- Naranj Research Desk

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

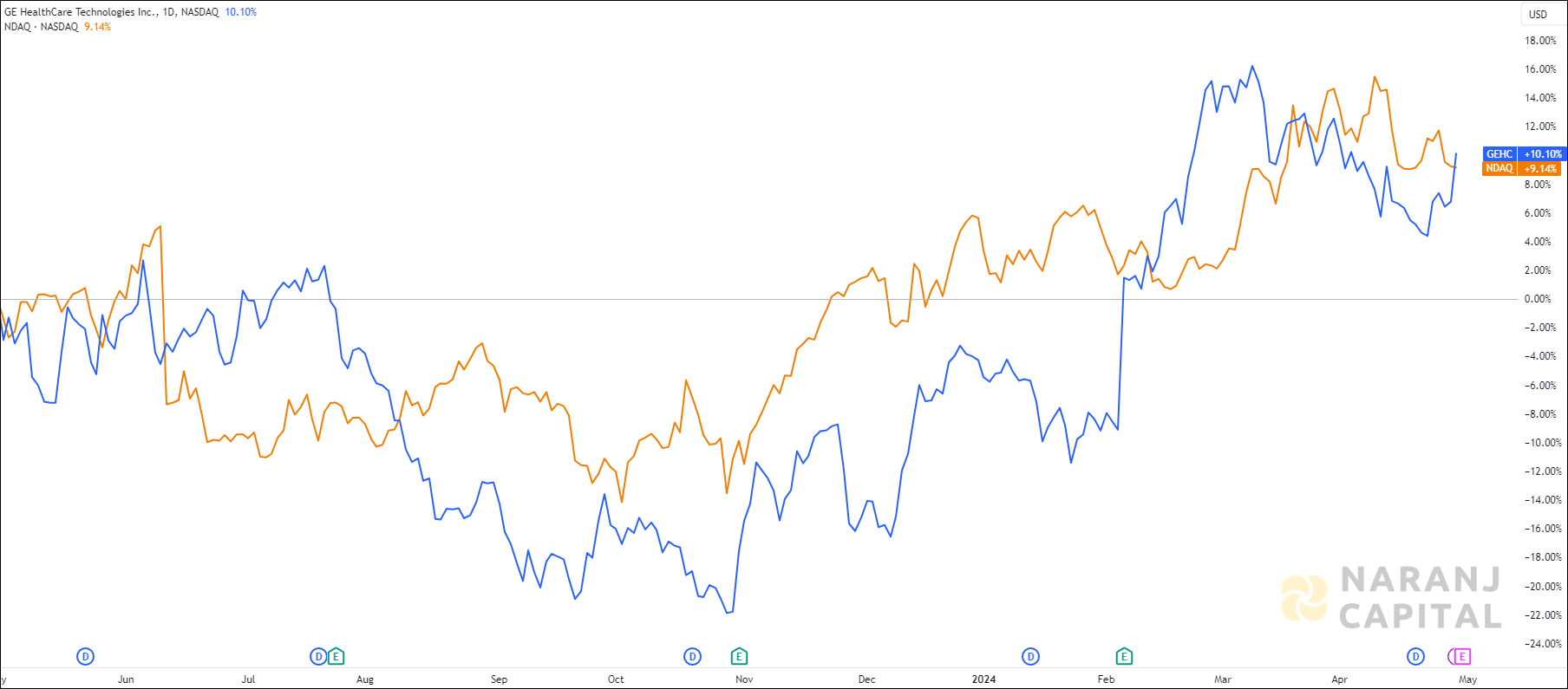

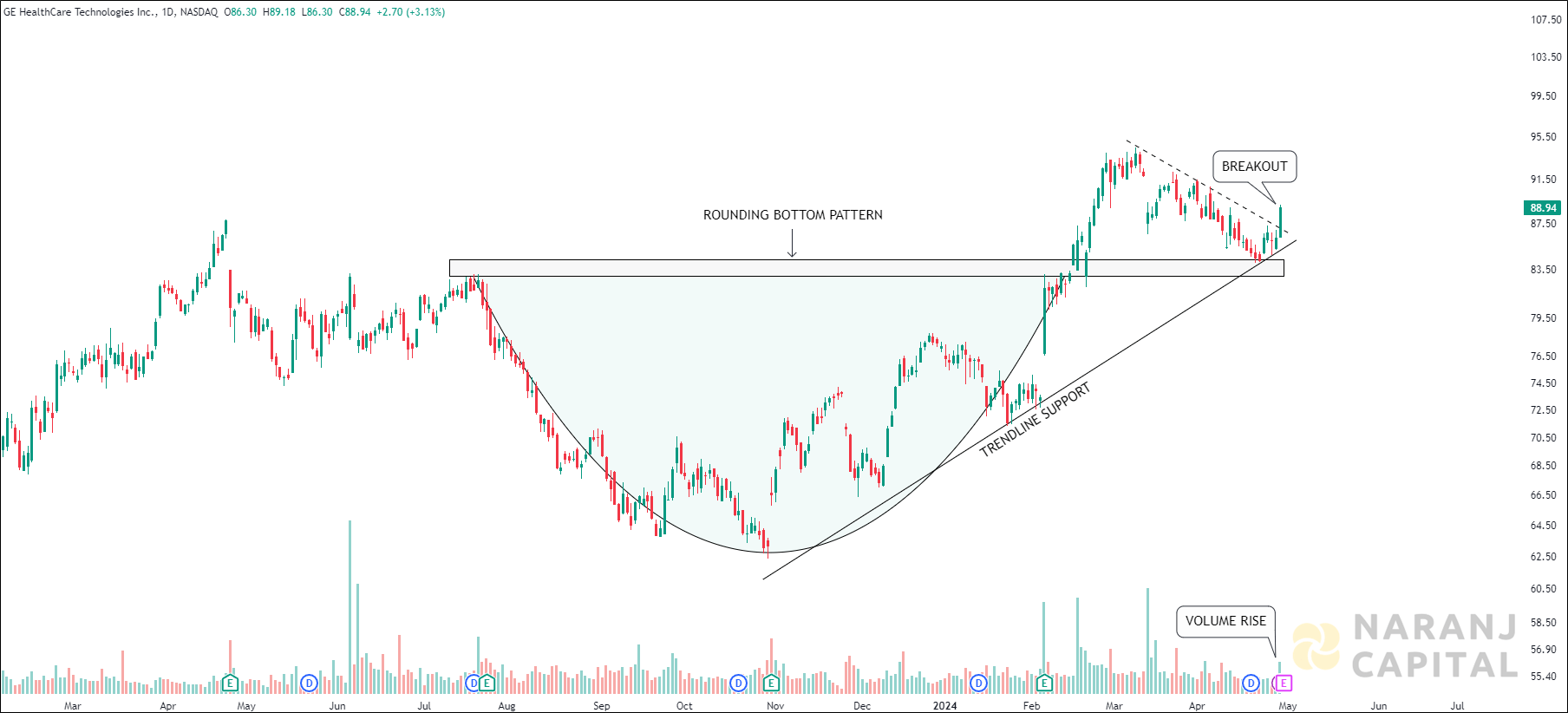

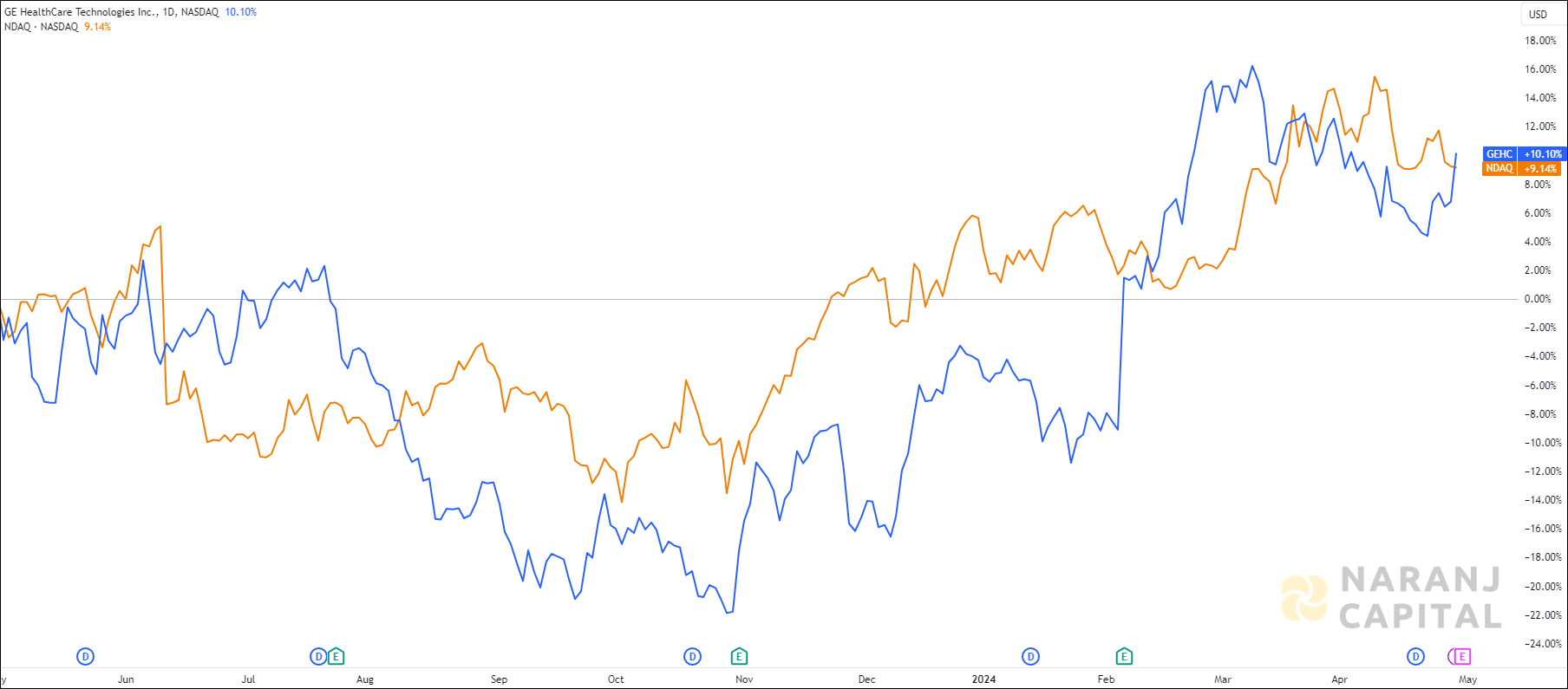

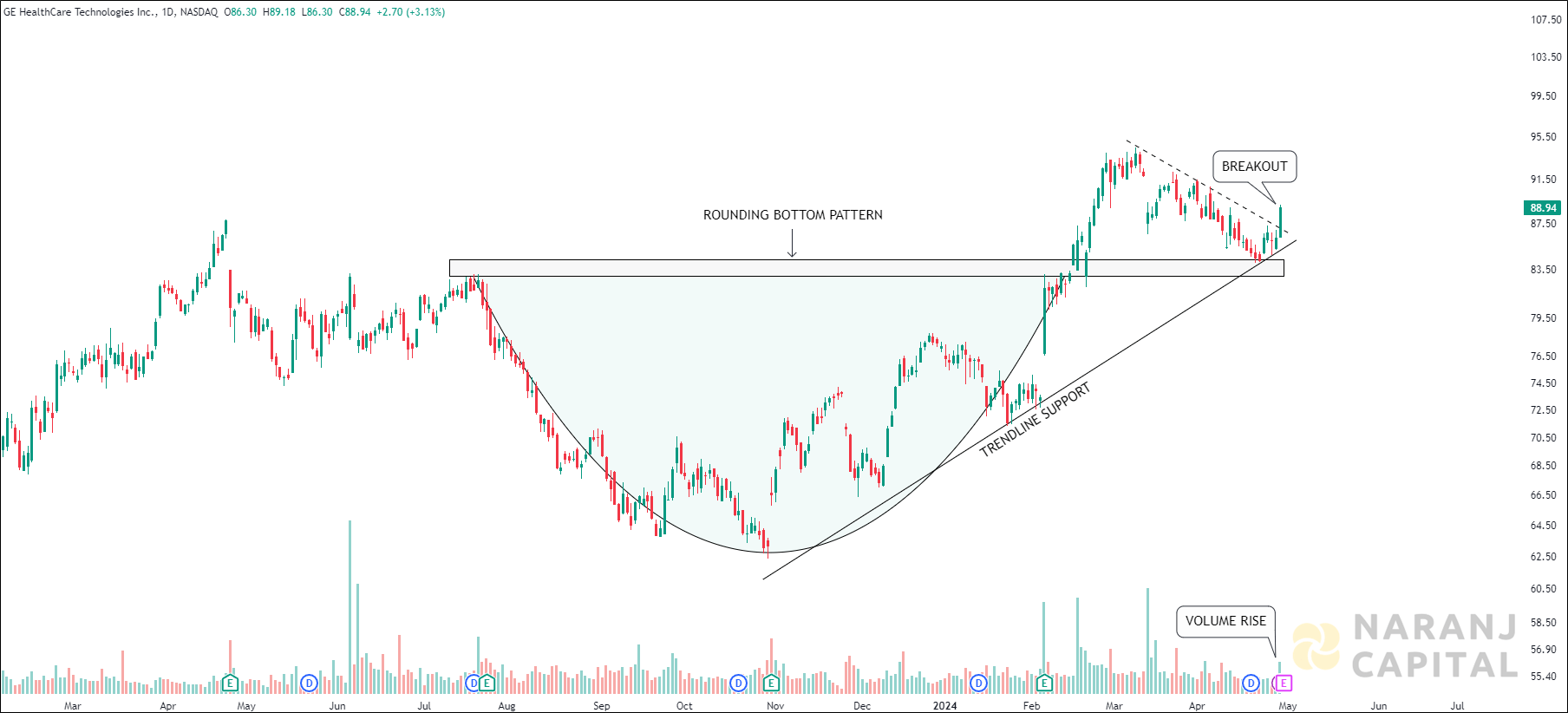

GEHC — NASDAQ —

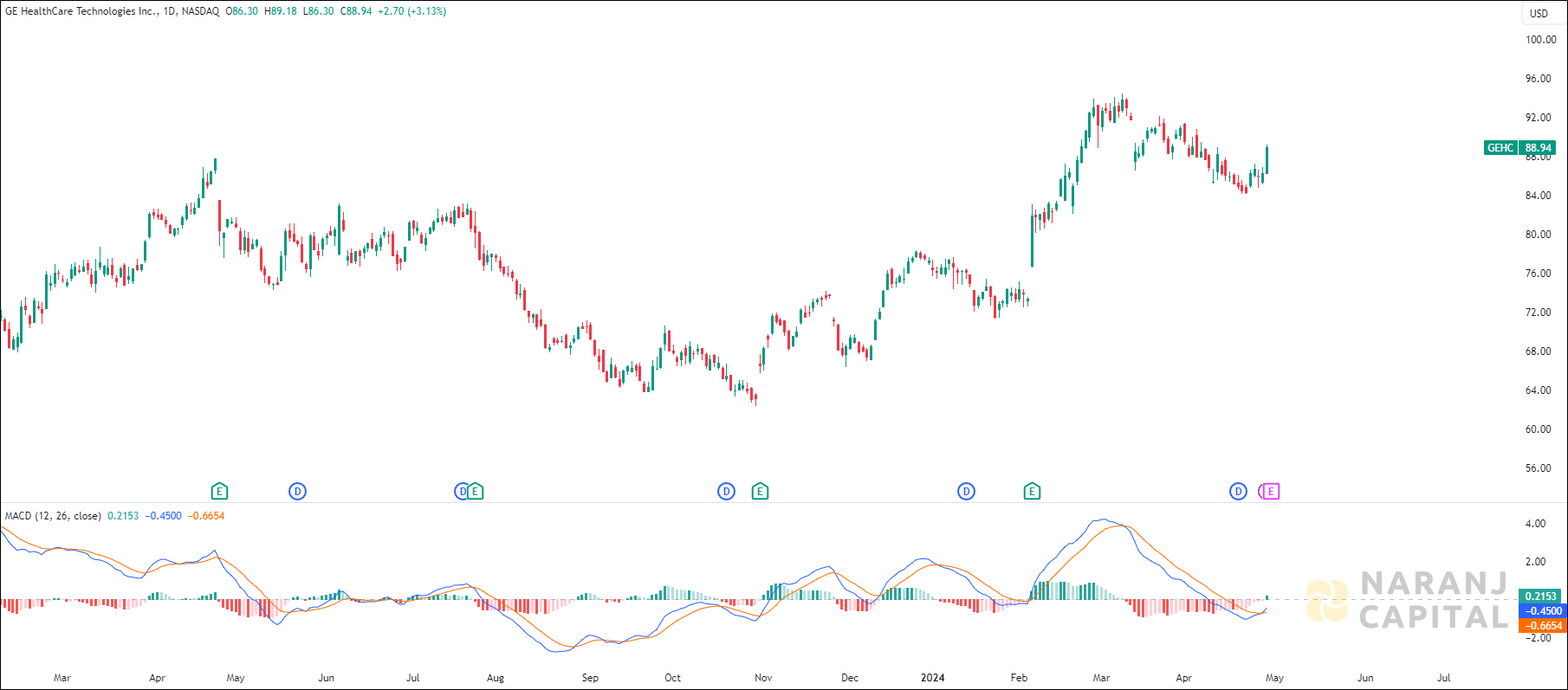

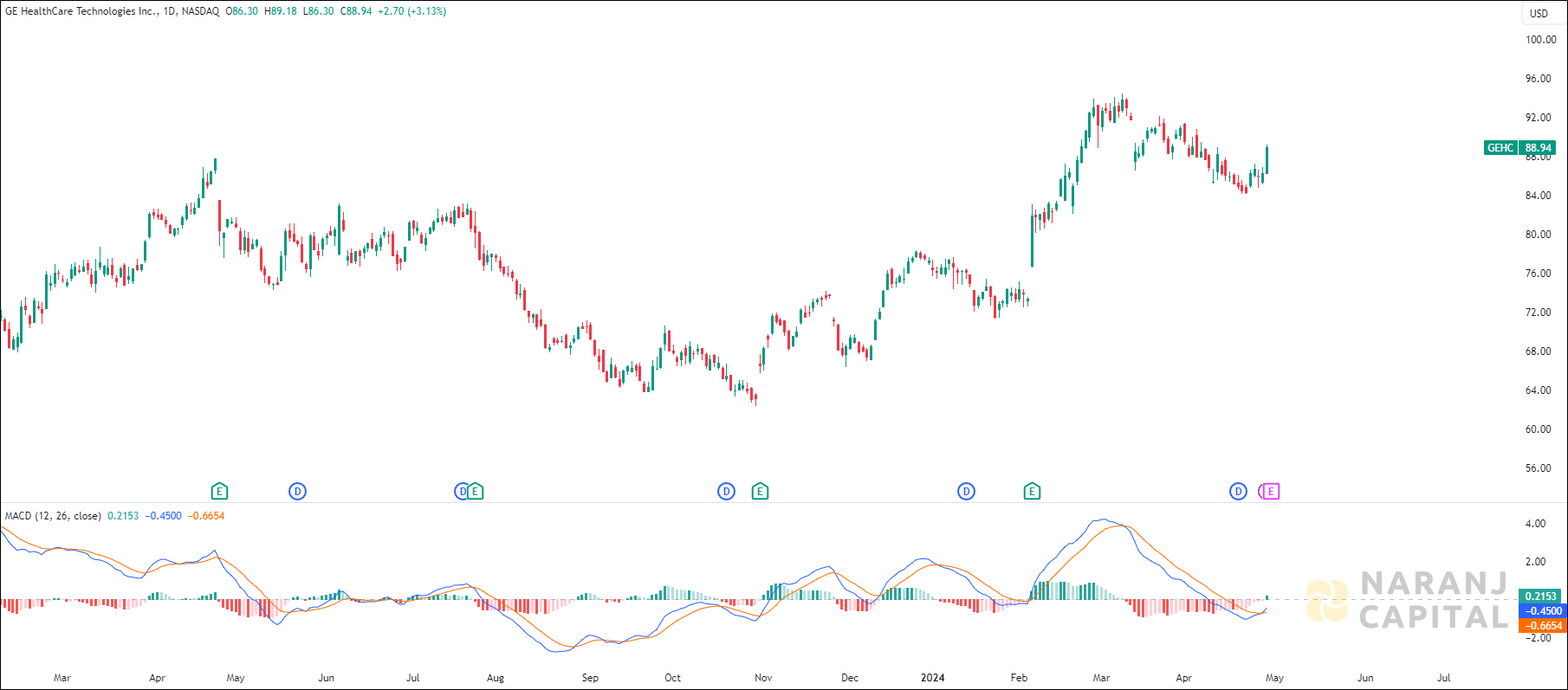

MACD line has just crossed the signal line from the below and a positive histogram chart is forming. This can be considered as a bullish signal.

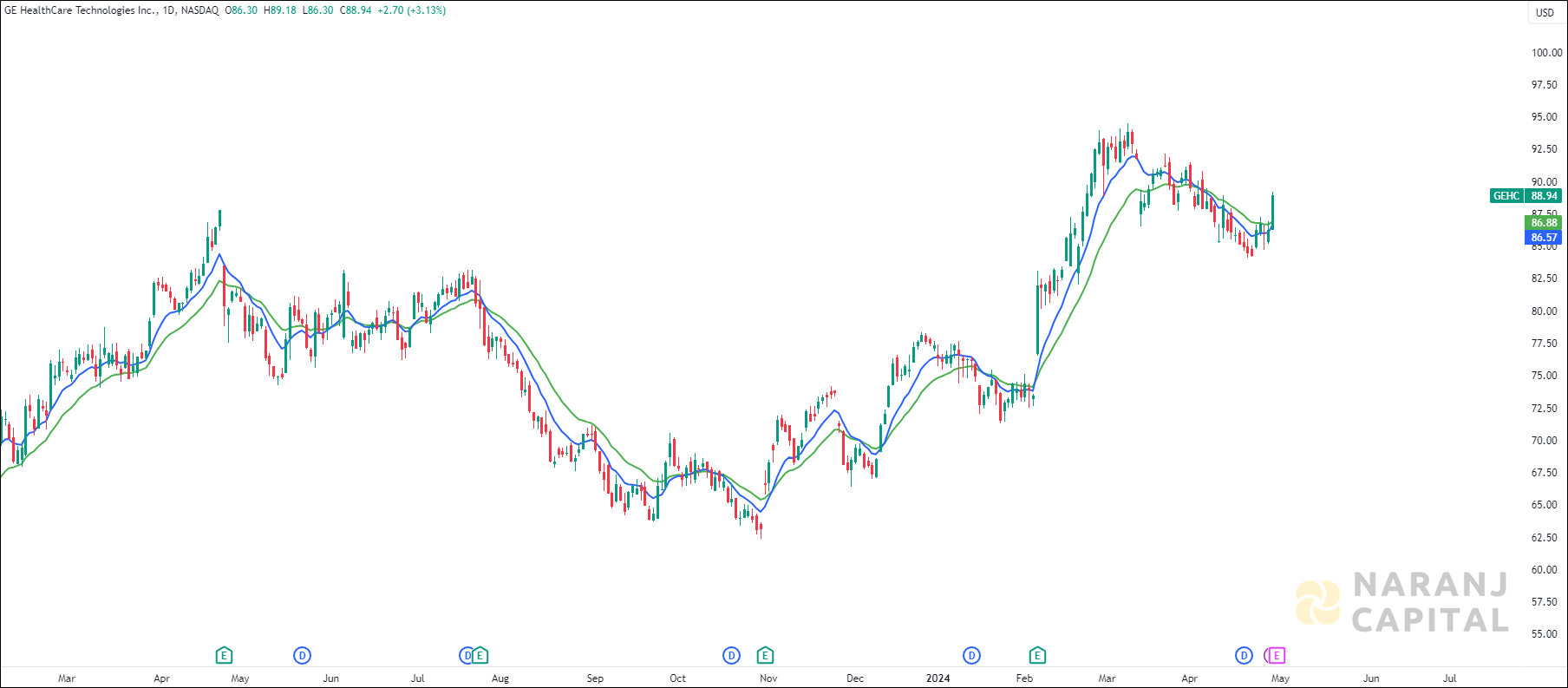

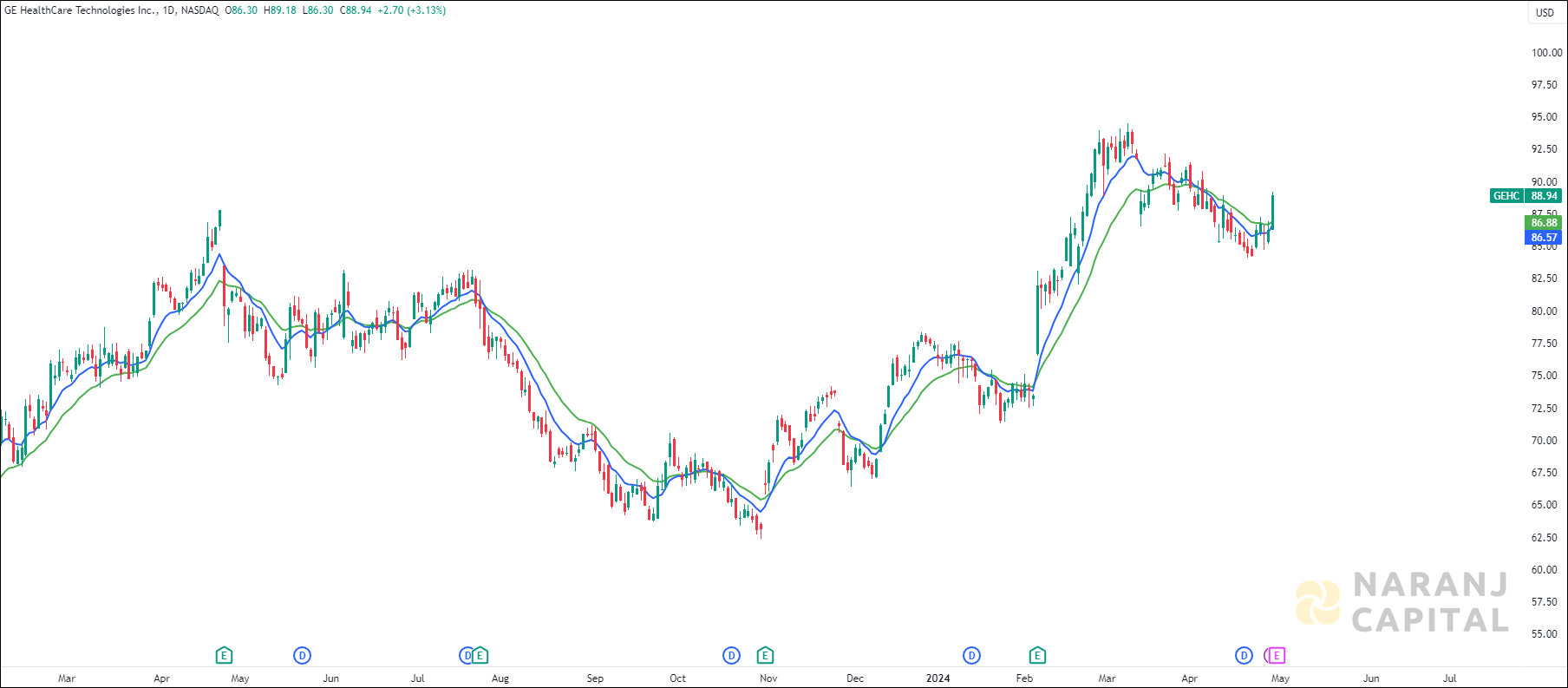

The short length exponential moving average (10 EMA) is about to cross the long length exponential moving average (20 EMA) from the below, generates bullish signal. Last day’s candle has closed above all these moving averages. This suggests buyers are taking interest in this stock.

Based on our stock trading picks in US, GE HealthCare Technologies stock price target will be USD 93 - USD 95 in the next 12-14 trading sessions.

GE HealthCare Technologies Inc. engages in the development, manufacture, and marketing of products, services, and complementary digital solutions used in the diagnosis, treatment, and monitoring of patients in the United States, Canada, and internationally. The company operates through four segments: Imaging, Ultrasound, Patient Care Solutions, and Pharmaceutical Diagnostics. The Imaging segment offers molecular imaging, computed tomography (CT) scanning, magnetic resonance (MR) imaging, image-guided therapy, X-ray systems, and women’s health products. The company was incorporated in 2022 and is headquartered in Chicago, Illinois.

GEHC — NASDAQ —

MACD line has just crossed the signal line from the below and a positive histogram chart is forming. This can be considered as a bullish signal.

The short length exponential moving average (10 EMA) is about to cross the long length exponential moving average (20 EMA) from the below, generates bullish signal. Last day’s candle has closed above all these moving averages. This suggests buyers are taking interest in this stock.

Based on our stock trading picks in US, GE HealthCare Technologies stock price target will be USD 93 - USD 95 in the next 12-14 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website