- Naranj Research Desk

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

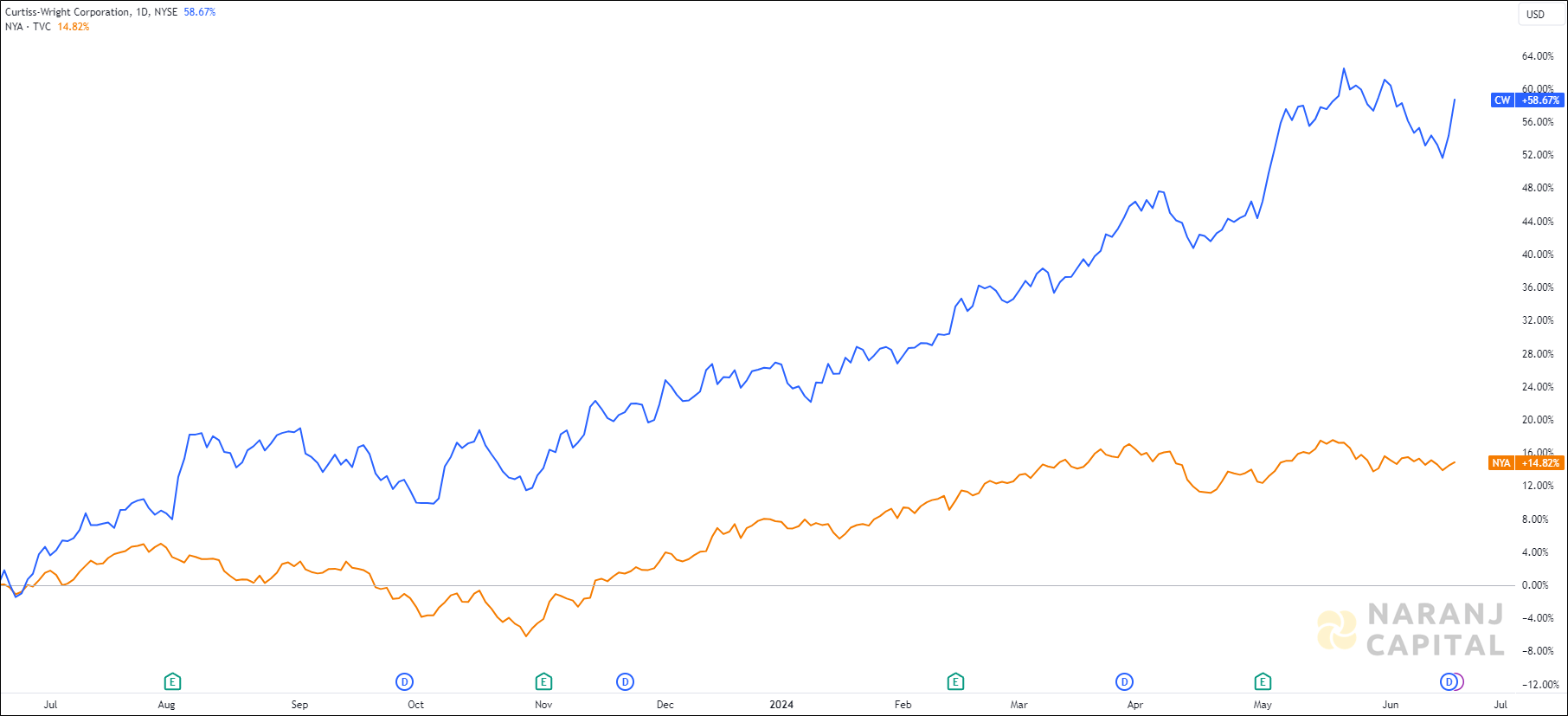

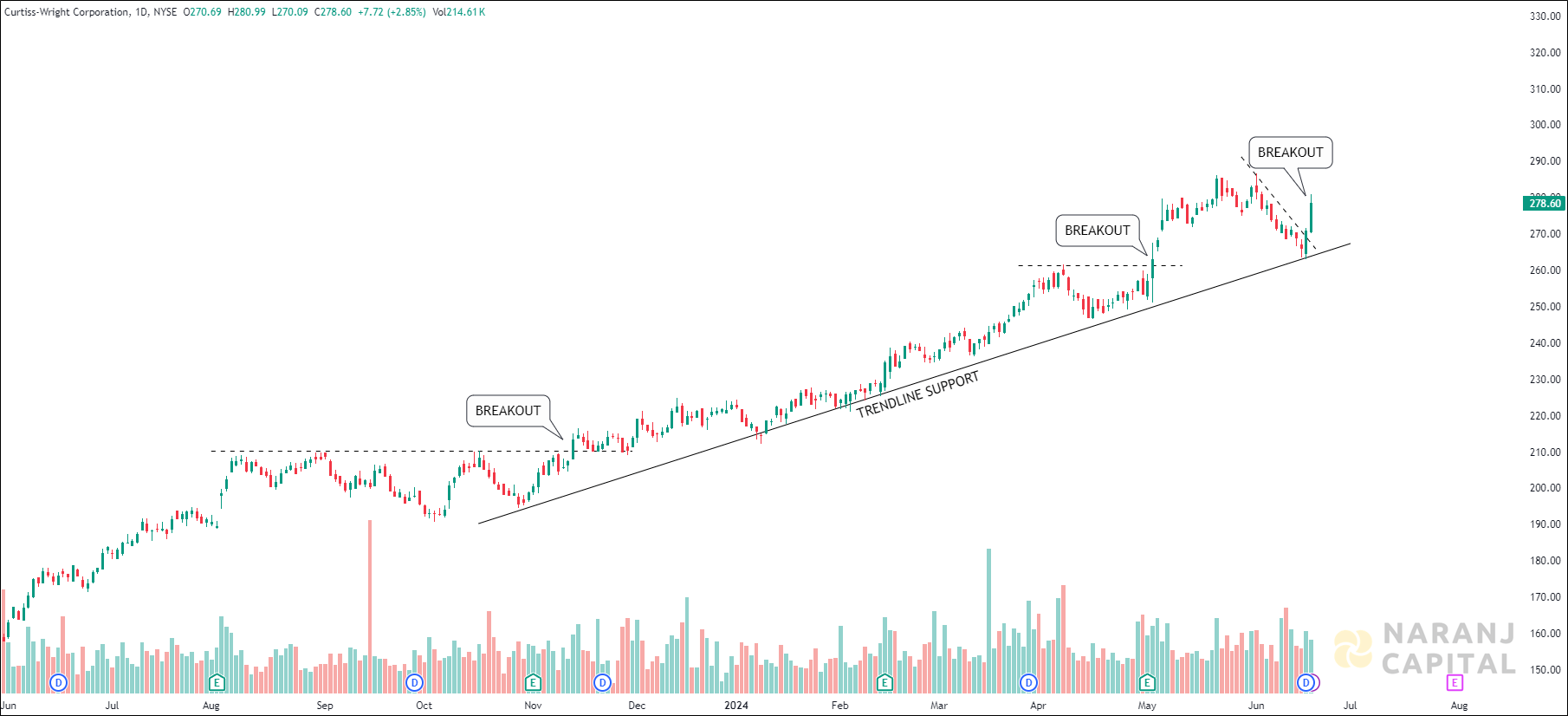

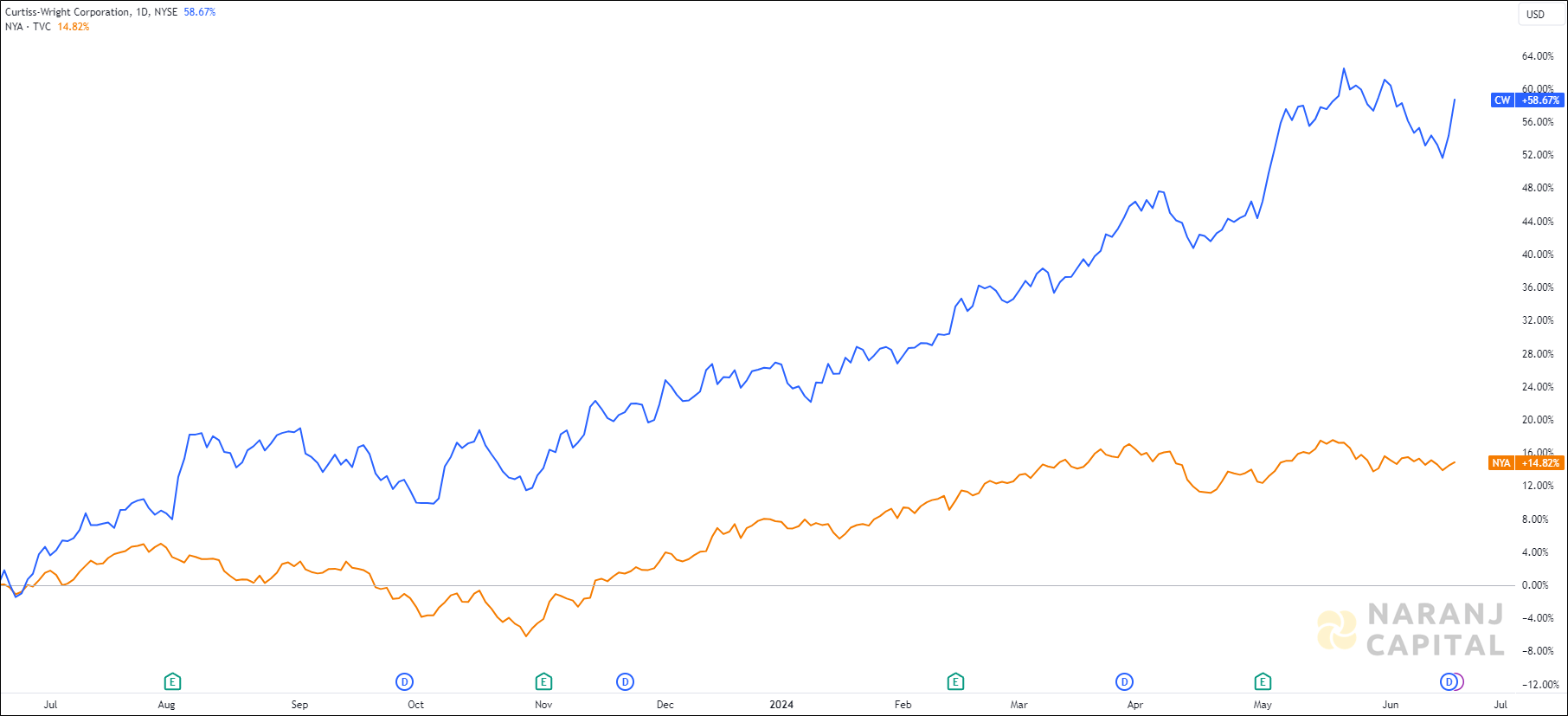

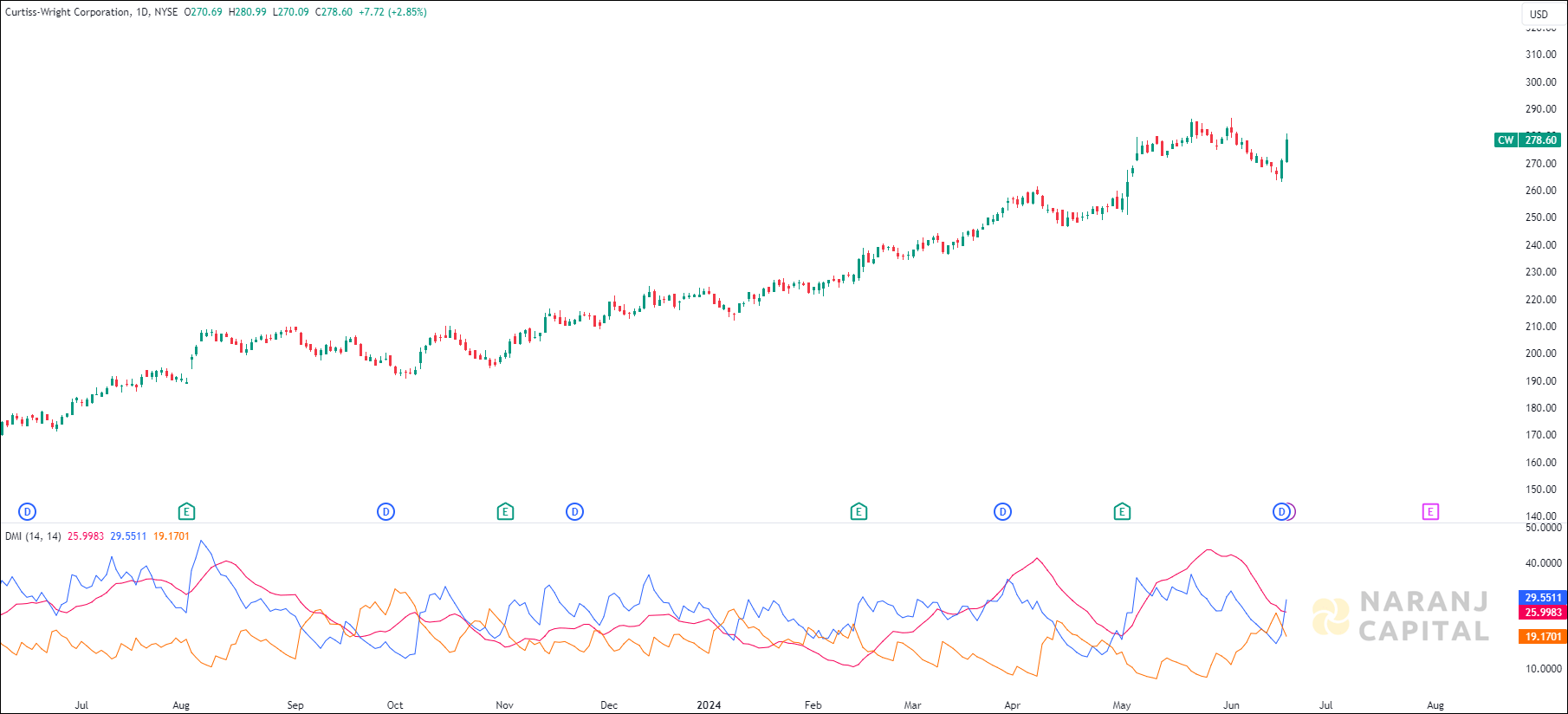

CW — NYSE —

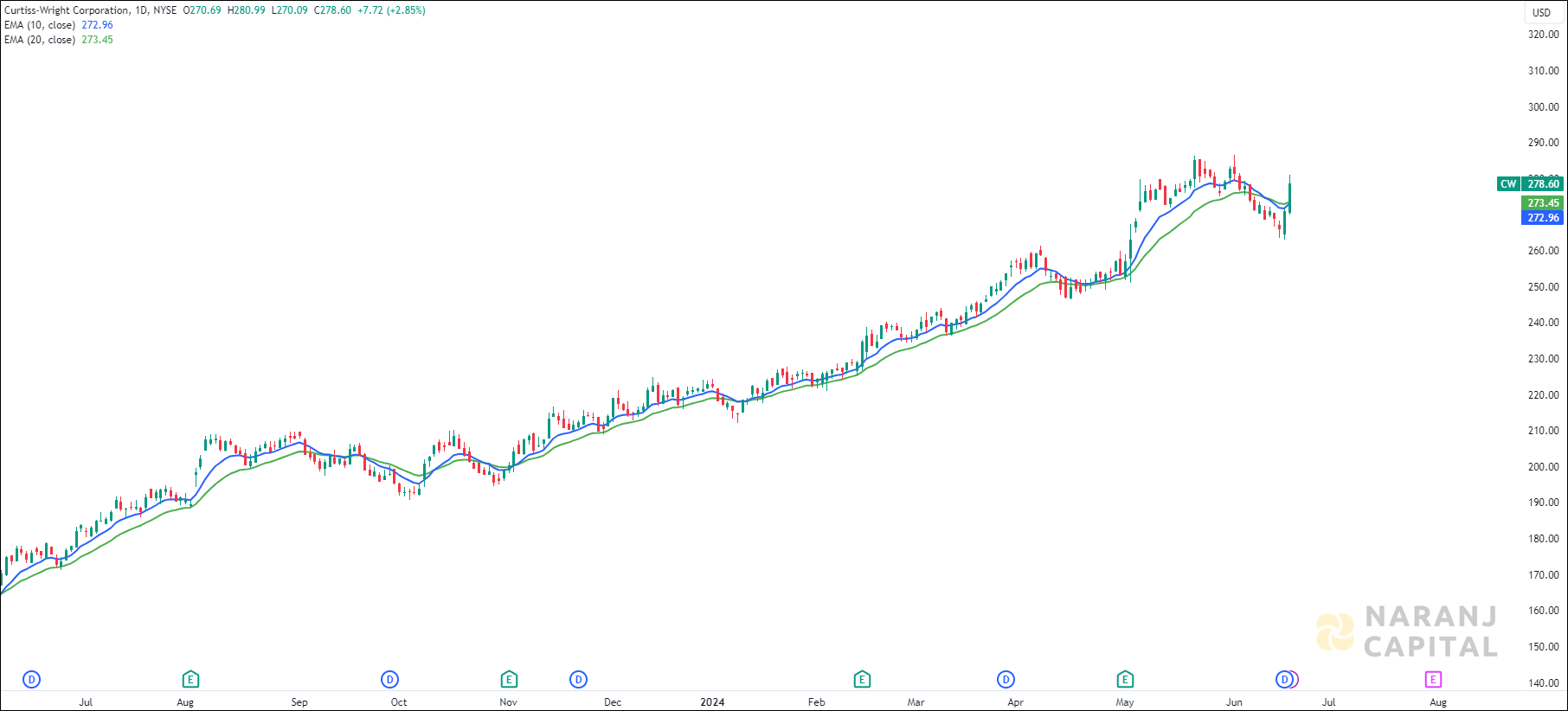

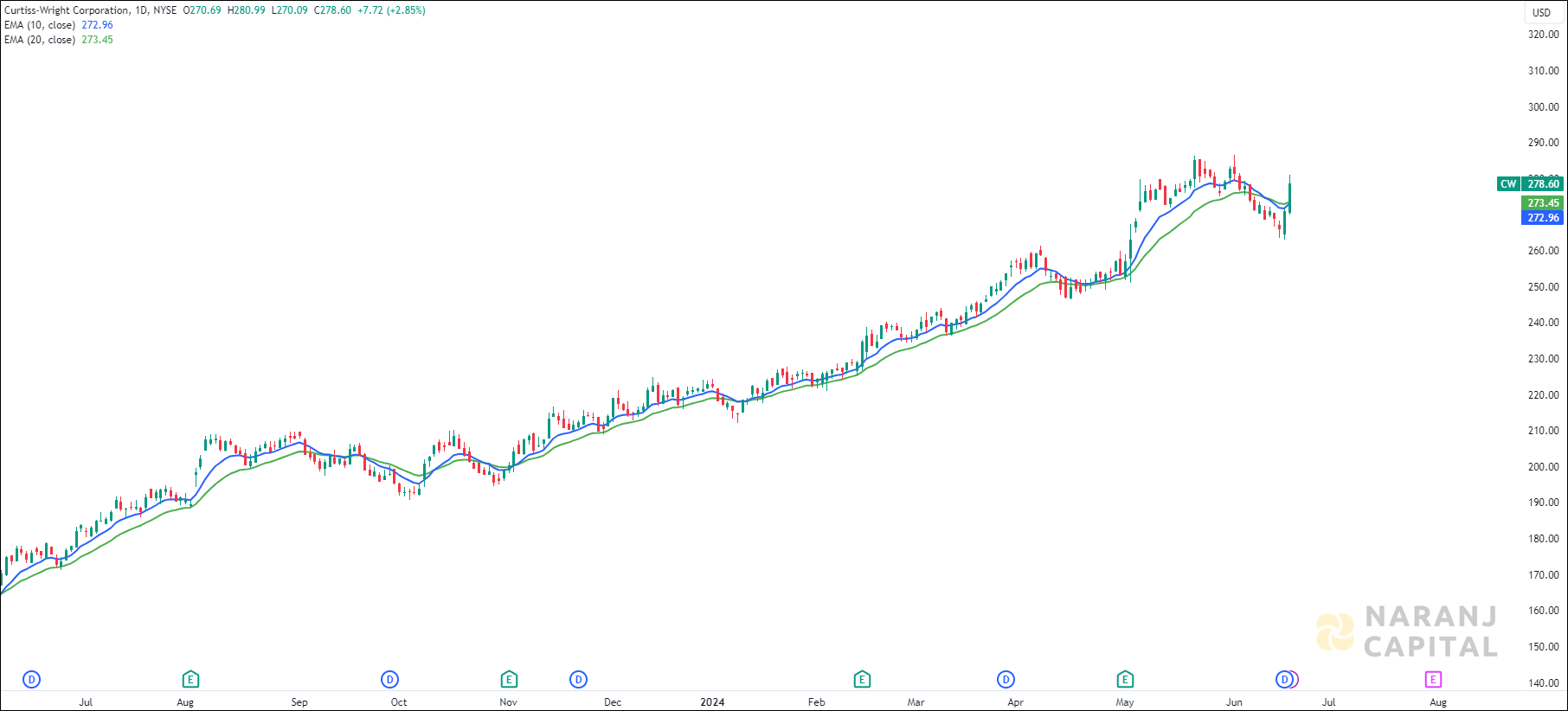

The short length exponential moving average (10 EMA) is about to cross the long length exponential moving average (20 EMA) from the below, generates bullish signal. Last day’s candle has closed above all these moving averages. This suggests buyers are taking interest in this stock.

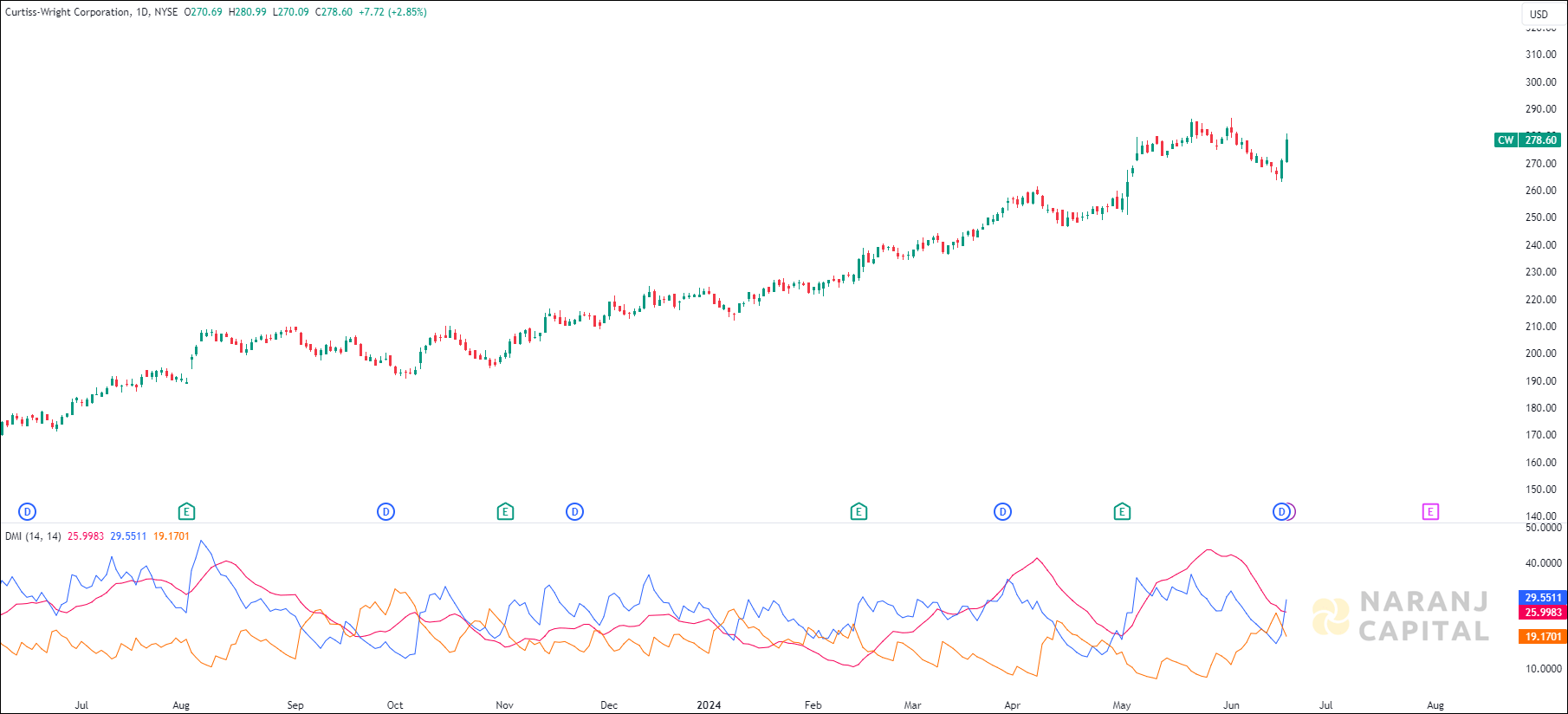

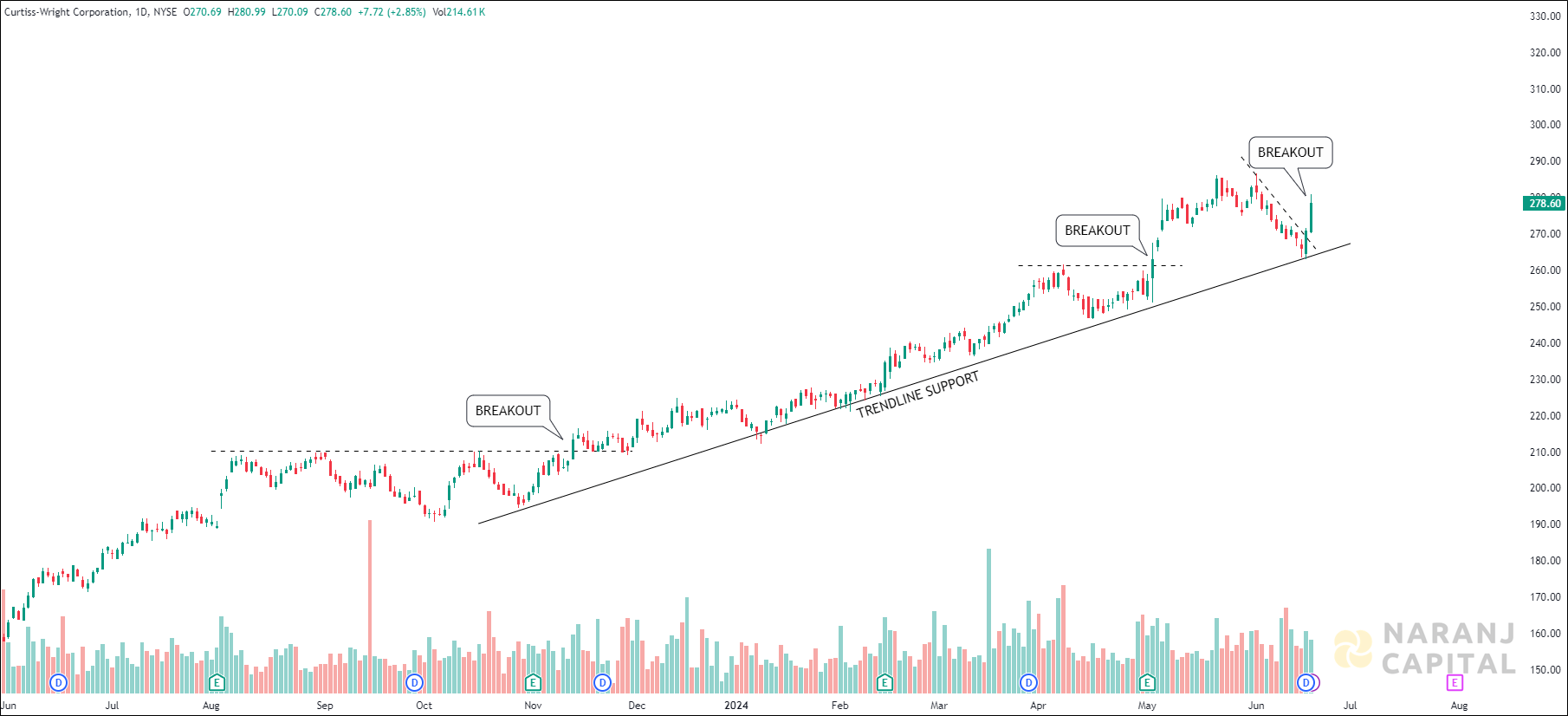

Increasing ADX value above 20, indicated the strength of the trend, thereby uptrending ADX confirms the bullish or bearish supportive decisions. Along with the rising ADX, and the +DI is above (or crossing) -DI, indicates the long trades should be favoured.

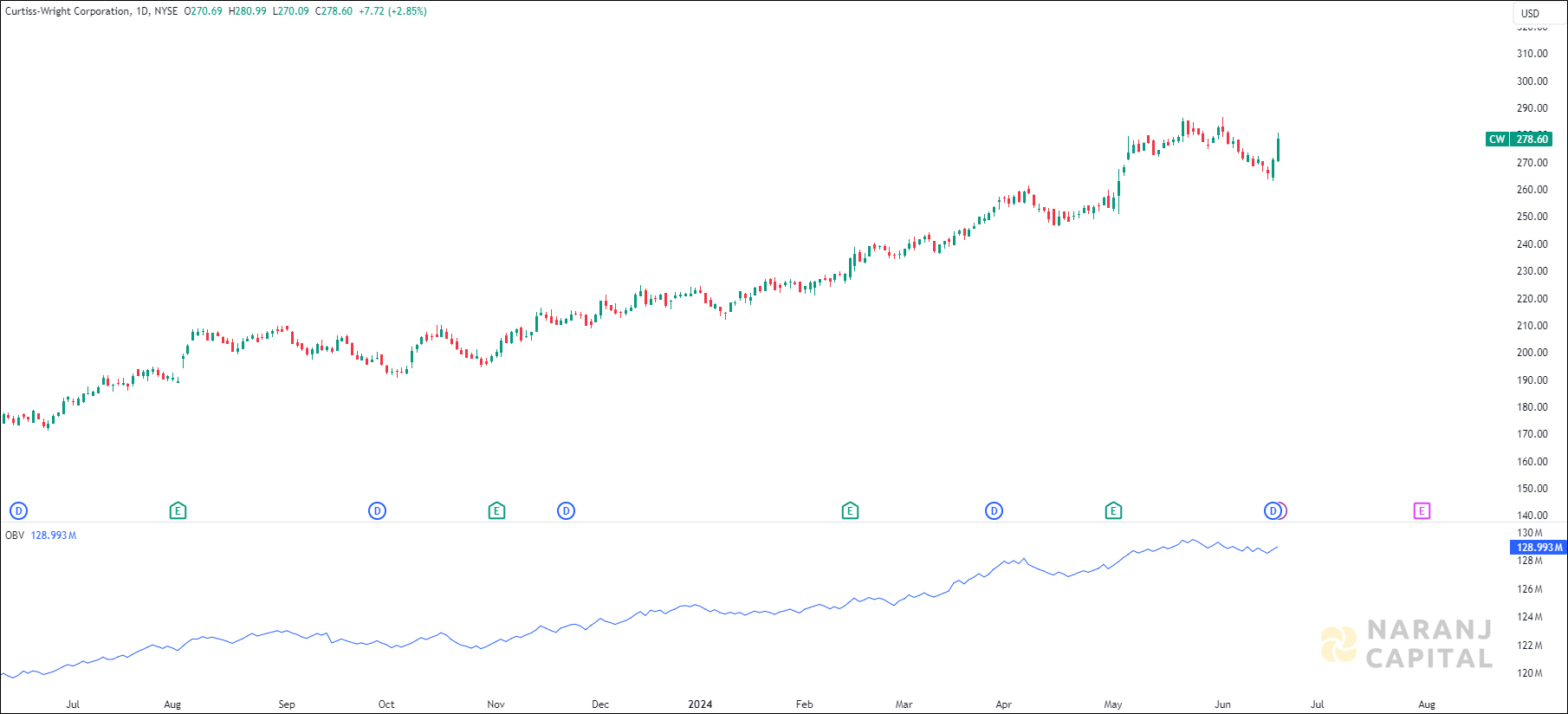

The OBV line is moving in the same upward direction which means there is a positive sentiment in the market. Also the significant price up move accompanying with increasing OBV volume suggests strong buying pressure.

Based on our swing stock trading picks in USA, Curtiss-Wright Corporation stock price target will be USD 292 - USD 295 in the next 12-14 trading sessions.

Curtiss-Wright Corp. is a global integrated business that offers engineered products, solutions, and services to the aerospace and defense markets, as well as critical technologies in commercial power, process, and industrial markets. The company operates in three segments: Aerospace & Industrial, Defense Electronics, and Naval & Power. The Aerospace & Industrial segment provides critical applications, while the Defense Electronics segment offers commercial off-the-shelf computing modules and tactical communications solutions. The Naval & Power segment provides naval propulsion equipment and nuclear power plant products. The company was founded on July 5, 1929 and is headquartered in Davidson, NC.

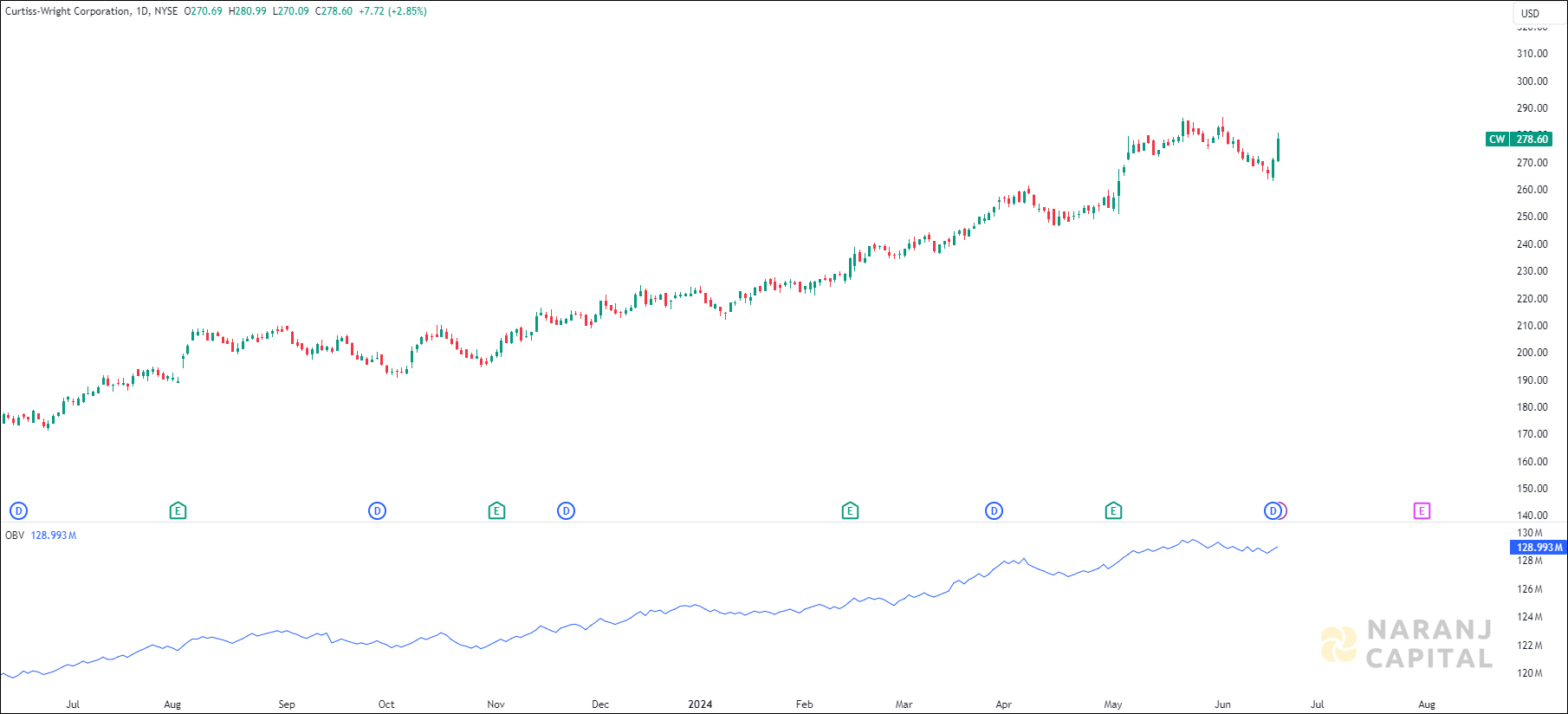

CW — NYSE —

The short length exponential moving average (10 EMA) is about to cross the long length exponential moving average (20 EMA) from the below, generates bullish signal. Last day’s candle has closed above all these moving averages. This suggests buyers are taking interest in this stock.

Increasing ADX value above 20, indicated the strength of the trend, thereby uptrending ADX confirms the bullish or bearish supportive decisions. Along with the rising ADX, and the +DI is above (or crossing) -DI, indicates the long trades should be favoured.

The OBV line is moving in the same upward direction which means there is a positive sentiment in the market. Also the significant price up move accompanying with increasing OBV volume suggests strong buying pressure.

Based on our swing stock trading picks in USA, Curtiss-Wright Corporation stock price target will be USD 292 - USD 295 in the next 12-14 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website