- Naranj Research Desk

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

| Metrics | Q2 FY25 | Q1 FY25 | Q2 FY24 | QoQ Change (%) | YoY Change (%) |

|---|---|---|---|---|---|

| Revenue ($ million) | 6,973 | 7,775 | 6,463 | -10.32% | 7.89% |

| Gross Margin (%) | 50.05% | 48.12% | 53.91% | 4.01% | -7.16% |

| Operating Income ($ million) | 1,764 | 2,010 | 1,939 | -12.24% | -09.03% |

| Net Income ($ million) | 880 | 1,334 | 1,203 | -34.03% | -26.85% |

| GAAP EPS ($) | 0.8 | 1.21 | 1.09 | -33.88% | -26.61% |

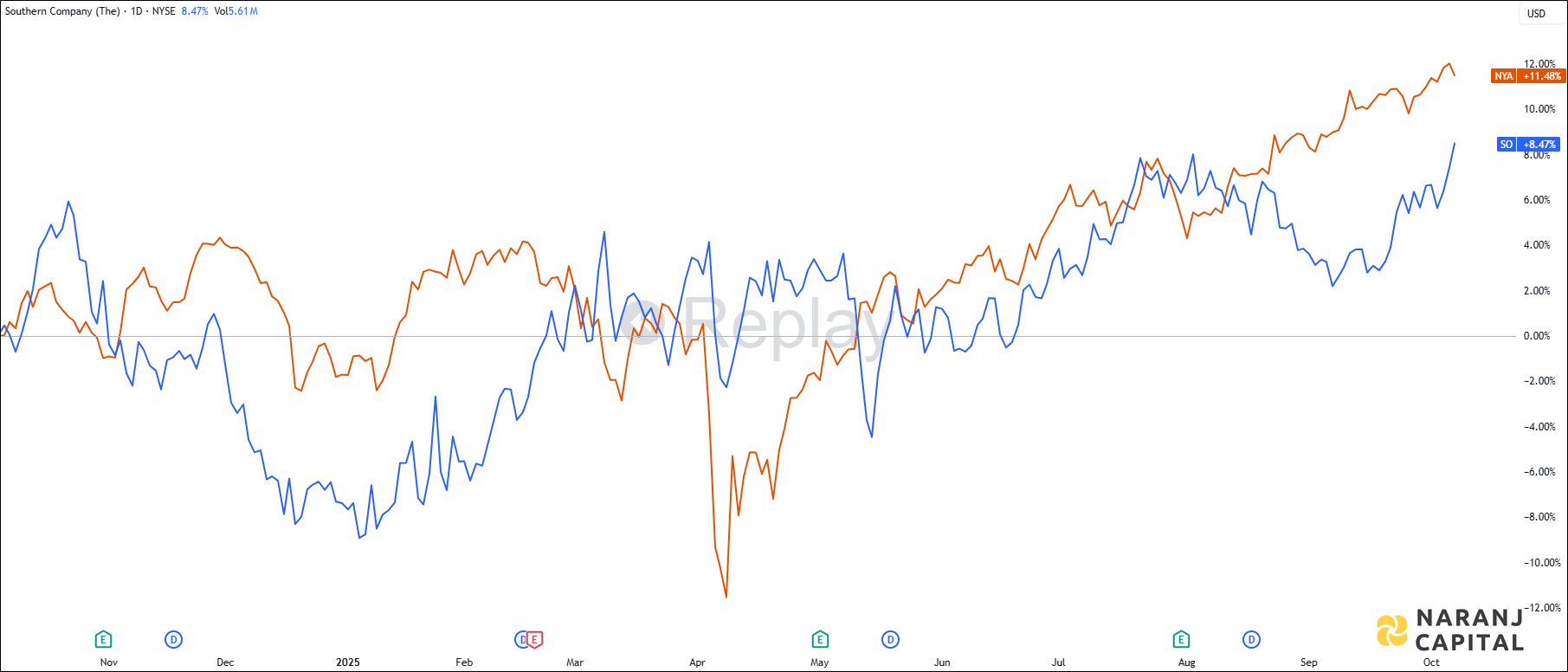

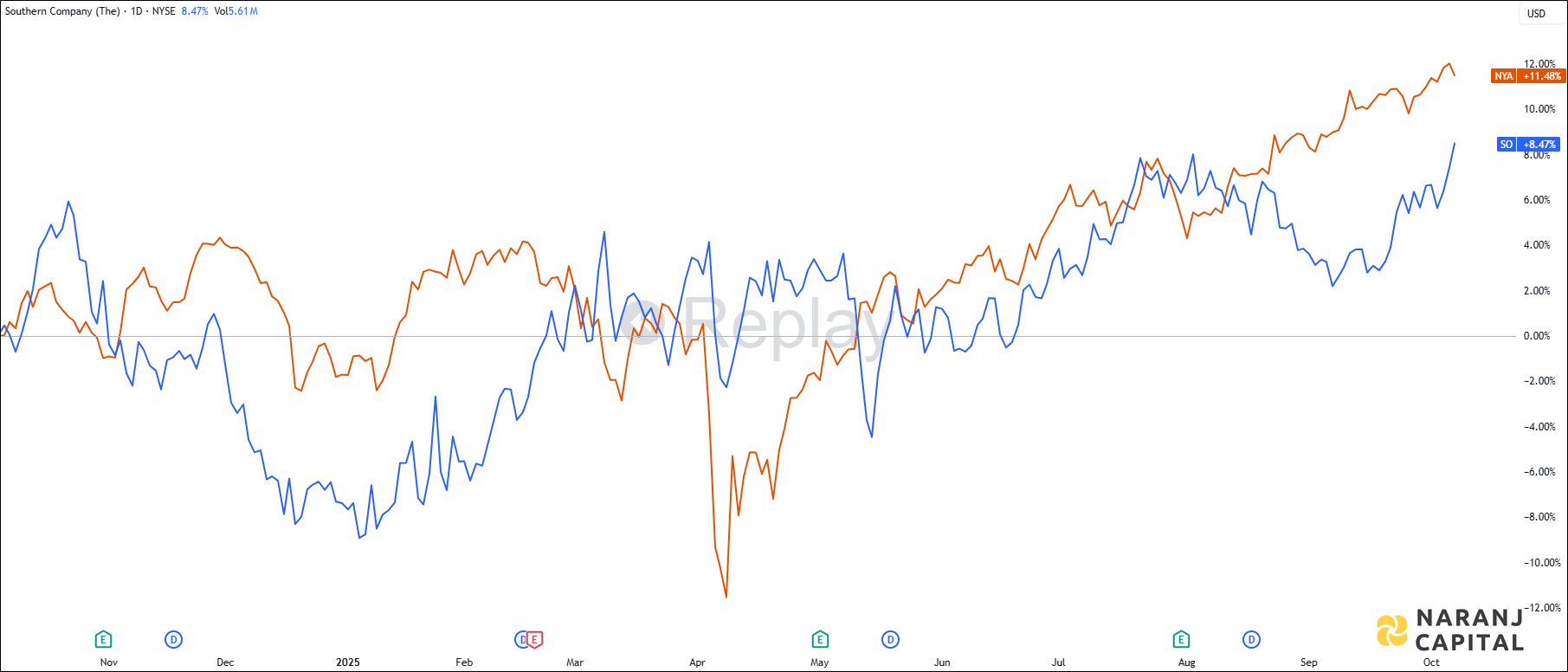

SO — NYSE —

| Indicator | Value | Zone |

|---|---|---|

| RSI-14 | 66.73 | Neutral |

| CCI-14 | 152.93 | Overbought |

| ROC | 2.13 | Positive |

| MFI | 77.97 | Neutral |

| William %R | -5.45 | Overbought |

| EMA | Value | Stock Position |

|---|---|---|

| 5 EMA | 95.27 | Above |

| 10 EMA | 94.61 | Above |

| 20 EMA | 93.91 | Above |

| 50 EMA | 93.27 | Above |

| 100 EMA | 92.34 | Above |

| 200 EMA | 90.26 | Above |

Based on our swing stock trading in USA, Southern Company stock price target will be USD 99 - USD 100 in the next 12-14 trading sessions.

The Southern Company, headquartered in Atlanta, Georgia, generates, transmits, and distributes electricity and natural gas across multiple U.S. states. It operates power generation assets, including renewable energy projects, and manages over 78,500 miles of gas pipelines. The company also provides energy, communication, and microgrid solutions for commercial, industrial, and government clients. Founded in 1946, it serves both retail and wholesale customers and continues to invest in clean energy and grid modernization.

| Metrics | Q2 FY25 | Q1 FY25 | Q2 FY24 | QoQ Change (%) | YoY Change (%) |

|---|---|---|---|---|---|

| Revenue ($ million) | 6,973 | 7,775 | 6,463 | -10.32% | 7.89% |

| Gross Margin (%) | 50.05% | 48.12% | 53.91% | 4.01% | -7.16% |

| Operating Income ($ million) | 1,764 | 2,010 | 1,939 | -12.24% | -09.03% |

| Net Income ($ million) | 880 | 1,334 | 1,203 | -34.03% | -26.85% |

| GAAP EPS ($) | 0.8 | 1.21 | 1.09 | -33.88% | -26.61% |

SO — NYSE —

| Indicator | Value | Zone |

|---|---|---|

| RSI-14 | 66.73 | Neutral |

| CCI-14 | 152.93 | Overbought |

| ROC | 2.13 | Positive |

| MFI | 77.97 | Neutral |

| William %R | -5.45 | Overbought |

| EMA | Value | Stock Position |

|---|---|---|

| 5 EMA | 95.27 | Above |

| 10 EMA | 94.61 | Above |

| 20 EMA | 93.91 | Above |

| 50 EMA | 93.27 | Above |

| 100 EMA | 92.34 | Above |

| 200 EMA | 90.26 | Above |

Based on our swing stock trading in USA, Southern Company stock price target will be USD 99 - USD 100 in the next 12-14 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website