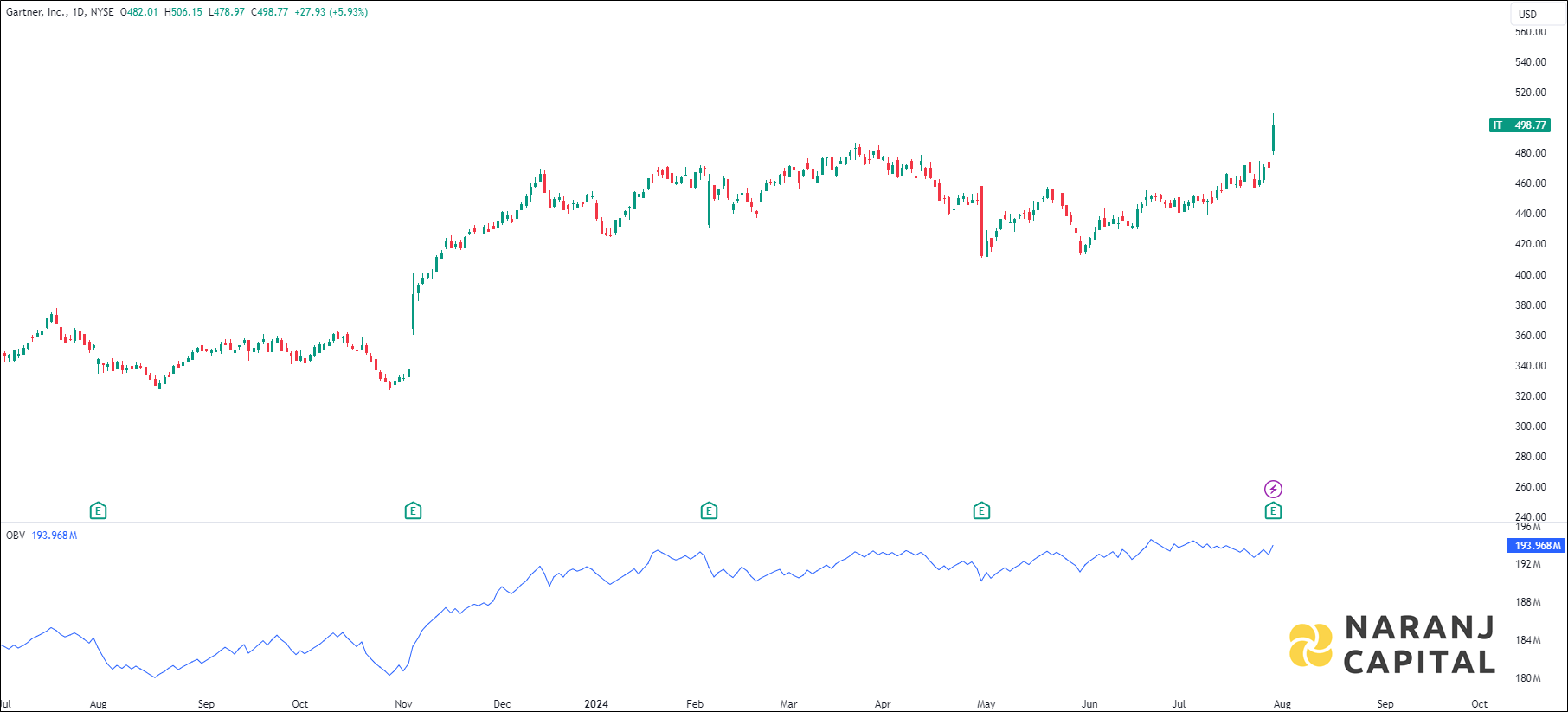

The OBV line is moving in the same upward direction which means there is a positive sentiment in the market. Also the significant price up move accompanying with increasing OBV volume suggests strong buying pressure.

Based on our positional trading advisory in USA stocks, Gartner stock price target will be USD 530 - USD 540 in the next 15-16 trading sessions.

Gartner, Inc. is a research and advisory firm based in the United States, with operations in Canada, Europe, the Middle East, Africa, and beyond. It has three main areas: Research, Conferences, and Consulting. The Research area provides a subscription service that gives users access to published research, data, benchmarks, and a network of experts. The Conferences area allows executives and teams to learn, share ideas, and connect with others. The Consulting area offers top research, tailored analysis, and support services, focusing on IT needs like cost optimization, digital transformation, and sourcing strategies. Founded in 1979, Gartner, Inc. is located in Stamford, Connecticut.

IT — NYSE —

Current RSI of this stock is 74.26, which indicates the strength of buyers.

MACD line has just crossed the signal line from the below, generates bullish signal.

The OBV line is moving in the same upward direction which means there is a positive sentiment in the market. Also the significant price up move accompanying with increasing OBV volume suggests strong buying pressure.

Based on our positional trading advisory in USA stocks, Gartner stock price target will be USD 530 - USD 540 in the next 15-16 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website