- Naranj Research Desk

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

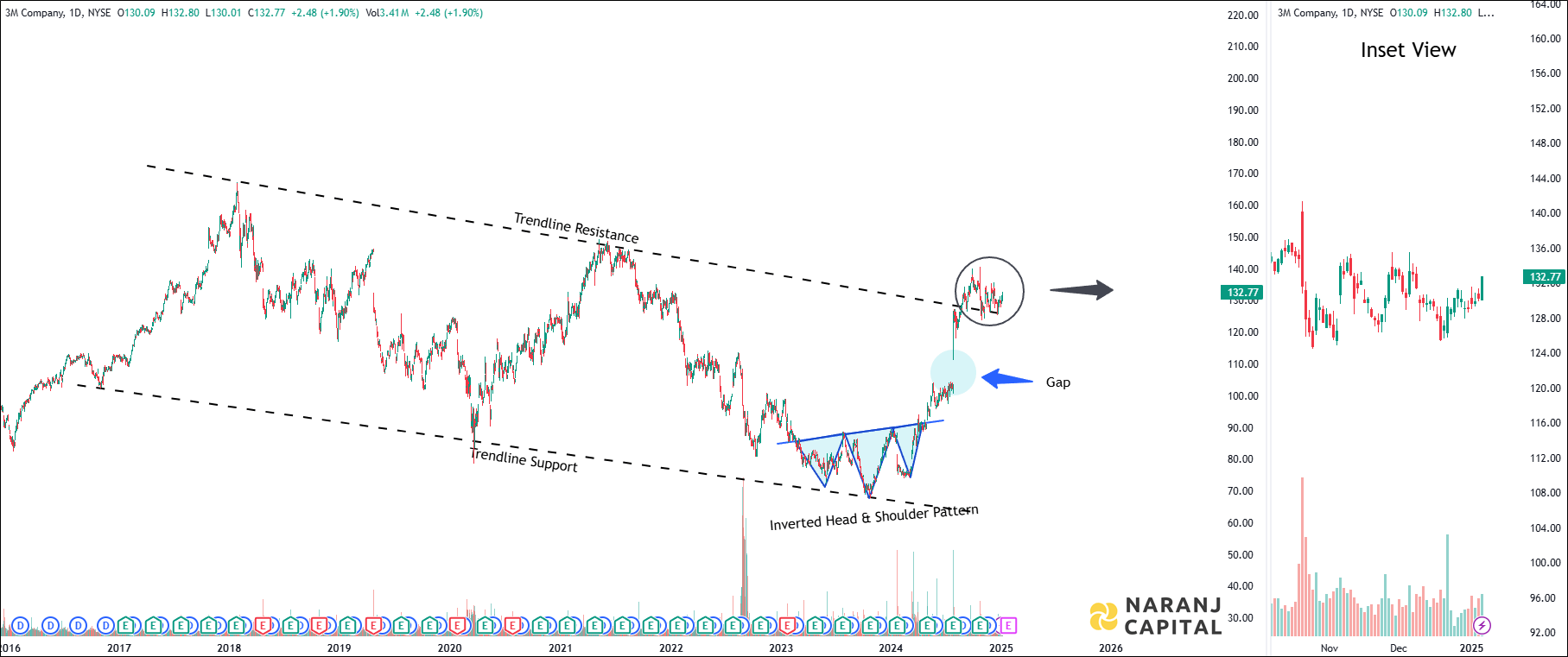

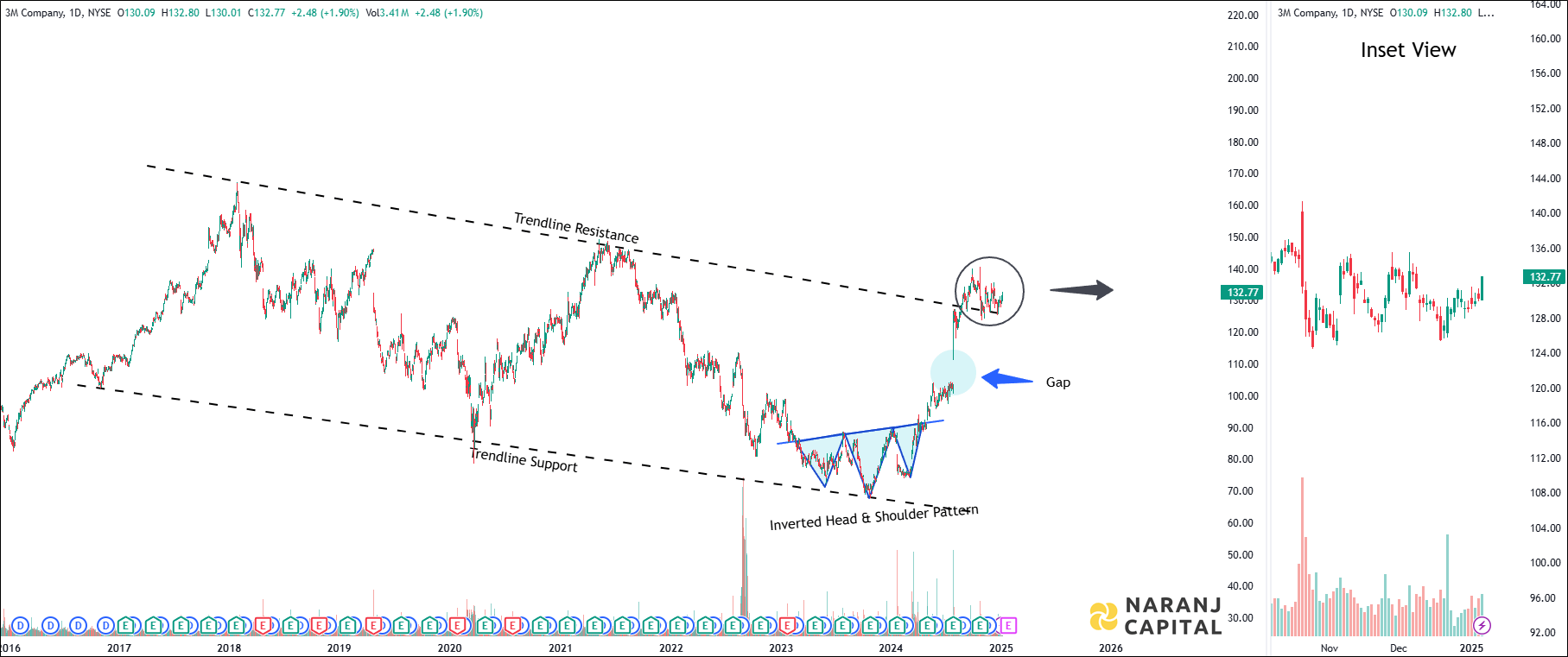

MMM — NYSE —

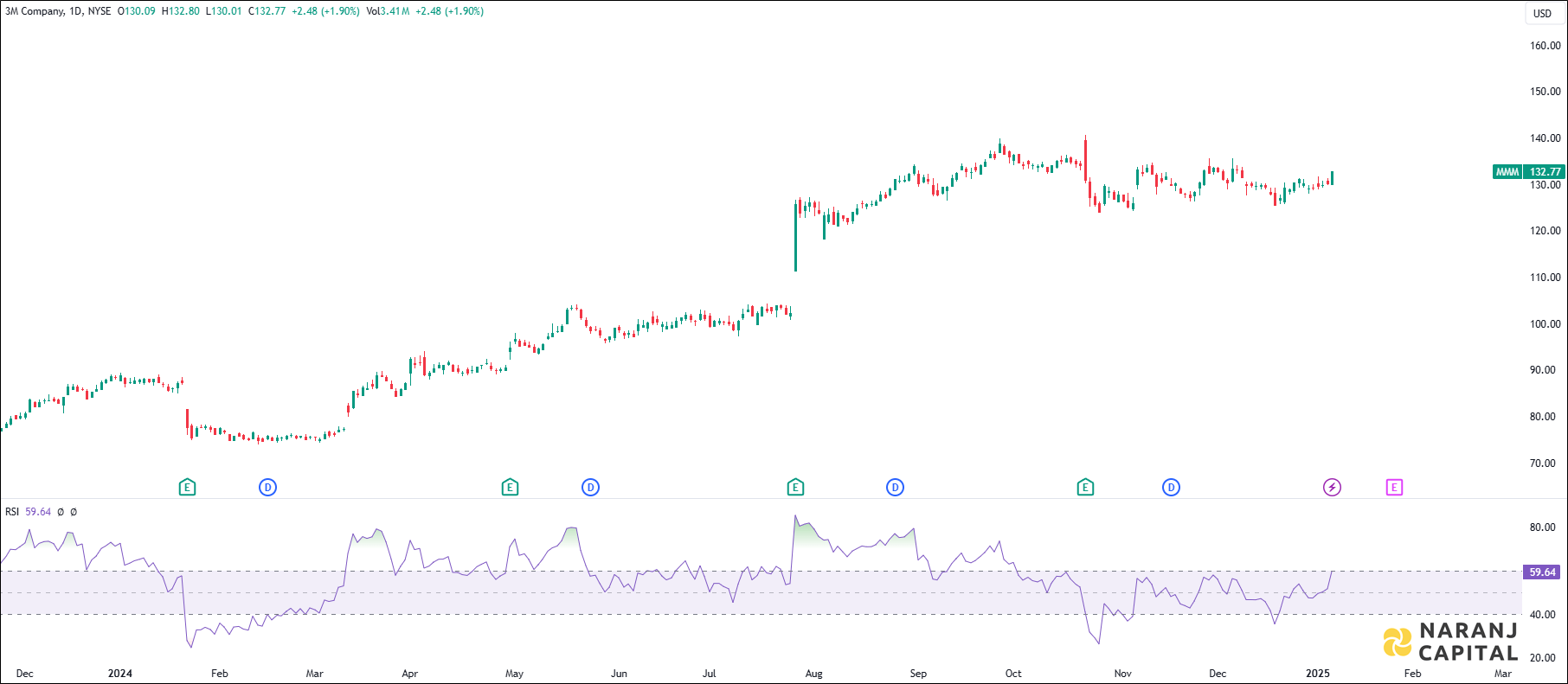

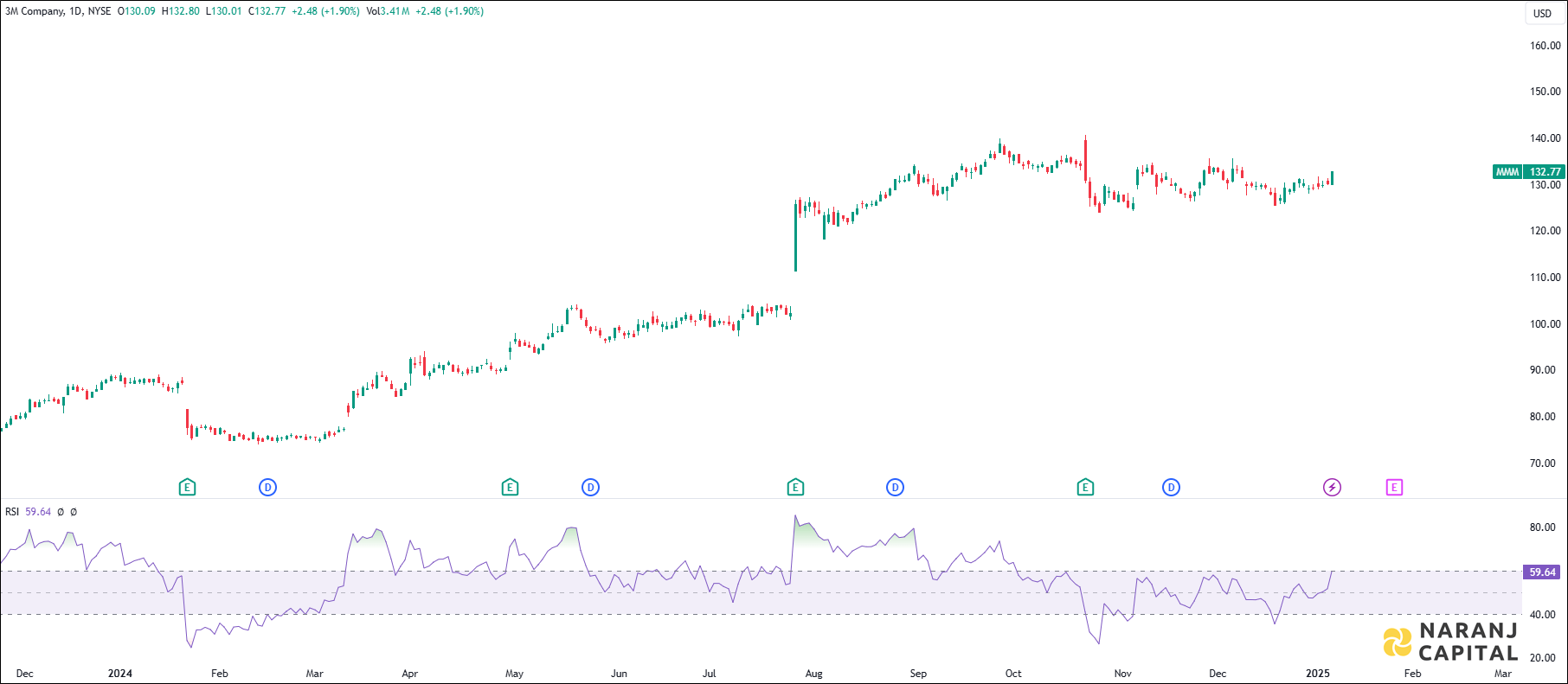

Current RSI of this stock is 59.64, which indicates the strength of buyers.

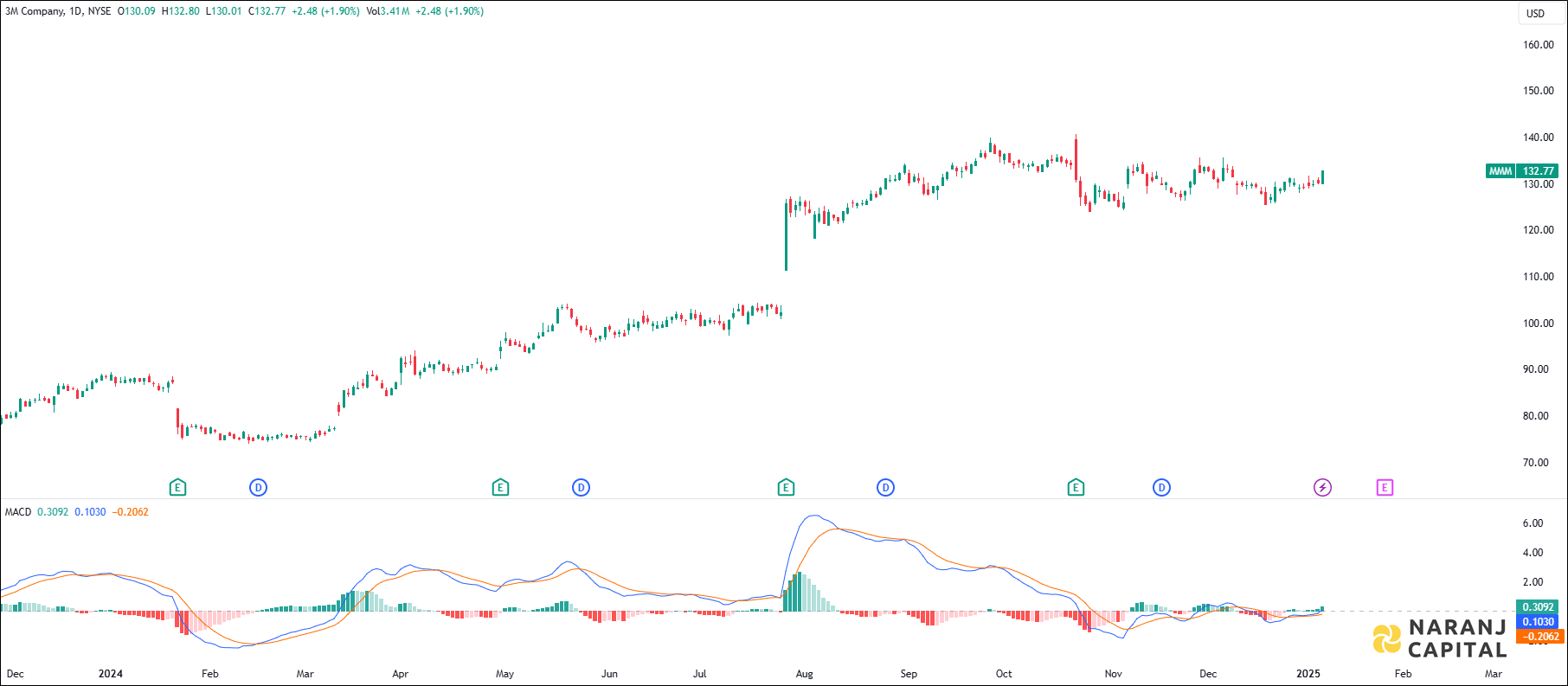

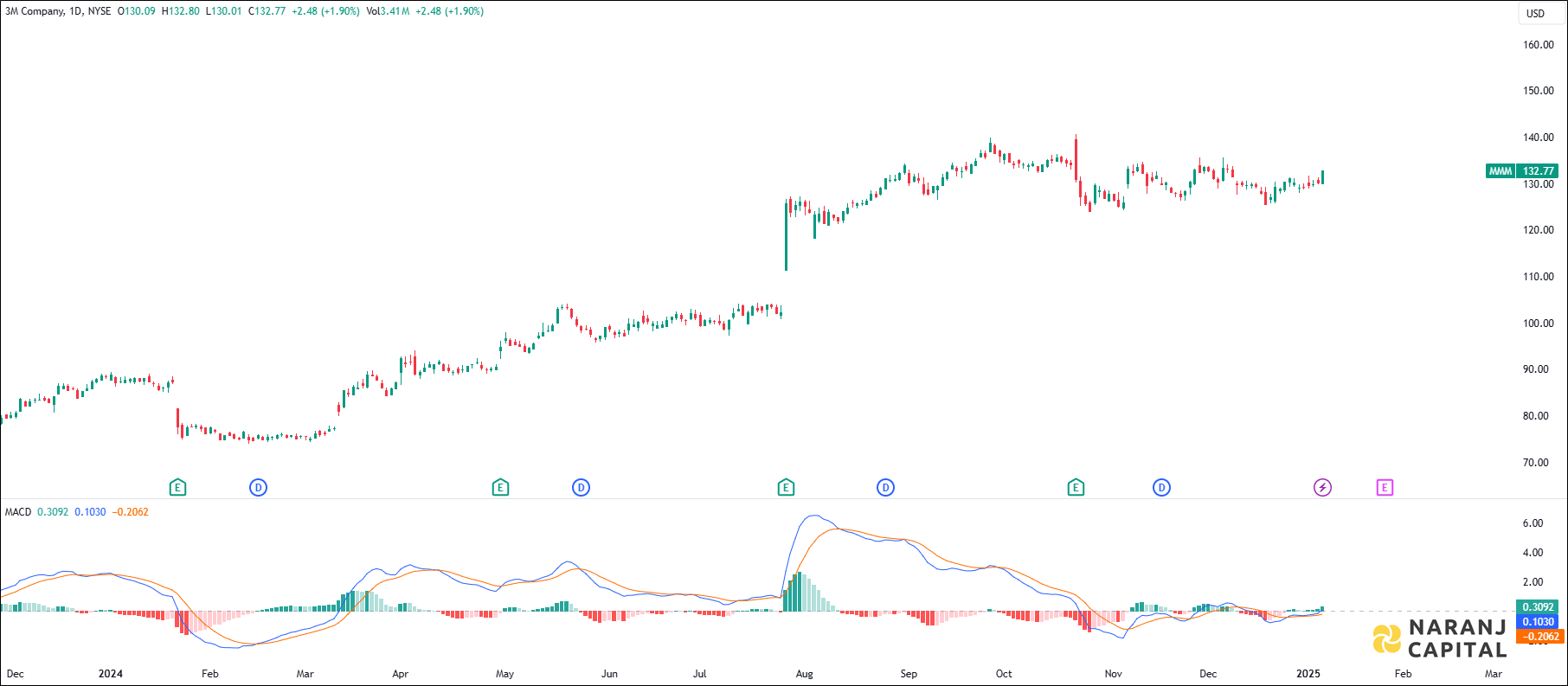

MACD line has just crossed the signal line from the below, generates bullish signal.

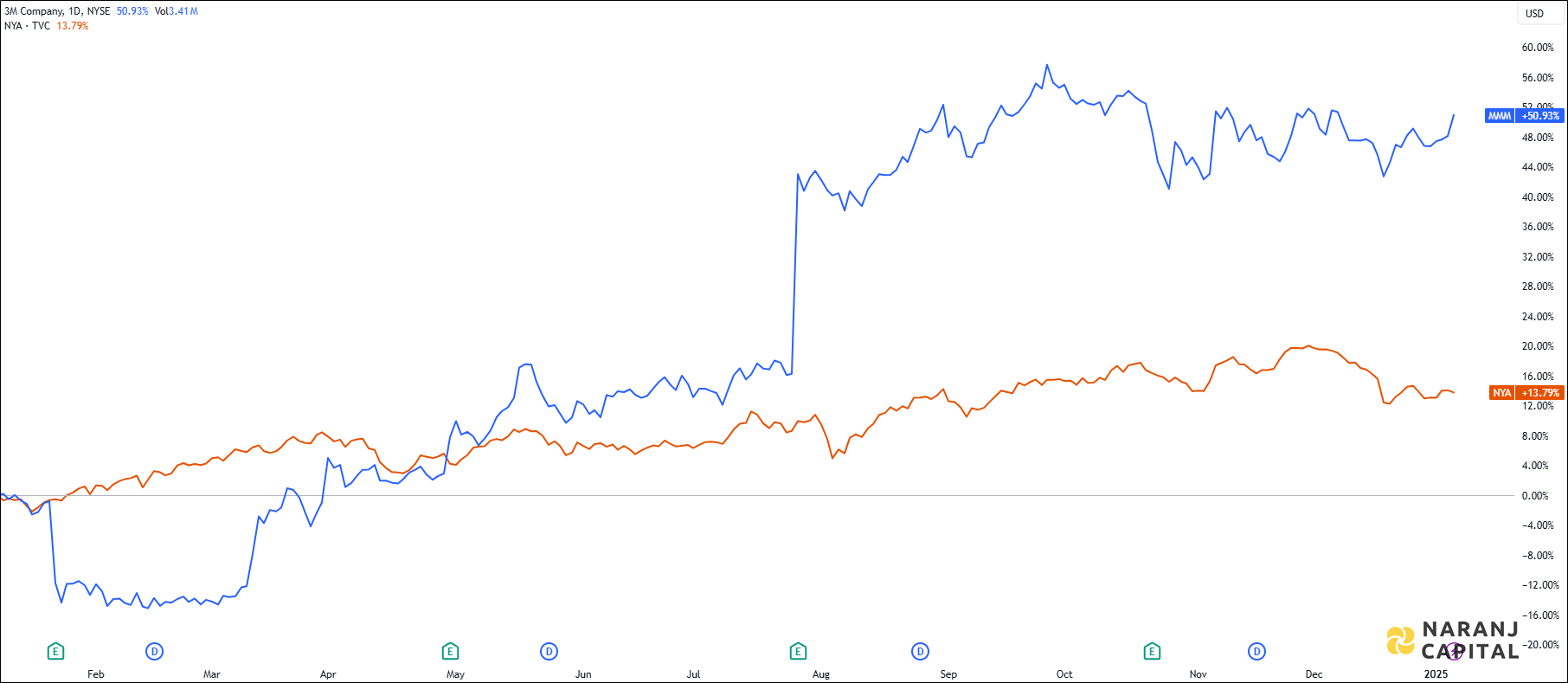

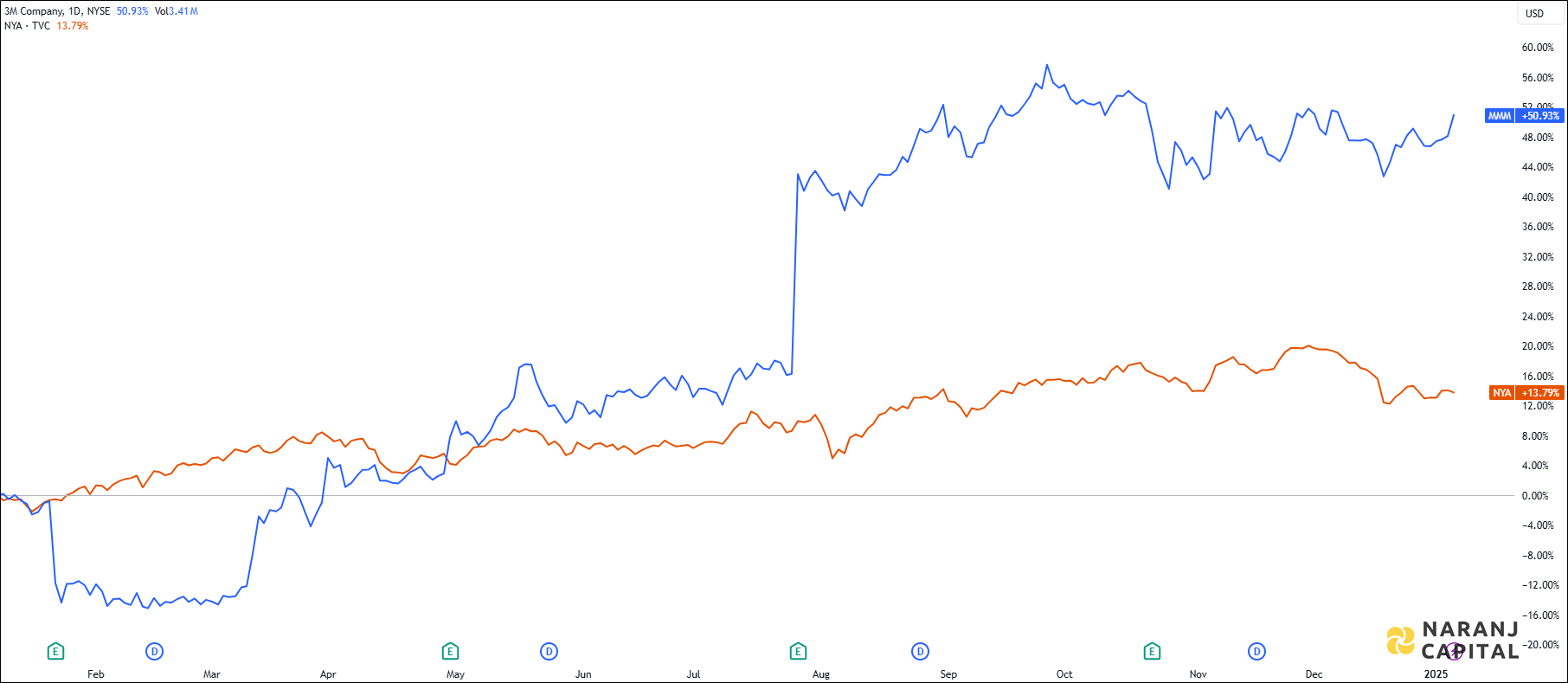

Based on our positional trading picks in USA stocks, 3M stock price target will be USD 137 - USD 139 in the next 12-14 trading sessions.

3M Company delivers a range of technology services both in the U.S. and globally. It operates in four main areas: Safety and Industrial; Transportation and Electronics; Health Care; and Consumer. The Safety and Industrial division provides industrial abrasives, autobody repair solutions, personal hygiene product closures, electrical materials, structural adhesives, protective equipment, and mineral granules for roofing. The Transportation and Electronics segment offers ceramic products, bonding solutions, graphic films, light management films, packaging solutions, semiconductor materials, data center solutions, and reflective signage for safety. The Healthcare division supplies coding software, wound care products, dental solutions, and filtration systems. The Consumer segment features bandages, braces, cleaning products, DIY car care items, and stationery. Products are available through e-commerce and various retail channels. Founded in 1902, 3M is based in Saint Paul, Minnesota.

MMM — NYSE —

Current RSI of this stock is 59.64, which indicates the strength of buyers.

MACD line has just crossed the signal line from the below, generates bullish signal.

Based on our positional trading picks in USA stocks, 3M stock price target will be USD 137 - USD 139 in the next 12-14 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website