- Naranj Research Desk

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

Red Sea International Company, based in Riyadh, Saudi Arabia, specializes in modular building solutions across Saudi Arabia, the UAE, and globally. They develop, construct, sell, and lease residential and commercial properties, including temporary and semi-permanent industrial buildings like workforce accommodations, offices, and hospitals. The company also provides housing solutions for both private and public sectors, along with building materials, general contracting, maintenance, and utility construction services. Established in 1967, Red Sea International serves various sectors, including oil and gas, infrastructure, and defense, and is a subsidiary of Al Dabbagh Group Holding Company Limited.

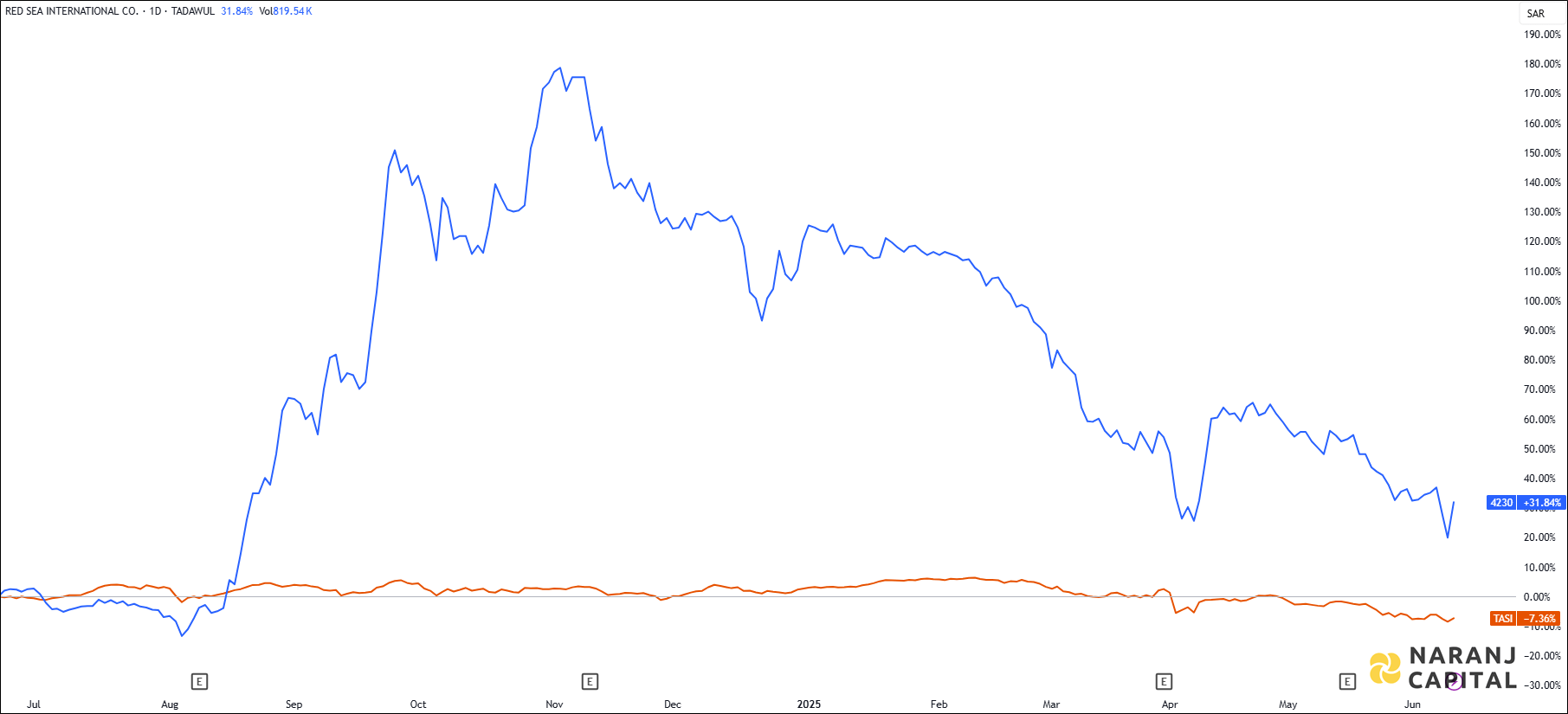

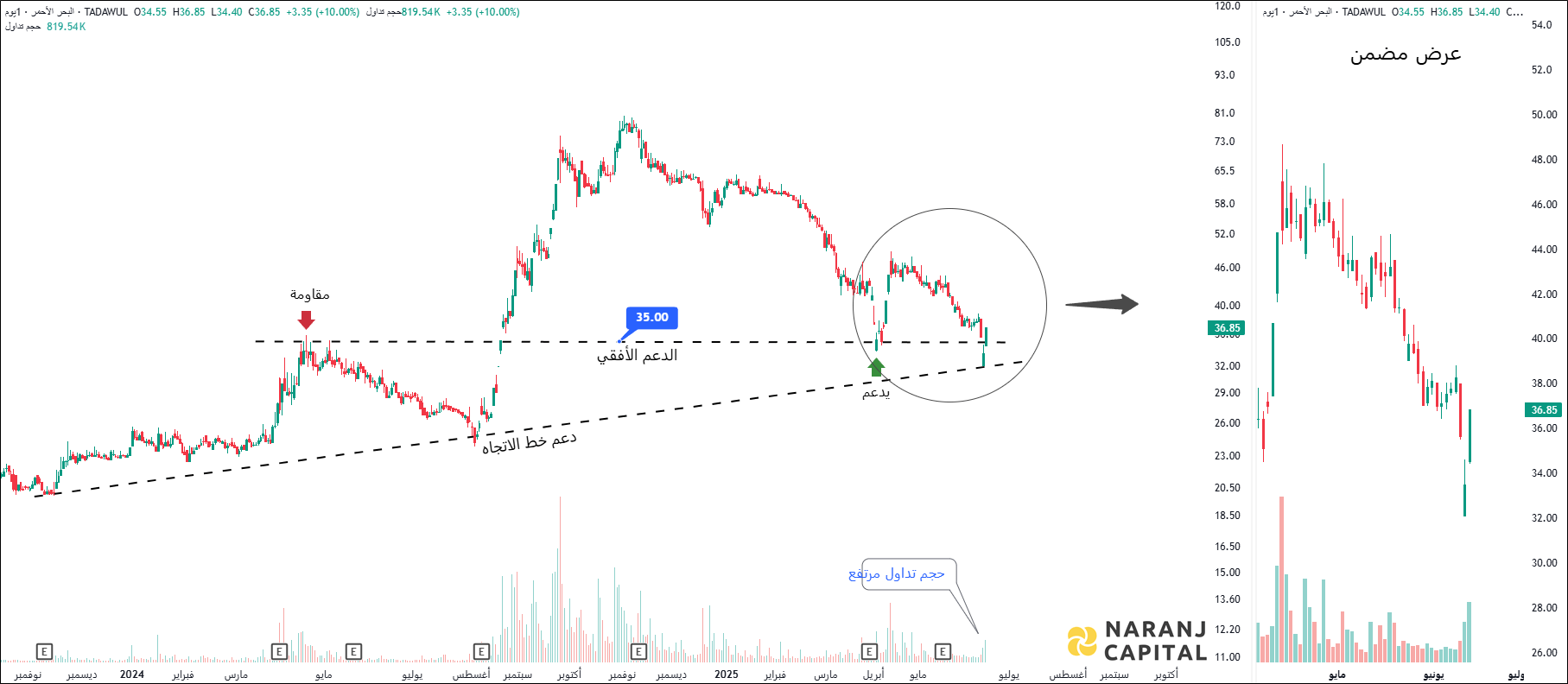

RED SEA — TASI —

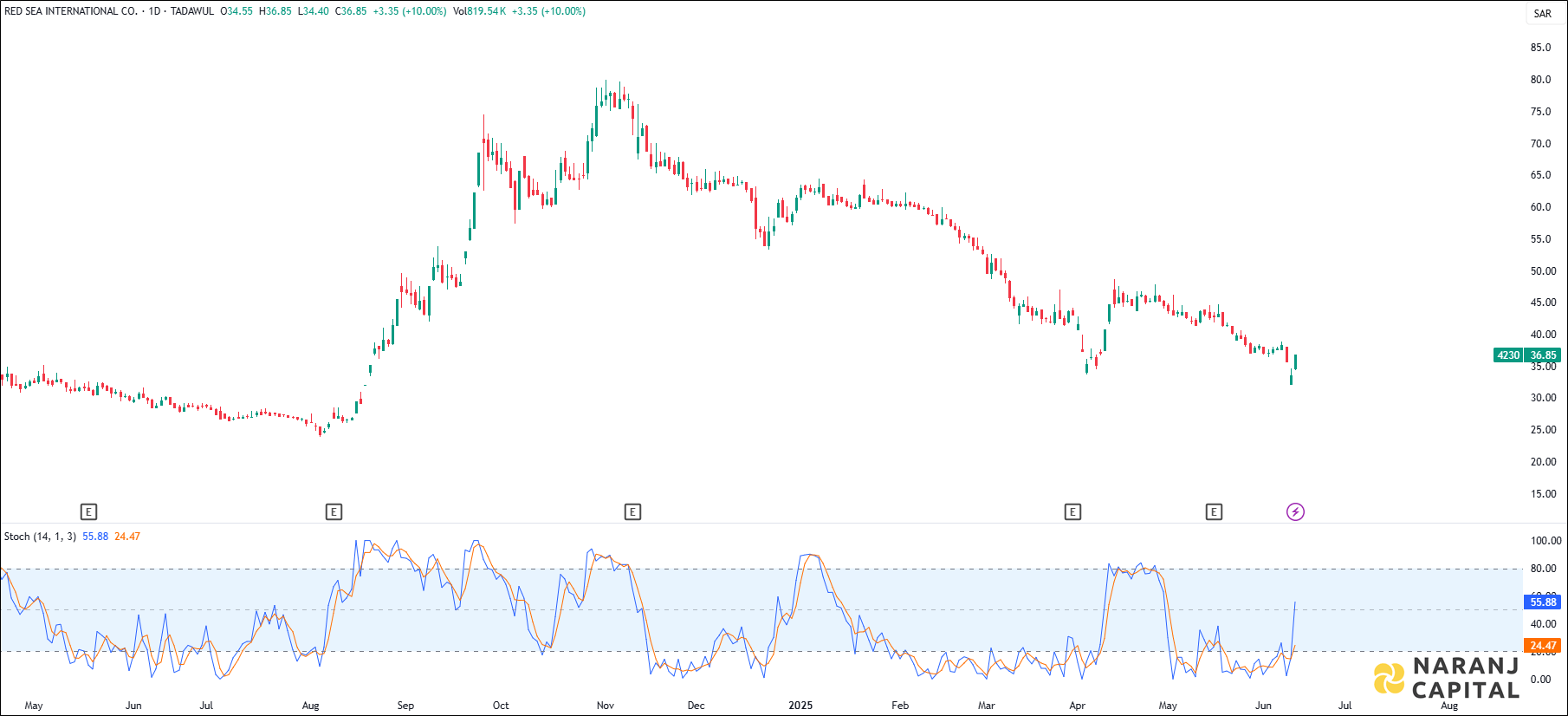

The K (Blue) line has just crossed the D (Orange) line from the below, generates bullish signal.

Based on our trading tips for Saudi Tadawul stocks, Red Sea International stock price target will be SAR 40 - SAR 41 in the next 14-15 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website