- Naranj Research Desk

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

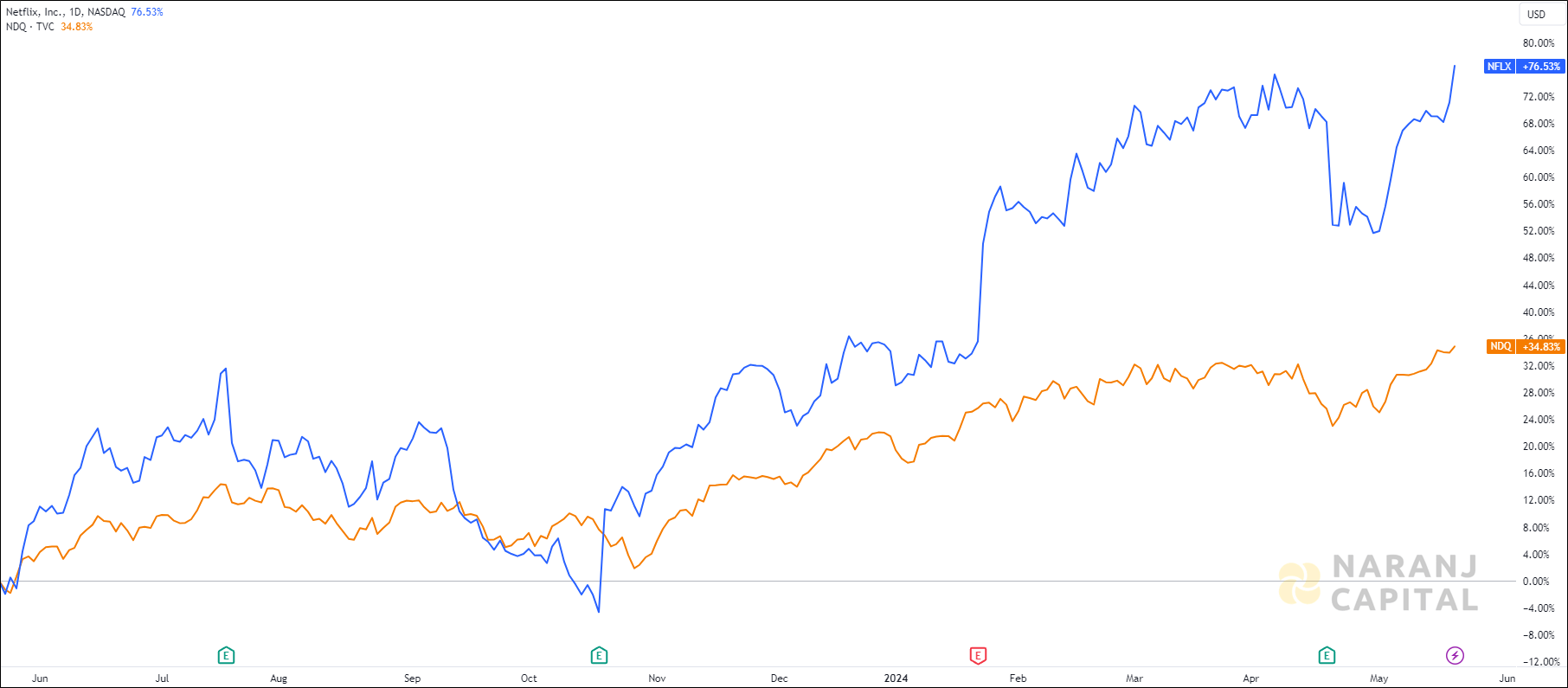

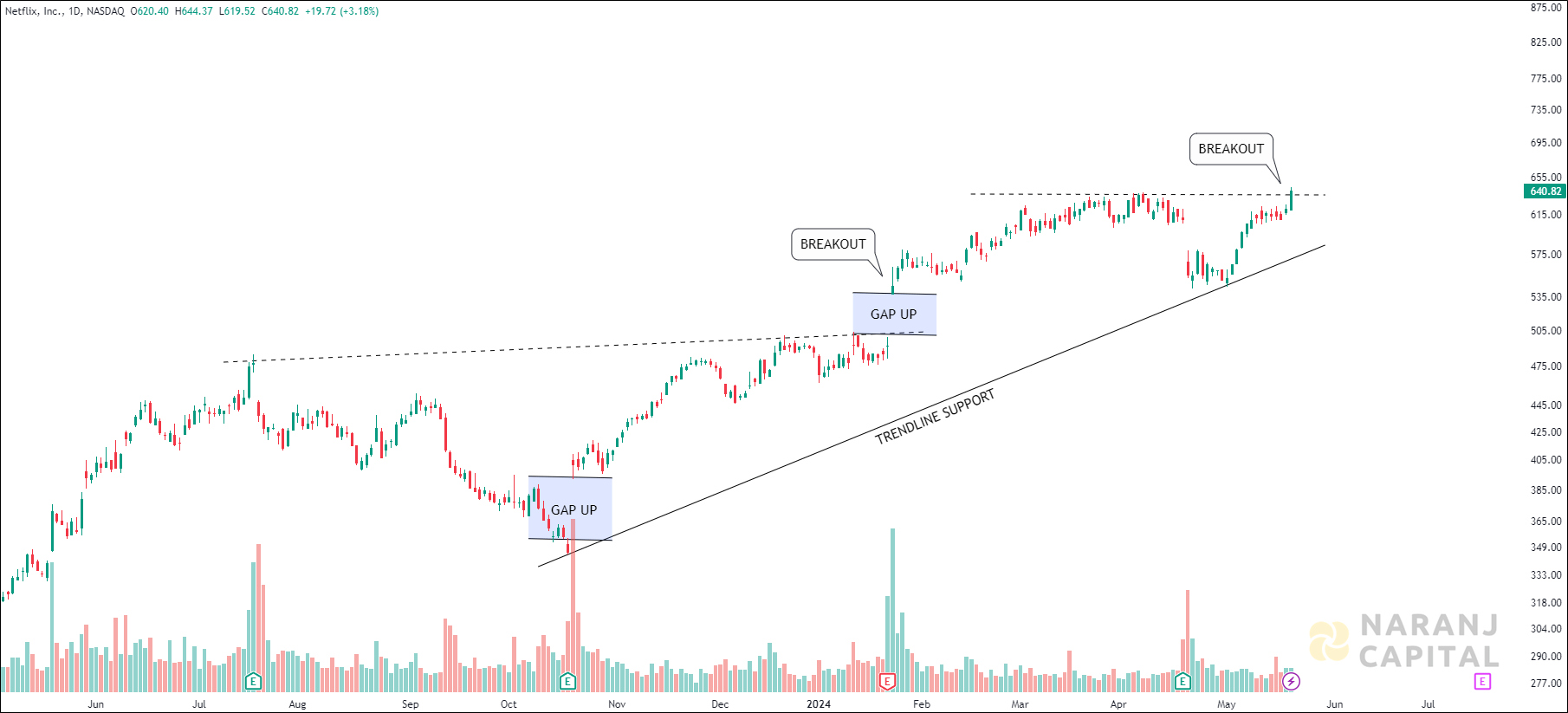

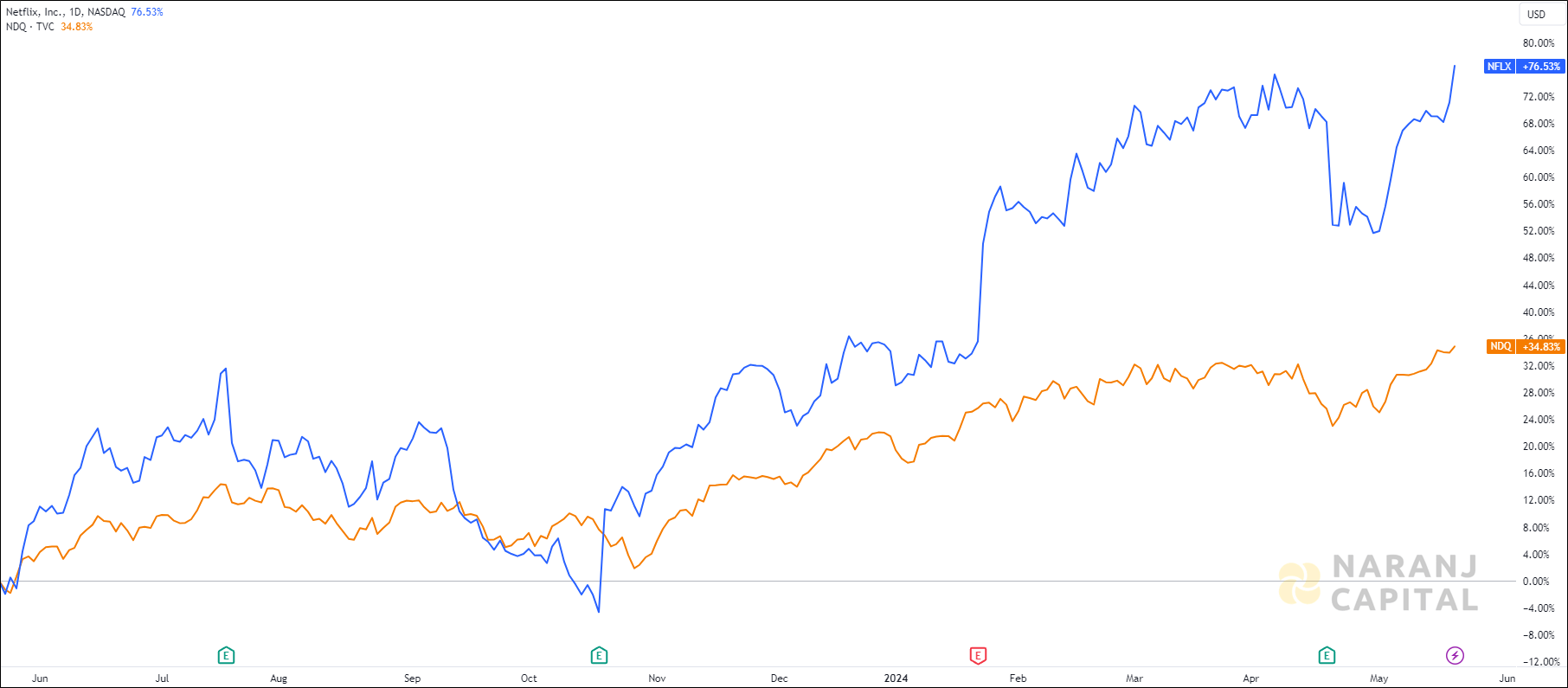

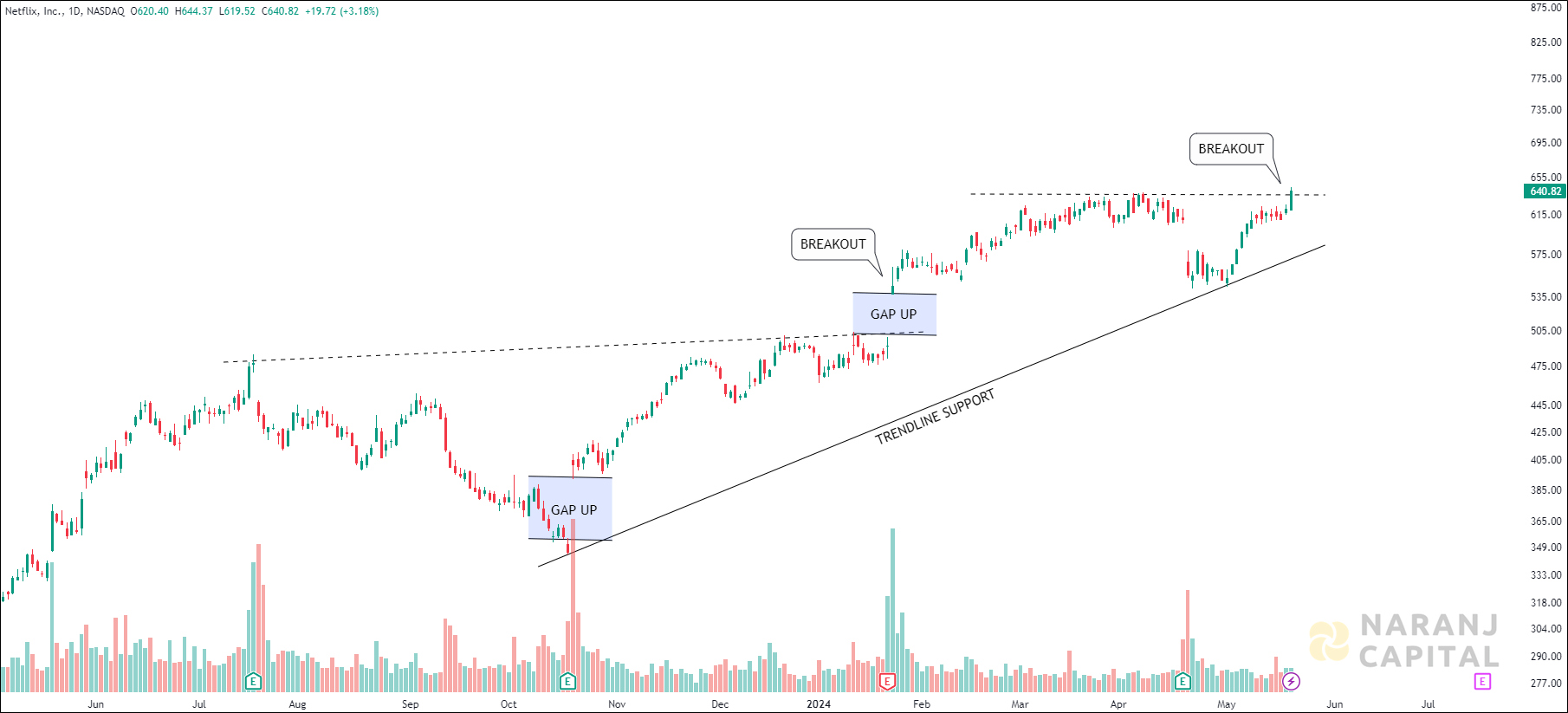

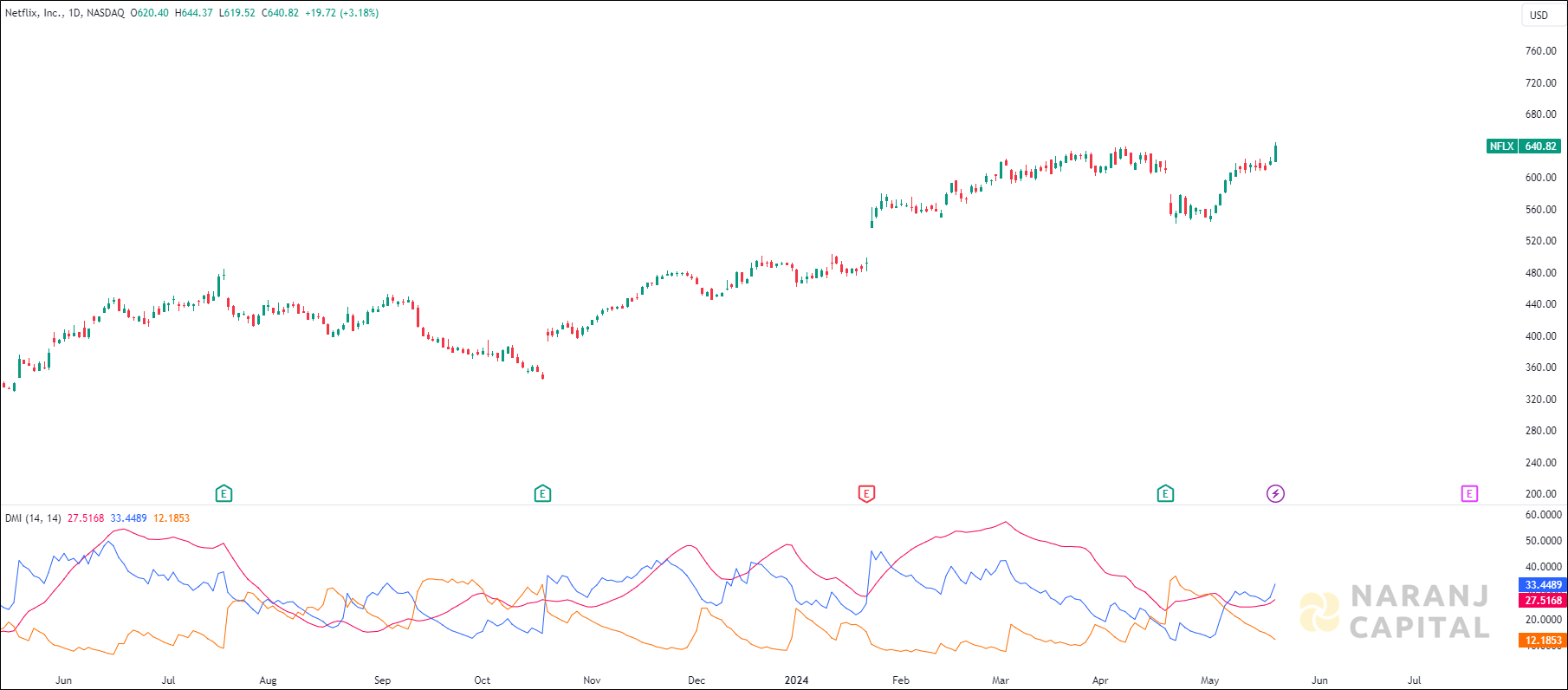

NFLX — NASDAQ —

Current RSI of this stock is 67.34, which indicates the strength of buyers.

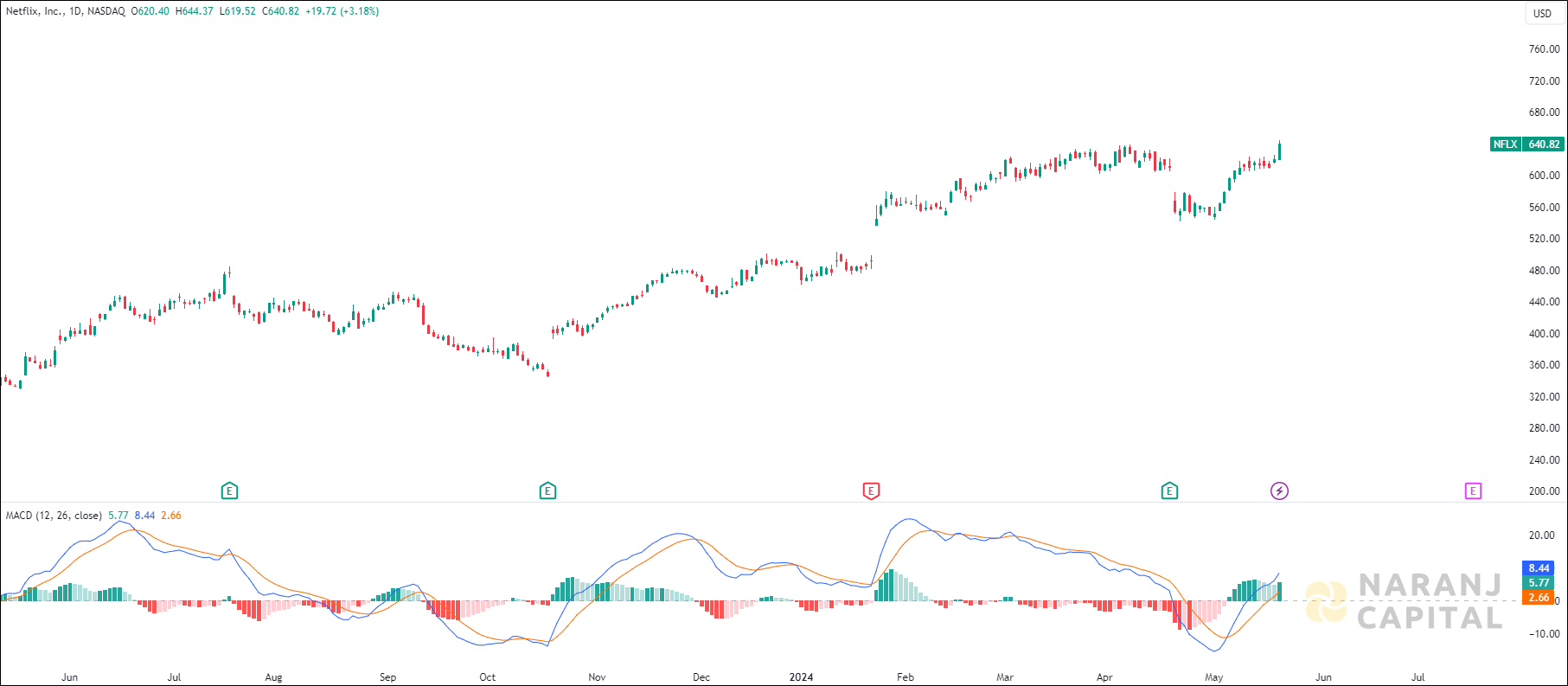

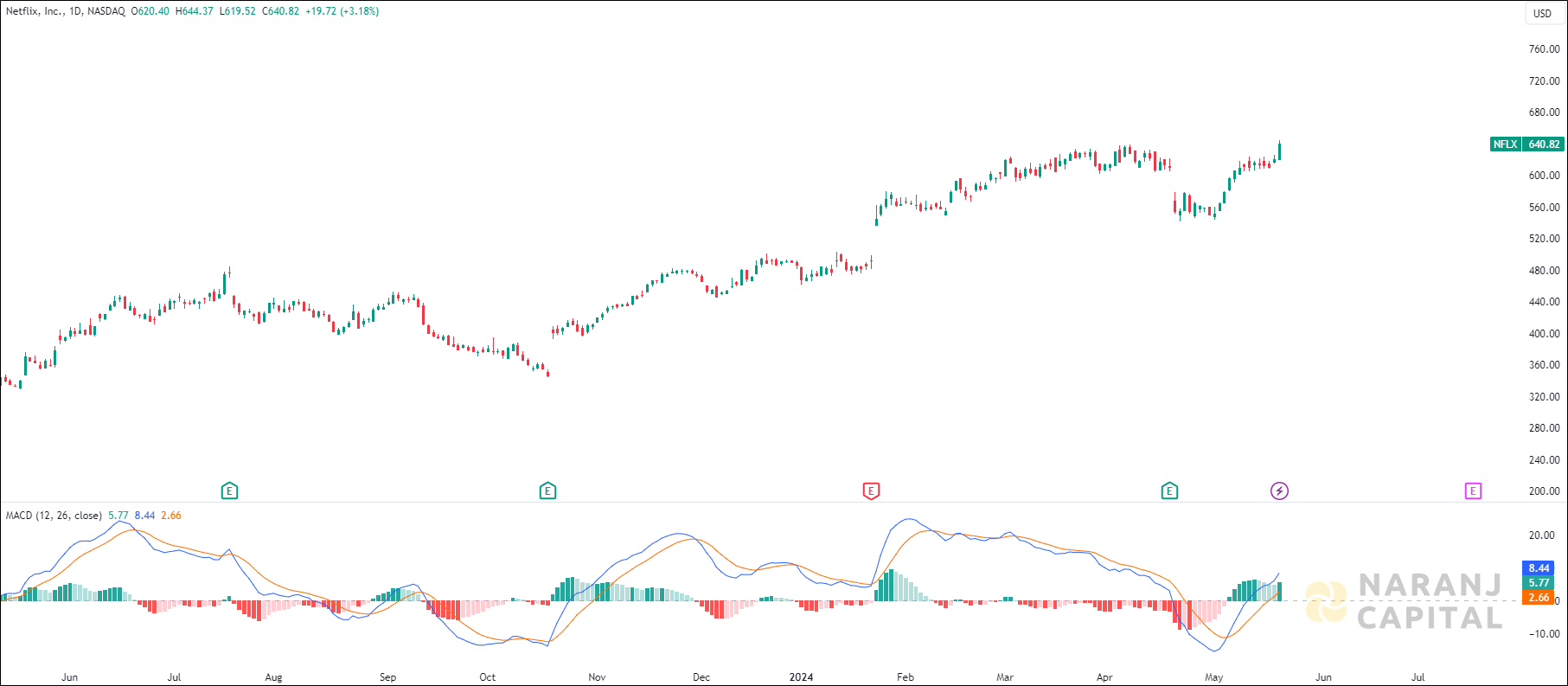

MACD line has just crossed the signal line from the below, generates bullish signal.

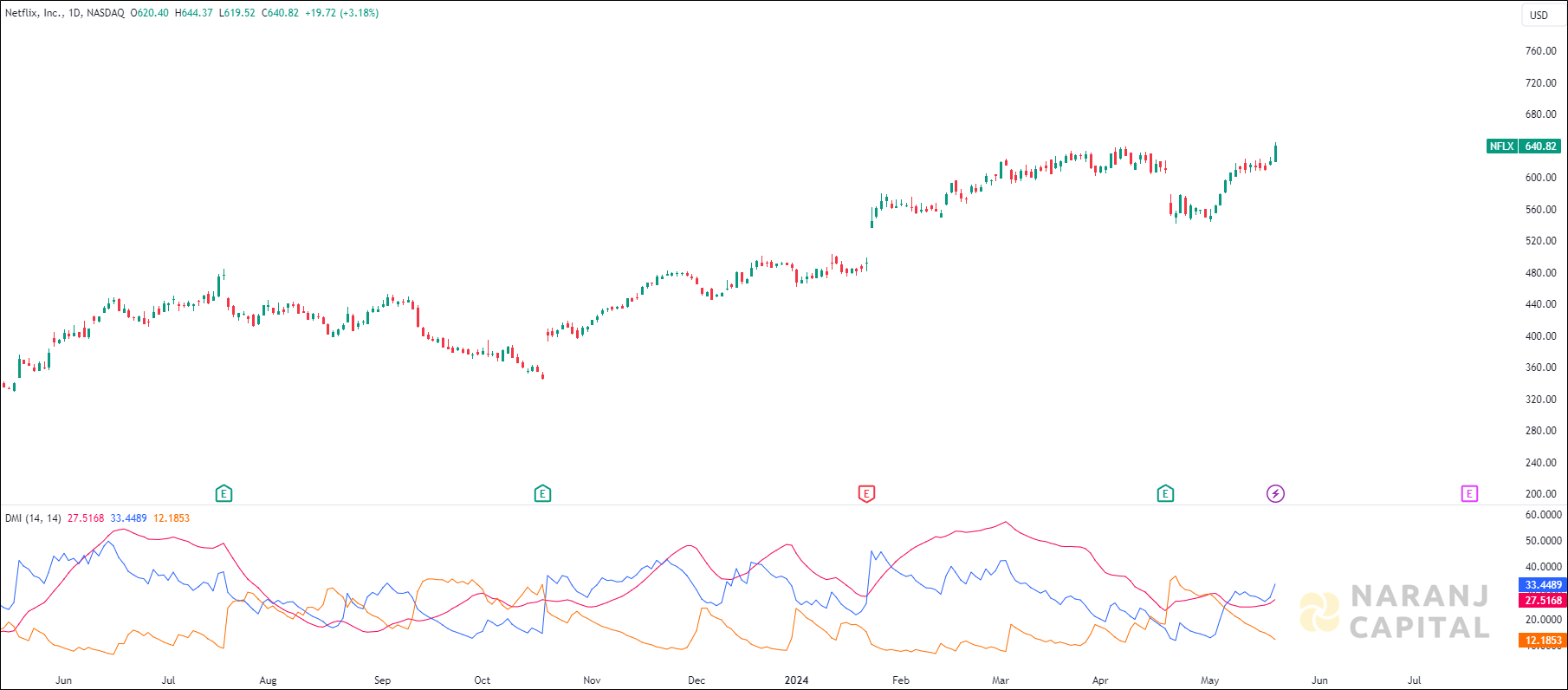

Increasing ADX value above 20, indicated the strength of the trend, thereby uptrending ADX confirms the bullish or bearish supportive decisions. Along with the rising ADX, and the +DI is above (or crossing) -DI, indicates the long trades should be favoured.

Based on our USA swing trading strategies, Netflix stock price target will be USD 670 - USD 680 in the next 15-16 trading sessions.

Netflix, Inc. provides entertainment services. It offers TV series, documentaries, feature films, and games across various genres and languages. The company also provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, TV set-top boxes, and mobile devices. It has operations in approximately 190 countries. The company was incorporated in 1997 and is headquartered in Los Gatos, California.

NFLX — NASDAQ —

Current RSI of this stock is 67.34, which indicates the strength of buyers.

MACD line has just crossed the signal line from the below, generates bullish signal.

Increasing ADX value above 20, indicated the strength of the trend, thereby uptrending ADX confirms the bullish or bearish supportive decisions. Along with the rising ADX, and the +DI is above (or crossing) -DI, indicates the long trades should be favoured.

Based on our USA swing trading strategies, Netflix stock price target will be USD 670 - USD 680 in the next 15-16 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website